Hong Kong is solidifying its position as a global hub for virtual assets, and the latest news is sending ripples of excitement through the crypto community! Just announced: Interactive Brokers, a major international brokerage firm, has received license approval in Hong Kong to offer retail clients the ability to trade Bitcoin (BTC) and Ethereum (ETH). This exciting development comes hot on the heels of a similar announcement from Hong Kong-based Victory Securities, signaling a significant acceleration in virtual asset adoption in the region.

Interactive Brokers Greenlights Retail Crypto Trading in Hong Kong

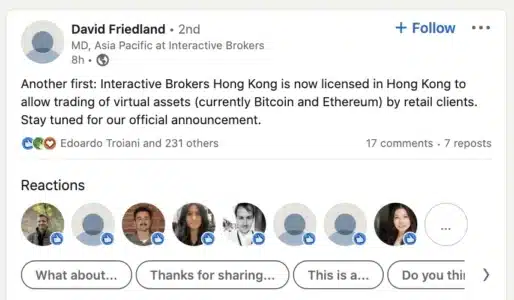

David Friedland, Managing Director for the Asia Pacific region at Interactive Brokers, dropped the exciting news on LinkedIn on November 23rd. While details are still emerging and an official company announcement is expected soon, Friedland’s post clearly indicates that Interactive Brokers has secured a crucial license in Hong Kong. This license is specifically for offering virtual asset trading services to retail investors, marking a major step forward for crypto accessibility in Hong Kong.

This move positions Interactive Brokers to tap into the growing demand for crypto assets in Hong Kong, and it arrives amidst a flurry of crypto-related activity in the region. Hong Kong has been actively working to establish itself as a regulated and attractive environment for crypto businesses, and these recent licensing approvals are a testament to their efforts.

Victory Securities Joins the Crypto Race

Adding fuel to the fire, Victory Securities, a securities firm based in Hong Kong, announced on November 24th that they too have received the green light from the Hong Kong SFC (Securities and Futures Commission). This approval allows Victory Securities to provide virtual asset trading and consulting services to retail investors. According to Chen Peiquan, Executive Director of Victory Securities, this achievement is a landmark, making them the first licensed corporation in Hong Kong authorized to offer these services to the retail sector.

The simultaneous announcements from Interactive Brokers and Victory Securities within a 24-hour period underscore the rapid pace of virtual asset adoption in Hong Kong. It’s clear that the race is on to capture a significant share of this emerging market.

Why is Hong Kong Becoming a Crypto Hotspot?

What’s driving this surge in crypto activity in Hong Kong? Several factors are at play:

- Pro-crypto Regulations: Hong Kong is adopting a relatively progressive stance towards virtual assets, creating a regulatory framework that encourages innovation while aiming to protect investors.

- Attracting Crypto Businesses: The licensing regime and clear guidelines are attracting numerous crypto companies seeking to establish a presence in the region. Hashkey Exchange, for example, became the first licensed crypto exchange in Hong Kong to offer retail trading earlier this year.

- Financial Hub Status: Hong Kong’s long-standing reputation as a major international financial center makes it a natural location for the growth of the virtual asset industry.

- Investor Demand: There is a growing appetite for virtual asset investments among both institutional and retail investors in Hong Kong and the broader Asia-Pacific region.

What Does This Mean for Crypto Investors?

For crypto investors, particularly those in Hong Kong, these developments are incredibly positive:

- Increased Accessibility: The entry of established players like Interactive Brokers and Victory Securities into the retail crypto space makes virtual asset trading more accessible and mainstream.

- Greater Choice: Investors will have more options when it comes to choosing platforms and services for buying, selling, and managing virtual assets.

- Enhanced Security and Regulation: Licensed platforms operate under regulatory oversight, offering a greater level of security and investor protection compared to unregulated exchanges.

- Potential for Growth: As Hong Kong becomes a more prominent crypto hub, it could attract further investment and innovation in the virtual asset space, potentially benefiting the entire crypto ecosystem.

Challenges and Considerations

While the outlook is bright, it’s also important to acknowledge potential challenges and considerations:

- Regulatory Evolution: The regulatory landscape for virtual assets is still evolving globally. Ongoing adjustments and refinements to regulations in Hong Kong are to be expected.

- Market Volatility: The virtual asset market is known for its volatility. Investors need to be aware of the risks involved and exercise caution.

- Education and Awareness: Continued efforts are needed to educate investors about virtual assets, blockchain technology, and responsible investing practices.

See Also: Whale Moves $10M In Sol To Binance, Raises Sell-Off Concerns In The Crypto Market

Hong Kong: A Virtual Asset Future?

The dual announcements from Interactive Brokers and Victory Securities firmly place Hong Kong at the forefront of virtual asset adoption. As more established financial institutions enter the crypto space under a regulated framework, it signals a maturing market and increased confidence in virtual assets as a legitimate asset class. Hong Kong’s proactive approach could serve as a model for other jurisdictions looking to foster innovation in the crypto industry while ensuring investor protection. The race for virtual asset dominance in Asia, and globally, is clearly intensifying, and Hong Kong is positioning itself as a key player.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.