Hold onto your hats, crypto enthusiasts! MicroStrategy, the business intelligence firm led by Michael Saylor, is making headlines again – and this time, it’s all about massive profits. Their strategic bet on Bitcoin is looking incredibly smart as the price of the leading cryptocurrency blasts past $42,000. We’re talking about a staggering $2 billion profit on their Bitcoin holdings. Let’s dive into how MicroStrategy turned Bitcoin volatility into a goldmine.

MicroStrategy’s Bitcoin Bet: A Timeline of Bold Moves

Back in August 2020, when many were still scratching their heads about Bitcoin, MicroStrategy, under the guidance of Executive Chairman Michael Saylor, took a decisive leap into the crypto world. This wasn’t just a toe-dip; it was a full-on plunge. Let’s break down their journey:

- August 2020: MicroStrategy initiates its Bitcoin investment strategy, making it one of the first publicly traded companies to adopt Bitcoin as a primary treasury reserve asset.

- Consistent Accumulation: Since then, they’ve consistently added to their Bitcoin stack, viewing it as a superior long-term store of value compared to traditional assets.

- Strategic Funding: Saylor and MicroStrategy haven’t shied away from using various financial instruments, including debt and equity, to fuel their Bitcoin acquisitions.

- Long-Term Vision: Even through the volatile crypto winters, MicroStrategy doubled down, reinforcing their conviction in Bitcoin’s future.

By the Numbers: MicroStrategy’s Bitcoin Treasure Chest

Let’s get down to the nitty-gritty. As of November 30th, the numbers speak volumes about MicroStrategy’s commitment and the payoff it’s generating:

| Metric | Details |

|---|---|

| Total Bitcoin Holdings | 174,530 BTC |

| Total Purchase Price | Approximately $5.28 billion |

| Average Cost Per Bitcoin | $30,252 |

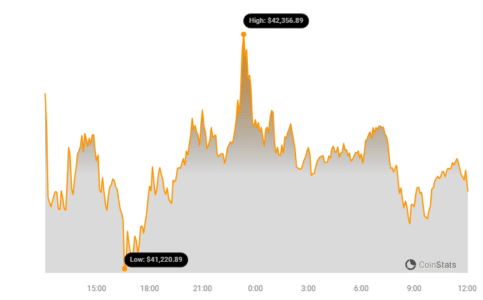

Now, fast forward to this week. As Bitcoin’s price surged to $42,000 (and even briefly beyond!), the value of MicroStrategy’s crypto vault exploded. Calculating the current value:

| Metric | Details |

|---|---|

| Bitcoin Price (Peak) | $42,000+ |

| Value of 174,530 BTC at $42,000 | Roughly $7.3 billion |

| Profit on Bitcoin Holdings | Over $2 billion! |

Even with a slight dip to around $41,700, MicroStrategy remains firmly in the profit zone, showcasing the immense potential of strategic Bitcoin allocation.

Remember the Crypto Winter? MicroStrategy Weathered the Storm

It wasn’t always sunshine and roses for Bitcoin or MicroStrategy’s investment. Think back to 2022 – the year of the Terra (LUNA) collapse and a brutal bear market. Bitcoin’s price plummeted, sinking below $16,000. For MicroStrategy, with billions invested, this was a critical test. Concerns arose about the viability of their strategy.

However, Michael Saylor and MicroStrategy remained unfazed. Instead of panicking or selling, they doubled down. They continued to accumulate Bitcoin, leveraging dips as buying opportunities. This resilience and long-term vision are now paying off spectacularly.

See Also: Ethereum Price Is Gaining Pace Above The $2,200 Resistance, Is $2,500 Feasible?

Michael Saylor: Bitcoin Bull and ‘Legend’

Michael Saylor’s unwavering advocacy for Bitcoin has solidified his position as a leading figure in the crypto space. His conviction and strategic execution have garnered attention and praise. Recently, MicroStrategy added another 16,130 Bitcoins to their holdings. This move didn’t go unnoticed. Mike Novogratz, billionaire investor and CEO of Galaxy Digital, publicly lauded Saylor as a “legend.” High praise indeed, highlighting the respect Saylor commands within the financial and crypto communities.

El Salvador Joins the Profit Party

MicroStrategy isn’t the only entity celebrating Bitcoin’s resurgence. El Salvador, under President Nayib Bukele, also made a bold move by adopting Bitcoin as legal tender and adding it to their national treasury. Bukele recently announced that El Salvador’s Bitcoin investments are now in profit, exceeding $3 million. This parallel success story further underscores the potential benefits of Bitcoin adoption, even for nations.

Market Reacts Positively: MicroStrategy Stock on the Rise

The market is clearly taking note of MicroStrategy’s Bitcoin success. On Monday, MicroStrategy’s shares (MSTR) jumped by 6% in trading. This reflects investor confidence in the company’s strategy and the potential for continued gains as Bitcoin’s bull run potentially continues.

Currently, Bitcoin is trading at around $41,593 (at press time), having briefly touched above $42,000 yesterday. The momentum is palpable, and the crypto market is buzzing with renewed optimism.

Key Takeaways: What Can We Learn from MicroStrategy’s Bitcoin Success?

- Conviction Pays Off: MicroStrategy’s unwavering belief in Bitcoin, even during downturns, is a testament to the importance of long-term vision in investing.

- Strategic Allocation: Treating Bitcoin as a treasury reserve asset can be a viable strategy for corporations seeking diversification and potential upside.

- Risk Management is Crucial: While MicroStrategy’s bet is currently winning, it’s important to remember the inherent volatility of crypto markets. Diversification and careful risk assessment remain paramount.

- Saylor’s Leadership: Michael Saylor’s bold leadership and clear communication have been instrumental in MicroStrategy’s Bitcoin journey.

In Conclusion: Is Corporate Bitcoin Here to Stay?

MicroStrategy’s $2 billion Bitcoin profit is more than just a number; it’s a powerful signal. It demonstrates the potential for significant financial gains through strategic Bitcoin adoption. As Bitcoin continues its upward trajectory and institutional interest grows, MicroStrategy’s story serves as a compelling case study. Will more corporations follow suit and add Bitcoin to their balance sheets? The answer may well depend on the continued success stories like MicroStrategy’s, proving that in the world of finance, sometimes, the boldest bets yield the biggest rewards.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.