The SEC’s recent scrutiny of Lido and Rocket Pool’s staking programs has sent ripples through the crypto market. Are these platforms offering innovative DeFi solutions or unregistered securities? Let’s dive into the heart of the matter and explore the potential ramifications for investors and the future of staking.

SEC Labels Lido and Rocket Pool Staking Programs as Securities

- The SEC is now considering Lido and Rocket Pool’s staking tokens as securities.

- This reclassification stems from how these programs operate similarly to investment contracts.

The United States’ SEC (Securities and Exchanges Committee) is again in the news. This time, it’s for labeling Lido [LDO] and Rocket Pool [RPL] as securities.

SEC Strikes Again

The SEC considers Lido and Rocket Pool’s staking programs to be securities because they function similarly to investment contracts.

Investors contribute their ETH to a shared pool, expecting to earn profits based on the program’s managers’ efforts, rather than their own actions.

The SEC classifying Lido and Rocket Pool’s staking programs as securities can have several negative consequences.

- Registering and complying with securities regulations can be expensive and time-consuming. Lido and Rocket Pool might face significant hurdles in meeting these requirements.

- The lawsuit has fueled fear in the market, potentially leading to a decline in user participation and a drop in the value of their tokens (stETH & rETH).

Data from Santiment revealed that the network growth associated with both stETH and rETH fell materially over the past few weeks.

This suggests that the number of new addresses interested in both these staking tokens declined significantly.

If new users continue to lose interest in them, both these protocols could suffer.

Additionally, operating as a security might restrict Lido and Rocket Pool’s ability to offer their services freely.

They might face limitations on who they can offer their services to or how they structure their programs.

Deja Vu

The SEC’s lawsuit against Ripple Labs provides valuable insights into the potential consequences Lido and Rocket Pool might face.

In that case, the lawsuit triggered a significant drop in XRP’s price as exchanges delisted it due to uncertainty over its legal status. In fact, LDO and RPL have already recorded price drops following the SEC’s announcement.

And, a further decline is not exactly out of the question.

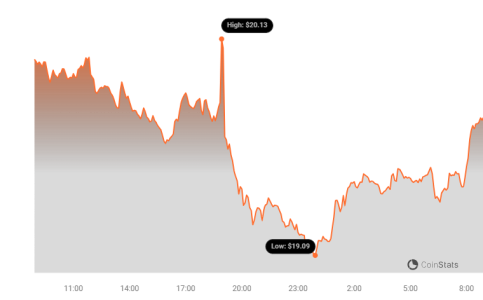

At the time of writing, LDO was down by 18.17% in the last 24 hours. RPL, on the other hand, fell by 1.08%.

However, it is also important to see that the SEC’s core argument in the Ripple case was that XRP itself was a security sold through an unregistered offering.

Lido and Rocket Pool’s case is slightly different. The SEC views their staking programs as investment contracts, not the tokens themselves, which could mean bad news for stETH and rETH. Thus, the impact on LDO and RPL will remain largely uncertain for some time.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.