In blockchain’s unceasing evolution, the ascent of decentralized autonomous organizations (DAOs) is a testament to the ongoing surge in technological advancements propelling global restructuring in favor of collective empowerment.

As the stars guide this transformation, DAOs journey toward self-awareness, redefining their operational dynamics. Abounding with vibrant ideas, proposals, and discussions, these entities are on a quest for effective mechanisms and continuous introspection, for in the absence of a cohesive system, the profusion of good ideas might remain futile.

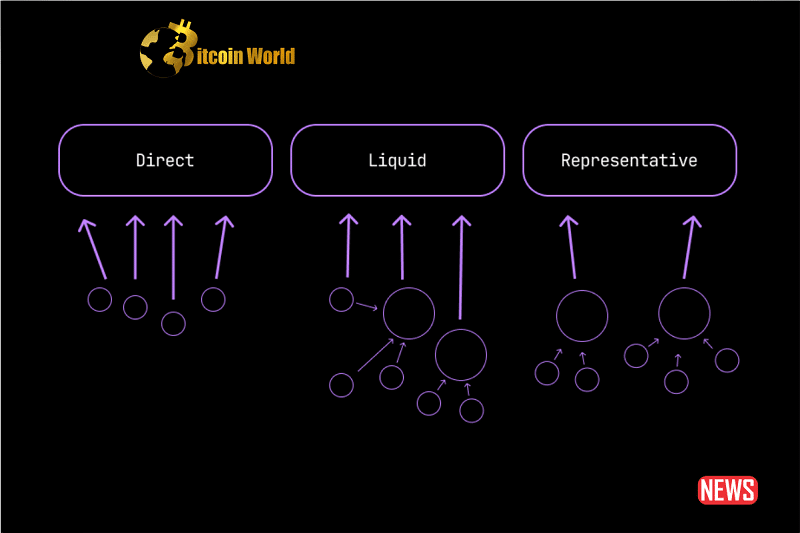

Akin to the core ethos they represent, the heart of a DAO’s functionality lies within its voting systems, shaping outcomes and steering projects toward triumph. Astonishingly, most DAOs exhibit a Gini Coefficient leaning toward 1—a sign of centralized voting power. Surprisingly, the architecture of tokenized voting, anchoring influence to token ownership, inadvertently encourages dominance by the elite few. Startling data from Chainalysis unveils that a mere 1% of holders command 90% of voting power across major DAO initiatives.

The repercussions of this power disparity reverberate widely. Numerous DAO members, disempowered by this skewed system, remain reluctant to exercise their voting rights, spawning disengagement. Moreover, those holding the reins of decision-making might lose touch with the essence of proposals. A recent study reveals that voter participation has plummeted to an alarming 20% on average.

The narrative of DAO members armed with specialized knowledge capable of steering projects is stifled. This predicament robs DAOs of the potential to assimilate novel ideas and adapt to uncharted paths. While capital influences voting weight, it’s a solitary metric that discounts the wealth of experience harbored by stakeholders. A DAO’s potency rests on its community, necessitating rectifying these governance gaps. Multi-stakeholder models are emerging as pioneers in confronting these challenges.

Consider ApeCoin DAO, which has birthed the ApeAssembly—a gateway open to investors and participants in their forums. Meanwhile, Optimism seeks equilibrium by erecting a Citizen’s House to balance token-holder power.

Innovative models like credential-based governance hinged on verified credentials or soulbound tokens via platforms like Otterspace and Gateway advocate that voting rights be earned rather than purchased. The efficacy of this approach is proven, as achieving a Gini Coefficient of 0 through equal vote distribution exemplifies.

Simultaneously, proof-of-participation heralds a groundbreaking approach to leveling the playing field, fostering an egalitarian ambiance among community members. Aspiring voters showcase genuine commitment by completing tasks to secure membership, culminating in a single, equitable voting token.

The blueprint for designing a multi-stakeholder governance model unveils three pivotal considerations:

Complete Representation: DAOs must acknowledge stakeholders with distinctive expertise, ensuring their voices resonate. Builders, often underrepresented, bear insights crucial to project frameworks and impact generation. Models like Optimism’s “Citizens” embody active stakeholders whose alignment with a project’s mission empowers decision-making.

Dynamic Representation: Flexibility is vital, given the rapid evolution of Web3. Governance must adapt in tandem with projects. Verified credentials’ response to changing behaviors is decisive in sustaining effective representation.

Balancing Power: Different stakeholder groups wield unique viewpoints. Creating branches within a DAO mitigates monolithic approaches and endorses balanced influence.

Innovative governance isn’t solely about safeguarding minority rights and sustaining Web3 decentralization. It has the potential to elevate DAOs beyond traditional organizations in decision-making prowess. Models such as proof-of-participation empower the voices most equipped to shape infrastructure challenges, steering DAOs toward mass decentralization.

In the unfolding chronicles of blockchain’s evolution, DAO governance is primed for experimentation and refinement, promising an era where the power of technology converges with the wisdom of collective management.