Remember when NFTs were all the rage, and celebrities were diving headfirst into the digital collectibles craze? Well, reality is starting to bite, and even pop royalty isn’t immune. Take Justin Bieber, for example. At the beginning of the year, he splashed out a staggering 500 ETH for Bored Ape #3001. That’s right, 500 Ethereum! Fast forward to today, and that very same ape is now valued at a mere 59.16 ETH. Ouch. That’s an eye-watering 88% drop in value. Let’s dive into what this means for Bieber, the Bored Ape Yacht Club (BAYC), and the broader NFT landscape.

The ‘Lonely Ape’ and its Price Plunge: By the Numbers

To put this into perspective, let’s break down the numbers:

- The Purchase: Justin Bieber acquired Bored Ape #3001 for 500 ETH in January 2022.

- Initial Cost (in USD): At the time, 500 ETH translated to a whopping $1.3 million.

- Current Value (in ETH): As of recent data, Bored Ape #3001 is valued around 59.16 ETH.

- Current Value (in USD): With the fluctuating price of Ethereum throughout 2022, 59.16 ETH is now worth approximately $71,500.

- Percentage Loss: A dramatic 88% decrease in value.

This isn’t just Bieber’s individual ape feeling the chill. Data from NFT Price Floor reveals a broader trend. The floor price of the entire Bored Ape Yacht Club collection has also taken a significant hit, currently hovering around 58.2 ETH. This indicates a wider market correction impacting even the blue-chip NFT collections.

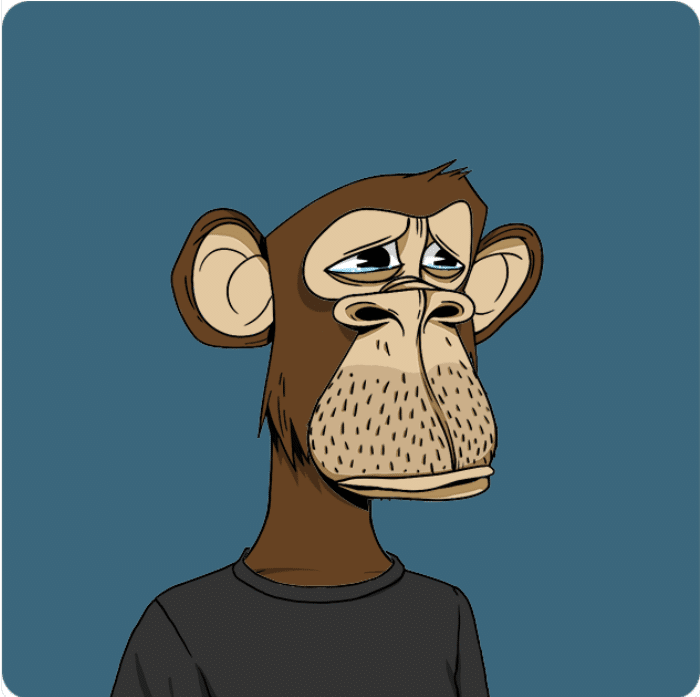

BAYC #3001 | Image Source: OpenSea

Why the ‘Lonely Ape’ and the BAYC Blues?

Several factors contribute to this dramatic downturn. Let’s unpack them:

- The Crypto Winter is Here: The entire cryptocurrency market has experienced a significant downturn in 2022. Ethereum, the cryptocurrency used to purchase most NFTs, has seen its value decrease, directly impacting the dollar value of NFTs priced in ETH.

- NFT Market Correction: The NFT market experienced explosive growth and hype in 2021 and early 2022. Many argue this was a bubble, and we are now seeing a necessary correction. The frenzy has cooled down, and valuations are becoming more realistic (or perhaps, even deflated).

- Was Bieber Overcharged? It’s been suggested that Bieber might have overpaid for his particular Bored Ape. While all BAYC NFTs are unique, some traits are considered rarer and more desirable, commanding higher prices. Reports indicate Bieber’s ape, while part of the prestigious collection, didn’t possess exceptionally rare characteristics.

- Floor Price Dynamics: The floor price of an NFT collection represents the lowest price at which you can buy an NFT from that collection. A declining floor price indicates decreased demand and overall market sentiment towards the collection.

NFTs: More Than Just JPEGs? A Quick Primer

For those still wrapping their heads around NFTs, let’s quickly break down what they are. NFT stands for Non-Fungible Token. In simpler terms, it’s a unique digital asset that represents ownership of a specific item or piece of content. Think of it as a digital certificate of authenticity recorded on a blockchain.

