Is your Bitcoin activity under the scanner? For crypto enthusiasts in India, the answer is increasingly becoming ‘yes,’ especially if you’re navigating the murky waters of the darknet. India’s Narcotics Control Bureau (NCB) is tightening its grip on digital currency transactions, and it’s all part of a larger strategy to dismantle drug trafficking networks operating within the nation. But what does this mean for the average crypto user in India? Let’s dive into the details of this developing situation.

Why is India Focusing on Crypto in Drug Trafficking?

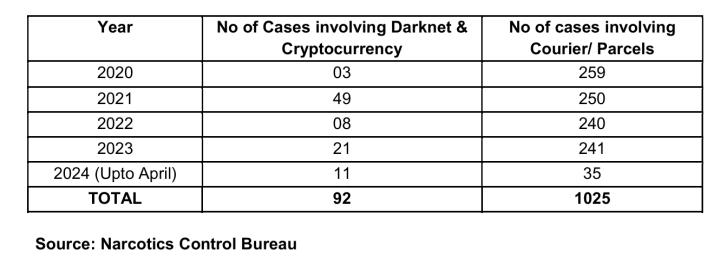

The connection between cryptocurrencies and illicit activities, particularly drug trafficking, isn’t new. Cryptocurrencies, with their promise of anonymity and decentralized transactions, have become a tool of choice for those operating in the shadows. India is witnessing a concerning trend, with approximately 92 incidents reported between 2020 and April 2024 where the dark web and crypto were utilized to procure drugs. This alarming statistic has prompted the NCB to take decisive action.

- The Narcotics Control Bureau (NCB) of India is actively monitoring crypto transactions to combat drug trafficking nationwide.

This isn’t just a casual observation; it’s a full-fledged strategy. The NCB is laser-focused on crypto transactions occurring on the darknet, recognizing it as a significant conduit for illegal drug trades. Let’s delve deeper into India’s strategic approach to tackle this evolving challenge.

India’s Multi-Pronged Strategy to Combat Drug Trafficking and Crypto Misuse

The urgency of the situation was underscored by Nityanand Rai, the minister of state for home affairs. He recently shared with the parliament a comprehensive plan designed to curb both the internal movement and international importation of drugs into India. This plan isn’t just about boots on the ground; it’s a sophisticated, multi-layered approach that includes a strong focus on the digital realm.

Minister Rai highlighted the stark reality: around 92 incidents involving darknet and crypto drug purchases between 2020 and April 2024. This data point alone underscores the scale of the problem and the necessity for targeted interventions.

Within the broader strategy, Rai outlined 13 key action plans aimed at reducing drug trafficking. Significantly, two of these directly address the misuse of cryptocurrencies. This highlights the government’s acknowledgment of crypto’s role in facilitating illegal drug trades and their commitment to counteracting it.

A pivotal step in this strategy is the formation of a dedicated task force. As Rai stated, “A Special Task Force on Darknet and Crypto Currency has been constituted to monitor suspicious transactions related to drugs on Darknet.” This specialized unit is designed to be the eyes and ears in the digital crypto space, specifically looking for red flags associated with drug-related activities.

But it’s not just about monitoring; it’s also about building capacity. The NCB is actively investing in training its personnel. They are offering a range of training courses focused on:

- Cryptocurrencies: Understanding the nuances of various cryptocurrencies and blockchain technology.

- Darknet: Navigating and investigating illicit activities on the dark web.

- Digital Forensics: Developing skills to trace and analyze digital evidence related to crypto transactions and online drug trafficking.

This investment in training signifies a long-term commitment to tackling crypto-related crime. It’s about equipping law enforcement with the necessary skills to stay ahead in the rapidly evolving digital landscape.

Will Crypto Taxes in India Change Amidst Crackdown?

While the NCB ramps up its efforts to combat crypto-fueled drug trafficking, another crucial aspect for crypto users in India is the tax regime. Many hoped for some relief or revisions in the recent budget, especially considering the stringent tax rules already in place. However, the latest budget for the 2024-25 session, presented by Finance Minister Nirmala Sitharaman, brought no changes to the existing crypto tax policy.

This means the existing, rather stringent crypto tax rules remain unchanged. Indian crypto investors are still subject to:

- 1% TDS (Tax Deducted at Source) on every transaction: This applies to every crypto transaction, regardless of profit or loss.

- 30% Income Tax on Crypto Profits: Profits from trading or transferring cryptocurrencies are taxed at a high rate of 30%, similar to lottery winnings.

Adding to the complexity, and often frustration, is the inability to offset losses. The current tax rules are quite rigid:

- No Loss Offsetting: Crypto losses cannot be offset against other income sources, such as salary or business income.

- No Carry Forward of Losses: Crypto losses cannot be carried forward to future years to offset potential profits.

These rules make crypto trading and investment in India a highly taxed activity. The lack of change in the budget signals that the government’s stance on crypto taxation remains firm, at least for now. You can see the ongoing discussion on platforms like X (formerly Twitter):

No change in Crypto Tax in Budget 2024.

1% TDS and 30% Income Tax to continue.

Very disappointing for Indian Crypto Investors.

What are your views?

— Sumit (@moneygurusumit) June 13, 2024

What Does This Mean for Crypto Users in India?

The increased scrutiny from the NCB and the unchanged tax regime paint a complex picture for crypto users in India. Here’s a breakdown of what it signifies:

- Increased Vigilance: Expect heightened monitoring of crypto transactions, especially those involving exchanges known for darknet activity or privacy coins often associated with illicit activities.

- Stricter KYC and AML Compliance: Crypto exchanges operating in India will likely face pressure to enhance their Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance measures to assist in tracking suspicious transactions.

- Potential for Further Regulation: The focus on crypto’s role in drug trafficking could lead to even stricter regulations in the future, potentially impacting the broader crypto ecosystem in India.

- Taxation Remains a Hurdle: The unchanged tax rules continue to be a significant deterrent for many potential crypto investors and traders in India. The high tax burden and lack of flexibility in loss offsetting make profitability challenging.

Looking Ahead: Balancing Security and Innovation

India’s approach to crypto is clearly evolving. On one hand, there’s a legitimate need to combat the misuse of cryptocurrencies for illegal activities like drug trafficking. On the other hand, there’s the potential to stifle innovation and growth in the burgeoning crypto space.

The key challenge lies in finding a balance. Can India effectively curb illicit crypto activities without overly burdening legitimate users and businesses? The answer likely lies in a combination of:

- Smart Regulation: Developing regulations that are targeted and effective in addressing illicit activities without hindering legitimate innovation.

- Technological Solutions: Leveraging blockchain analytics and other technologies to track and identify suspicious transactions more efficiently.

- International Cooperation: Collaborating with international agencies to share information and best practices in combating crypto-related crime.

- Education and Awareness: Educating both law enforcement and the public about the risks and responsible use of cryptocurrencies.

In Conclusion: Navigating the Crypto Landscape in India

India’s crypto landscape is currently under intense scrutiny. The NCB’s increased monitoring to combat drug trafficking, coupled with the unchanged and stringent tax regime, presents both challenges and a call for greater responsibility within the crypto community. While the crackdown might seem concerning, it also underscores the importance of compliance, transparency, and responsible crypto usage. As India navigates this complex terrain, the future of crypto in the nation will depend on finding a balance between security concerns and fostering a conducive environment for innovation and growth in the digital economy.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.