Hold on to your hats, crypto enthusiasts! The winds of institutional investment are shifting, and it seems Ethereum (ETH), the once-undisputed king of altcoins, is experiencing a bit of a capital exodus. Where is the smart money flowing now? Buckle up, because it looks like Layer 1 blockchain rivals like Avalanche (AVAX), Solana (SOL), Terra (LUNA), and Algorand (ALGO) are turning heads and opening wallets.

Institutional Investors Cool Off on Ethereum, Warm Up to Altcoins

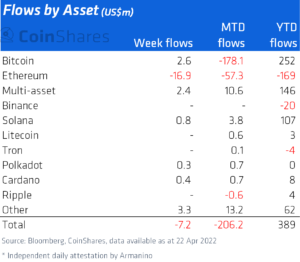

Last week, ending April 22nd, a noteworthy $3.5 million poured into investment products focused on AVAX, SOL, LUNA, and ALGO. This isn’t just pocket change; it signals a potential strategic pivot by institutional players in the crypto space. But where did this money come from? Well, perhaps a clue lies in the $16.9 million outflow from Ethereum investment products during the same period, as reported by CoinShares’ insightful Digital Asset Fund Flows report.

This marks the third consecutive week of withdrawals from Ethereum products, totaling a significant $59.3 million. To put that in perspective, that’s about 35% of the total year-to-date outflows from the second-largest cryptocurrency, which stands at $169 million. Is this a temporary blip or a more profound shift in institutional sentiment?

Interestingly, amidst this altcoin buzz, Bitcoin (BTC), often referred to as ‘digital gold,’ managed to attract $2.6 million in inflows. It seems even in a diverse crypto landscape, the original cryptocurrency still holds a certain allure for investors.

Ethereum’s Inflow Slowdown: Is Institutional Optimism Waning?

Could the reduced inflow into Ethereum products be a sign of institutional pessimism? Consider this: in the last ten weeks, inflows into Ethereum goods have only reached $68.5 million. While still positive, this figure is notably modest compared to the overall crypto investment landscape and potentially hints at a cautious, or even slightly bearish, stance from institutions towards Ethereum in the short term.

Image : Weekly flows showing $16.9m outflows from Ethereum. Source: CoinShares

Why the Altcoin Attraction? Solana, Avalanche, and More in the Spotlight

So, what’s fueling this altcoin fascination? Several factors could be at play:

- Layer 1 Blockchains Gaining Momentum: Alternate Layer 1 blockchains like Solana and Avalanche have been rapidly gaining traction. They often boast faster transaction speeds and lower fees compared to Ethereum, especially as Ethereum grapples with scalability challenges ahead of its full Ethereum 2.0 upgrade.

- Solana’s dApp Ecosystem Thrives: Look at Solana, for example. DappRadar analytics show a surge in decentralized application (dApp) usage on the Solana network in the past week. Decentralized exchanges like Orca witnessed a whopping 43% increase in usage, while automated market makers like Raydium saw a 15.5% jump, with app volume exceeding $1.5 billion. These are not insignificant numbers!

- Avalanche’s Developer Push: While Avalanche’s dApp usage might not have spiked as dramatically in the immediate past week, investor optimism remains high. Avalanche has been strategically investing in incentive programs and spending millions to attract developers to its platform. This proactive approach suggests a strong belief in future growth and adoption.

Let’s break down the inflows into these rising altcoins:

| Cryptocurrency | Inflows (Last Week) |

|---|---|

| Avalanche (AVAX) | $1.8 million |

| Solana (SOL) | $800,000 |

| Terra (LUNA) | $700,000 |

| Algorand (ALGO) | $200,000 |

| Bitcoin (BTC) | $2.6 million |

It’s clear that while Bitcoin saw a welcome return of inflows after two weeks, the combined strength of altcoin inflows, particularly into these Layer 1 competitors, is a story worth paying attention to.

Market-Wide Crypto Investment Trends: A Broader Perspective

While Ethereum experienced outflows, and altcoins and Bitcoin saw inflows last week, it’s important to zoom out and look at the bigger picture. Total withdrawals across the crypto market have been decreasing recently. Over the last three weeks, total withdrawals amounted to $219 million, but last week’s figure was significantly lower at $7.2 million. This is a substantial drop from the $134 million outflow in the first week of April, indicating a potential stabilization or even a recovering sentiment in the overall crypto investment landscape.

Furthermore, despite the recent fluctuations, analysts point out that year-to-date flows remain positive, with a robust $389 million invested in crypto assets since the year began. This suggests that while there might be short-term shifts and reallocations, the underlying trend of institutional investment in cryptocurrencies remains healthy.

Key Takeaway: Institutional investors are actively exploring and investing in alternative Layer 1 blockchains, potentially diversifying away from a heavy reliance on Ethereum. While Ethereum is still a dominant force, these trends highlight the dynamic and evolving nature of the crypto market, where innovation and competition are constantly reshaping the landscape.

Related Read: Elon Musk, a Dogecoin supporter, has decided not to join the Twitter board of directors

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.