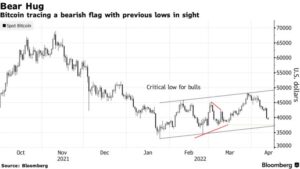

Bitcoin Price Plunge Alert: Is a $26,000 Bitcoin Crash Imminent?

Buckle up, crypto enthusiasts! The Bitcoin rollercoaster seems to be heading downhill again. Just when we thought we might see another bull run, whispers of a potential price crash are getting louder. According to a recent Bloomberg report, Bitcoin could potentially plummet to as low as $26,000. Yes, you read that right – $26,000! This alarming prediction is based on a technical analysis pattern called a “bearish flag.” Let’s dive into what’s fueling this bearish sentiment and what it could mean for your crypto portfolio.

What’s Causing This Bitcoin Price Dip?

This week started on a sour note for Bitcoin and the broader crypto market. Monday saw Bitcoin tumbling below the $40,000 mark, a level not seen since mid-May. This sudden drop triggered a massive liquidation event in the crypto market. Let’s break down the numbers:

- $439 Million Liquidated in 24 Hours: That’s a significant wipeout!

- Long Positions Hit Hardest: A whopping 88.03% of liquidations were from traders betting on Bitcoin’s price going up (long positions).

- Bitcoin Futures Traders Feeling the Pain: They accounted for $160.19 million of the total liquidations.

So, what’s behind this market turbulence? Several factors are at play, but a key driver is the shift in the Federal Reserve’s stance.

The Fed’s Hawkish Turn: A Dollar Boost, Crypto Squeeze

The US Federal Reserve’s recent hawkish policies are sending ripples through the financial markets. Their move towards tightening monetary policy has:

- Strengthened the US Dollar: The US dollar index (DXY), which measures the dollar’s strength against other major currencies, has surged past 100 for the first time in two years. A strong dollar often puts pressure on other assets.

- Increased Pressure on Risk Assets: Assets considered “risky,” like Bitcoin and stocks, tend to suffer when the dollar strengthens and interest rates potentially rise.

The traditional stock market is also feeling the heat. On Monday, the Dow Jones Industrial Average plunged by 1.89%, highlighting the overall risk-off sentiment in the market.

Key Support Levels to Watch: Will Bitcoin Hold?

For Bitcoin bulls, the next few days are crucial. Market analysis suggests that Bitcoin is approaching a critical support level around $37,500. Why is this level so important?

- Support Level Significance: Support levels are price points where buying interest is expected to be strong enough to prevent further price declines. Think of it as a floor for the price.

- Potential Downside if Support Breaks: If Bitcoin fails to hold above $37,500, it could signal further bearish momentum and potentially pave the way for the predicted drop to $26,000.

Currently, Bitcoin is trading around $40,121, still struggling to bounce back from recent losses. It’s a significant 41.81% down from its all-time high – a stark reminder of crypto’s volatility.

Expert Opinion: Navigating the Bitcoin Range

Jeffrey Halley, a senior market analyst at Oanda, offers some insights into Bitcoin’s current trading pattern. According to Halley, Bitcoin is currently trading within a defined range, with:

- Lower Limit: $36,500: This level is crucial. A break below this could trigger a significant sell-off, potentially leading to the $26,000 target.

- Upper Barrier: $47,500: On the flip side, if Bitcoin can break above this resistance level, it could signal renewed bullish momentum and potentially set the stage for a new record high.

Halley’s analysis emphasizes the importance of these key levels for Bitcoin’s near-term price action. Traders and investors should closely monitor these levels to anticipate potential price movements.

What Does This Mean for Crypto Traders?

The current market conditions present both challenges and opportunities for crypto traders:

- Increased Volatility: Expect continued price swings and volatility in the short term.

- Risk Management is Key: Now, more than ever, managing risk is crucial. Consider using stop-loss orders and diversifying your portfolio.

- Potential Buying Opportunity (Long-Term): For long-term investors, a significant price drop could present a buying opportunity, but only after careful research and risk assessment.

- Stay Informed: Keep a close eye on market news, technical analysis, and expert opinions to make informed trading decisions.

Related Read: Ex-SEC Chair, Jay Clayton Believes Cryptocurrency Industry Is For Long Haul

In Conclusion: Navigating the Bearish Bitcoin Market

The Bitcoin market is currently facing strong headwinds. Bearish technical patterns, coupled with macroeconomic factors like the Federal Reserve’s policies, are contributing to price uncertainty. While the $26,000 price target might seem alarming, it’s essential to remember that these are predictions based on current analysis. The crypto market is notoriously unpredictable, and things can change rapidly.

Whether Bitcoin will indeed plummet to $26,000 remains to be seen. However, the current market signals a period of caution. Crypto traders and investors should remain vigilant, manage their risk effectively, and stay informed about market developments. The coming weeks will be critical in determining Bitcoin’s next major price move. Will the bulls step in to defend the key support levels, or are we heading towards a deeper bear market? Only time will tell!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.