Here’s the core idea:

- Uniqueness: Each NFT is unique and cannot be replicated, unlike cryptocurrencies like Bitcoin which are fungible (one Bitcoin is the same as another).

- Blockchain-Based: NFTs are recorded on a blockchain, a secure and transparent digital ledger, ensuring verifiable ownership.

- Versatile Applications: While currently popular for digital art and collectibles, NFTs have potential applications in various fields, including:

- Digital Art & Collectibles: Proving ownership of digital art, music, in-game items, and more.

- Real-World Assets: Representing ownership of physical items like real estate, luxury goods, or tickets.

- Identity & Access: Verifying identity and granting access to exclusive communities or events (like BAYC’s Discord server).

- Immutable Ownership: Once an NFT is recorded on the blockchain, ownership is permanent and cannot be easily altered.

Bored Ape Yacht Club: Beyond the Hype

The Bored Ape Yacht Club (BAYC) is arguably the most famous NFT collection. Launched by Yuga Labs in April 2021, it quickly became a cultural phenomenon and a status symbol. Here’s what makes BAYC stand out:

- Early Mover Advantage: BAYC was launched relatively early in the NFT boom, capturing the initial wave of interest.

- Exclusivity and Community: Owning a Bored Ape grants access to a private online community (Discord server) and exclusive perks, fostering a sense of belonging and status.

- Celebrity Endorsement: High-profile celebrities like Justin Bieber, Jimmy Fallon, Gwyneth Paltrow, and Paris Hilton owning Bored Apes significantly boosted its mainstream appeal and perceived value.

- Cultural Impact: Bored Apes have transcended the crypto world and become recognizable pop culture icons, featured in media and used as profile pictures across social media.

Celebrity NFTs: Trendsetting or Risky Business?

Justin Bieber isn’t alone in the celebrity NFT space. He also owns NFTs from other popular collections like CLONE X – X TAKASHI MURAKAMI, Mutant Ape Yacht Club, Doodles, World of Women, and LIVES of LALISA. Many celebrities jumped on the NFT bandwagon, seeing it as a way to connect with fans, explore new technologies, and potentially make lucrative investments. However, Bieber’s Bored Ape experience highlights the risks involved.

Is celebrity involvement a sustainable driver for the NFT market? Or is it just adding fuel to a speculative fire? Here are some points to consider:

- Market Volatility: The NFT market, like the broader crypto market, is highly volatile. Values can fluctuate dramatically and rapidly, as Bieber’s case demonstrates.

- Due Diligence is Crucial: Even for celebrities with deep pockets, blindly jumping into NFT investments without proper research can lead to significant losses. Understanding the project, its community, and market trends is essential.

- Long-Term Value vs. Hype: It remains to be seen whether NFTs, especially celebrity-endorsed ones, will retain long-term value or if they are primarily driven by hype and short-term trends.

- Fan Engagement vs. Financial Investment: For celebrities, NFTs can be a tool for fan engagement. However, framing them purely as investments can be misleading, especially given the inherent risks.

Lessons from the ‘Lonely Ape’: Navigating the NFT World

Justin Bieber’s Bored Ape saga serves as a stark reminder of the risks and realities of the NFT market. What can we learn from this?

- NFTs are High-Risk Investments: Treat NFTs as highly speculative and volatile assets. Never invest more than you can afford to lose.

- Do Your Research: Thoroughly research any NFT project before investing. Understand the team, the community, the utility, and the market trends.

- Don’t Follow the Hype Blindly: Celebrity endorsements and social media buzz can create hype, but don’t let it cloud your judgment. Evaluate the intrinsic value and long-term potential.

- Understand Floor Prices and Market Dynamics: Pay attention to floor prices and market trends to gauge the overall health and sentiment of an NFT collection.

- Consider Utility and Community: Beyond the visual appeal, explore the utility and community associated with an NFT project. These factors can contribute to long-term value.

The Future of NFTs: Beyond the Bubble?

While Justin Bieber’s Bored Ape loss might seem like a grim headline for the NFT world, it’s crucial to remember that markets fluctuate. The NFT space is still evolving, and the current correction might be a necessary phase for maturation. The underlying technology of NFTs and their potential applications remain promising. Whether NFTs will rebound to their previous highs or find a more sustainable and practical role in the digital landscape remains to be seen. One thing is clear: the era of blind hype is likely over, and a more discerning and informed approach to NFTs is essential for both celebrities and everyday investors alike.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.