In the ever-evolving world of decentralized finance (DeFi), finding the right blockchain can feel like searching for the perfect oasis in a vast desert. With Ethereum scaling solutions popping up left and right, one name consistently shines brightly for DeFi enthusiasts: Arbitrum. But what makes Arbitrum the go-to chain for DeFi in the Layer-2 (L2) ecosystem? Let’s dive in and explore why Arbitrum continues to capture the hearts and minds of the DeFi community.

Arbitrum: Still the King of the Optimistic Rollups?

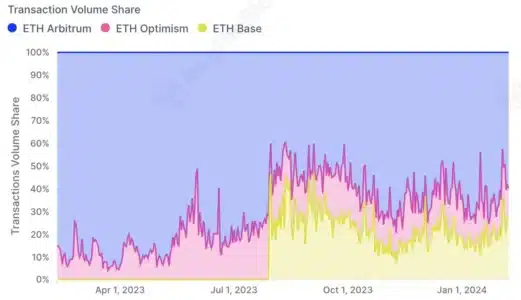

Despite the rise of other impressive L2 solutions like Optimism and Base, Arbitrum has maintained a strong grip on the landscape. Data from IntoTheBlock reveals that Arbitrum impressively handles over 50% of all Ethereum transaction volume across leading optimistic rollups. That’s a significant chunk of the pie! It clearly indicates a strong preference and usage of Arbitrum within the optimistic rollup space.

However, the L2 story gets a bit more nuanced when we zoom out and look at the broader picture. In the entire L2 market, Arbitrum has recently been overtaken in transaction volume by zkSync Era, a zk-rollup solution. Let’s break down why.

According to data from L2Beat analyzed by Bitcoinworld, Arbitrum processed just over 24 million transactions in the past month. zkSync Era, on the other hand, clocked in a whopping 41.3 million transactions in the same period. That’s a considerable difference! But what’s driving this gap?

The primary reason boils down to transaction fees. zkSync Era currently boasts significantly lower fees than Arbitrum. Bitcoinworld’s analysis of L2 Fees shows that sending ETH on Arbitrum costs around $0.14, while the same transaction on zkSync Era comes with a 64% discount. Lower fees naturally attract more users and thus, higher transaction volumes, especially for users sensitive to cost.

Looking ahead, the highly anticipated Dencun upgrade for Ethereum is expected to be a game-changer. This upgrade promises to drastically reduce transaction costs on L2s, potentially by as much as 10x! This fee reduction could reshape the L2 landscape and potentially impact the transaction volume distribution among different solutions.

But Here’s the Catch: DeFi is Where Arbitrum Truly Shines

While zkSync Era might be leading in overall transaction numbers, Arbitrum firmly holds its crown as the DeFi powerhouse in the L2 ecosystem. When it comes to decentralized finance, Arbitrum is in a league of its own.

Analyzing data from Artemis, Bitcoinworld discovered that Arbitrum boasts a Total Value Locked (TVL) exceeding $2.7 billion at the time of writing. This figure is not just impressive; it’s astronomical compared to its competitors. To put it in perspective, the combined TVL of the next three largest L2 solutions still falls short of Arbitrum’s single tally!

Another area where Arbitrum dominates is in the performance of its Decentralized Exchanges (DEXes). The graph above clearly illustrates Arbitrum’s leading position in DEX volume among all L2s.

In the past week alone, DEXes on Arbitrum facilitated trades worth over $1.7 billion. Contrast this with Base and zkSync Era, whose DEXes struggled to even reach $300 million in volume. This stark difference highlights the robust DeFi activity and user preference for trading on Arbitrum.

ARB Token: A Week of Green

Adding to the positive sentiment around Arbitrum, its native token, ARB, has shown positive price movement. As of this writing, ARB was trading in the green, recording weekly gains of 8.5% according to Coinstats. This upward trend suggests growing market confidence in the Arbitrum ecosystem.

It’s important to remember that ARB primarily functions as a governance token. It doesn’t directly accrue value from the on-chain activity of the Arbitrum network. Therefore, the recent price jump is likely driven more by overall market sentiment and belief in Arbitrum’s long-term potential rather than direct revenue accrual.

In Conclusion: Why Arbitrum is the DeFi Darling of L2s

While the L2 race is constantly evolving, Arbitrum has carved out a distinct and dominant position in the DeFi space. Despite facing competition in overall transaction volume from zkSync Era due to fee differences, Arbitrum reigns supreme when it comes to DeFi adoption, TVL, and DEX activity. With the upcoming Dencun upgrade promising to lower fees across the board, Arbitrum is well-positioned to further solidify its lead as the most desired chain for decentralized finance in the Layer-2 ecosystem. For DeFi users and builders, Arbitrum remains a compelling and powerful platform to watch and engage with.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.