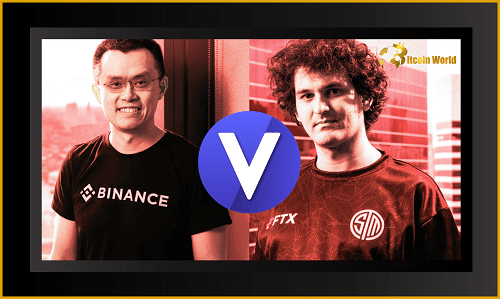

The crypto world is buzzing with news from the ongoing Voyager Digital bankruptcy proceedings. It appears a high-stakes bidding war is underway for the assets of the troubled crypto lender, with two industry giants, FTX and Binance, leading the charge. According to a recent Wall Street Journal report, both exchanges have placed top bids, but as of Tuesday, no winner has been declared. Let’s dive into what we know about this developing situation and what it means for the crypto landscape.

The Bidding Battle: FTX vs. Binance – Who’s Offering More?

Sources familiar with the matter, as reported by the Wall Street Journal, indicate that Binance’s current bid is slightly higher than FTX’s, hovering around the US$50 million mark. While this figure might seem modest compared to the billions often discussed in the crypto sphere, it represents a significant move in the context of Voyager Digital’s bankruptcy and the broader “Crypto Winter” we’re experiencing.

Why are FTX and Binance so Interested in Voyager’s Assets?

This isn’t just about acquiring assets; it’s a strategic play in the current crypto market. Both FTX and Binance have been strategically expanding their market share during the recent downturn. Think of it as a land grab in the digital world. While others are pulling back, these exchanges are doubling down, aiming to solidify their dominance.

Here’s a breakdown of why acquiring Voyager’s assets is attractive:

- Market Share Consolidation: Acquiring Voyager’s customer base and potentially its technology could significantly boost either FTX or Binance’s user base and trading volume.

- Strategic Expansion During Crypto Winter: When the market is down, valuations are lower. This presents an opportune moment for companies with strong balance sheets to acquire assets at a discount.

- Competitive Advantage: In the highly competitive crypto exchange landscape, every edge counts. Acquiring a struggling competitor’s assets can eliminate a potential rival and strengthen market position.

FTX’s Aggressive Expansion Strategy: A Closer Look

FTX, led by Sam Bankman-Fried, has been particularly active in acquiring distressed crypto companies and assets during this period. Beyond just acquisitions, FTX has also been extending lines of credit to struggling firms, acting as a sort of crypto industry ‘lender of last resort’. This proactive approach underscores FTX’s ambition to become a dominant force in the crypto space.

Alameda Research’s Role: Lending a Helping Hand (and Then Some)

Interestingly, Sam Bankman-Fried’s other company, Alameda Research, also has ties to Voyager Digital. In a court filing on Monday, Alameda Research announced its intention to repay Voyager Digital over $200 million in cryptocurrency. Furthermore, back in June, Alameda had entered into a non-binding agreement to provide Voyager with a substantial line of credit: $200 million in cash and USDC, and a separate 15,000 Bitcoin revolving credit facility.

This raises some interesting questions:

- Was this initial line of credit intended to prevent Voyager’s collapse?

- Does Alameda’s existing financial relationship with Voyager give FTX an advantage in the bidding process?

- What are the implications of Alameda both being a creditor and potentially a related party to the bidder (FTX)?

These are complex questions that will likely be scrutinized as the bankruptcy proceedings continue.

Voyager’s Auction: What’s Next and Who Else is in the Running?

The auction for Voyager’s assets commenced on September 13th, and the crypto world is eagerly awaiting the announcement of the winning bid at a hearing scheduled for September 29th. While FTX and Binance are currently leading the pack, other contenders are also in the mix. According to the Wall Street Journal, trading platform CrossTower and cryptocurrency investment firm Wave Financial have also submitted bids.

The final outcome remains uncertain, but the competition highlights the value still perceived in Voyager’s assets, despite its financial troubles.

The Voyager Digital Bankruptcy: A Quick Recap

Voyager Digital’s bankruptcy filing in July 2022 sent shockwaves through the crypto community. At the time of filing, Voyager reported:

- $4.9 billion in liabilities

- $5 billion in total assets

The significant gap between assets and liabilities, and the subsequent decline in Voyager’s stock value (plummeting over 99%), underscores the severity of the situation and the impact of the “Crypto Winter” on certain crypto businesses, particularly those involved in lending and yield-generating activities.

Key Takeaways and What to Watch For

The Voyager Digital auction is more than just a bankruptcy proceeding; it’s a microcosm of the larger shifts happening in the crypto industry. Here are some key takeaways and points to watch:

- Consolidation is Accelerating: The “Crypto Winter” is forcing consolidation in the industry, with larger players like FTX and Binance actively acquiring assets and market share.

- Strategic Acquisitions: These acquisitions are not just opportunistic; they are strategic moves to strengthen market position and expand reach for the acquiring companies.

- Regulatory Scrutiny: Bankruptcies and acquisitions in the crypto space will likely attract increased regulatory attention to protect consumers and ensure market stability.

- The Future of Crypto Lending: Voyager’s collapse and the ongoing auction raise questions about the viability and risks associated with crypto lending platforms.

- September 29th Hearing: Mark your calendars! The hearing on September 29th will be crucial, as the winning bid for Voyager’s assets is expected to be revealed. This will be a significant moment for Voyager creditors and the broader crypto industry.

In Conclusion: A Crypto Crossroads

The battle for Voyager Digital’s assets between FTX and Binance represents a pivotal moment in the crypto industry. It highlights the resilience of some players amidst market turmoil and underscores the ongoing evolution of the crypto landscape. As we await the outcome of the Voyager auction, one thing is clear: the “Crypto Winter” is reshaping the industry, and the actions of giants like FTX and Binance will play a crucial role in defining its future. Stay tuned for updates as this story develops!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.