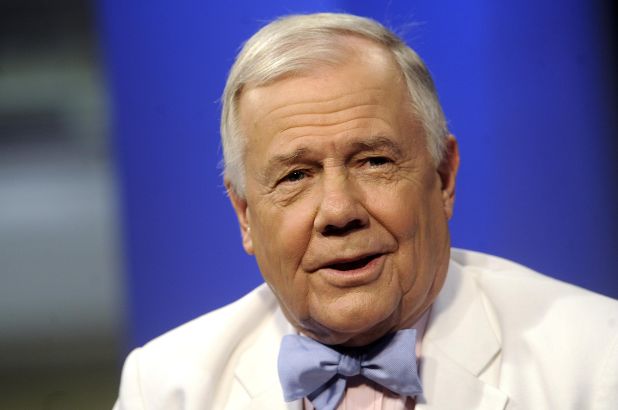

Jim Rogers, a veteran investor and co-founder of the Quantum Fund alongside George Soros, has long been a household name in the world of finance. Having witnessed multiple economic cycles, Rogers is recognized for his forthright opinions on markets and monetary policy. These days, he remains vocal about the fate of Bitcoin and other cryptocurrencies, believing that if digital assets become too successful as a medium of exchange, governments will step in to ban them. Below, we unpack Rogers’ reasoning, how he sees governmental monopoly threatened, and why many crypto proponents disagree.

1. Jim Rogers: Background and Stance on Crypto

1.1 A Storied Career in Investing

Jim Rogers rose to fame in the 1970s when he co-founded the Quantum Fund with George Soros. Over the decades, his global macro investing perspective has garnered respect—and sometimes controversy—for its straightforward, unfiltered observations on market shifts.

1.2 Skepticism Toward Bitcoin as Currency

Rogers has repeatedly shared concerns about Bitcoin. While acknowledging that some crypto traders profit from Bitcoin’s volatility, he doubts it can mature into a commonly used currency without governments fighting back. For Rogers, the lack of government backing is precisely why states may move to block its rise.

2. Fears of Government Outlawing Bitcoin

2.1 Why Would Governments Ban Bitcoin?

According to Rogers, the greatest threat to Bitcoin’s survival is governmental regulation. He argues that governments want to maintain control over money issuance and monetary policy. If Bitcoin and other decentralized currencies overshadow state currencies, governments could view them as competition, prompting a ban or severe restrictions.

“Every government is working on computer money… If [cryptocurrencies] become a viable currency, governments won’t just stand by and let it happen.”

— Jim Rogers

2.2 Historical Precedent: Sovereign Monopoly

Governments throughout history have closely guarded the right to issue money. In Rogers’ eyes, crypto directly challenges that prerogative. He believes if Bitcoin truly threatened official currencies, authorities would not hesitate to outlaw or heavily curtail its use to preserve their monetary sovereignty.

3. Crypto as a Trading Vehicle Versus Currency

3.1 Rogers’ View on Bitcoin for Speculation

While Rogers doubts Bitcoin’s future as a widely accepted currency, he notes that many traders “are making a lot of money” from its volatility. He concedes it’s a “great trading vehicle,” but warns that if too many people abandon national currencies in favor of Bitcoin, governments will step in.

3.2 Comparisons to Gold and Silver

Rogers agrees with other analysts, including U.S. Federal Reserve Chairman Jerome Powell, that Bitcoin is more akin to a speculative asset (like gold) than a stable currency. Powell once referred to Bitcoin as “essentially a substitute for gold” in speculation terms. Rogers goes further, stating silver and gold likely have stronger historical backing as inflation hedges, making them safer than digital tokens.

4. Other Skeptics on Potential Bans

4.1 Ray Dalio, Michael Burry, and Ron Paul

Rogers is not alone in predicting a potential clampdown on crypto:

- Ray Dalio (Bridgewater Associates): Warned that governments may outlaw Bitcoin if it undermines their ability to control money flows.

- Michael Burry (of “The Big Short” fame): Noted that crypto mania might face regulatory pushback.

- Ron Paul (former U.S. Congressman): Has raised concerns about the possibility of banning or restricting Bitcoin.

4.2 Government Digital Currencies (CBDCs)

Rogers also underscores the concept that many countries, like China and the U.S., are exploring or have launched central bank digital currencies. These official digital tokens could reduce the space for private cryptos, or at least place them under intense regulatory scrutiny.

5. Counterarguments: Why a Ban Might Fail

5.1 Hester Peirce: “Futile to Ban Bitcoin”

Not everyone agrees with Rogers’ dire outlook. Hester Peirce, commissioner at the U.S. SEC, believes banning Bitcoin would be “foolish,” equating it to “shutting down the internet.” She emphasizes Bitcoin’s decentralized and global nature, which makes it logistically and politically difficult for a single government to prohibit.

5.2 Importance of Peer-to-Peer and Blockchain

Bitcoin runs on an open-source, distributed network with thousands of nodes worldwide. Even if certain governments impose limitations, the technology remains accessible across borders, making a total ban less feasible without extreme and global cooperation among states.

6. Conclusion

Jim Rogers’ longstanding concern about government interventions overshadowing Bitcoin is rooted in his deep grasp of how states protect their monetary monopoly. Indeed, the talk of potential crypto bans resonates with other skeptics, as governments often react aggressively to perceived threats to their legal tender or the broader financial system. However, the broader crypto community points to Bitcoin’s decentralized architecture and growing acceptance as reasons a prohibition might be ineffective or limited in scope.

Despite the ongoing debate, it’s clear that while Bitcoin and other digital assets have entered mainstream finance, they stand at the intersection of innovation and governmental caution. Whether states escalate restrictions or allow crypto’s further integration may determine if Rogers’ fears materialize or if blockchain-based assets become too critical for any government to fully dismantle.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.