Is the Wall Street tide finally turning towards Bitcoin? It certainly looks that way! In a move that’s sending ripples through the financial world, Miller Value Funds, a well-respected asset management company overseeing a hefty $3.5 billion, has officially stepped into the Bitcoin arena. They’ve filed with the SEC to invest up to 15% of their portfolio in the Grayscale Bitcoin Trust (GBTC). Think about that – a significant chunk of a traditional investment firm’s assets potentially flowing into Bitcoin! This isn’t just another headline; it’s a powerful signal of growing institutional confidence in cryptocurrency, spearheaded by none other than legendary investor Bill Miller.

Miller Value Funds and Bitcoin: What’s the Big Deal?

Let’s break down what this SEC filing actually means. Miller Value Funds isn’t just dipping a toe; they’re planning to allocate up to 15% of their total portfolio to Bitcoin through the Grayscale Bitcoin Trust. Why GBTC? It’s a familiar and regulated vehicle for institutional investors to gain exposure to Bitcoin without directly holding the cryptocurrency. While the filing states they’ll cap new Bitcoin purchases at 15%, it’s interesting to note they haven’t clarified whether they’ll sell if price surges push their holdings beyond this limit. Keep an eye on that!

Perhaps most notably, this marks a historic moment: Bitcoin’s debut in a publicly traded portfolio managed by Miller Value Funds. This isn’t some small, experimental allocation; it’s a clear statement of intent.

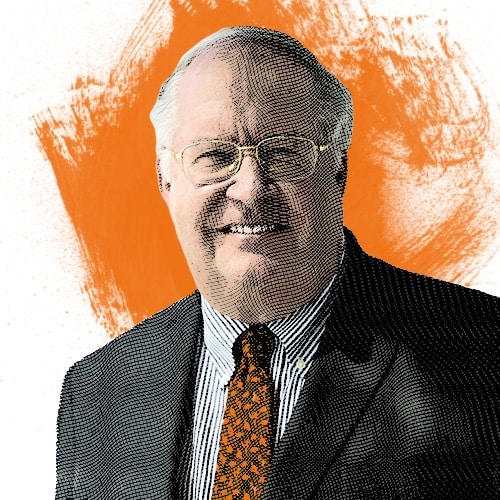

Bill Miller: Bitcoin Believer and Veteran Investor

Who is Bill Miller, and why should we care about his opinion on Bitcoin? He’s not just any investor; he’s a seasoned veteran with decades of experience and a strong track record. And he’s been a vocal Bitcoin advocate for years! Miller sees Bitcoin not as a fleeting trend, but as a genuine store of value, especially crucial in today’s uncertain economic climate. In his investor letters, he’s consistently championed Bitcoin as a vital portfolio component, particularly when inflation worries loom large.

Miller Value Funds: A Quick Snapshot

To understand the scale of this move, let’s look at Miller Value Funds. As of December 31, 2020, they managed $2.24 billion in AUM (Assets Under Management). Their portfolio already includes major players like:

- Amazon

- Uber

- Farfetch Ltd

- DXC Technology Co.

Adding Bitcoin to this mix isn’t a random decision; it aligns perfectly with their investment philosophy of seeking assets with substantial growth potential. They’re known for identifying opportunities, and Bitcoin, in their view, seems to be a significant one.

Institutional Bitcoin Rush: Is This the Start of Something Bigger?

Miller Value Funds isn’t alone in recognizing Bitcoin’s potential. We’re witnessing a broader trend of institutional Bitcoin adoption. Think about companies like MicroStrategy, who have boldly invested over $1.5 billion in Bitcoin. Their CEO, Michael Saylor, is practically Bitcoin’s biggest corporate cheerleader, actively encouraging other companies to follow suit.

Miller Value Funds’ Bitcoin move is happening alongside:

- MicroStrategy doubling down on Bitcoin, consistently increasing their holdings.

- Whispers of potentially massive $25 billion institutional inflows into Bitcoin by the end of the year, as predicted by NYDIG’s Ross Stevens.

- More and more publicly traded companies exploring Bitcoin as a strategic inflation hedge.

Bitcoin: Why Are Institutions Suddenly Interested?

Why the sudden surge in institutional interest in Bitcoin? It boils down to a few key factors:

- Scarcity Factor: Bitcoin’s limited supply of 21 million coins is a fundamental draw. In a world of potentially inflating fiat currencies, scarcity is valuable.

- Inflation Hedge: As governments print more money, concerns about fiat currency devaluation rise. Bitcoin is increasingly seen as a safe haven, a digital gold, to protect against inflation.

- Market Maturation: The Bitcoin market is evolving. We’re seeing greater regulatory clarity (though still evolving!), more sophisticated investment tools, and increased overall adoption. It’s becoming easier and more comfortable for institutions to participate.

The Takeaway: Bitcoin’s Institutional Future Looks Bright

Miller Value Funds’ foray into Bitcoin is more than just a news story; it’s a significant indicator. It underscores the growing conviction among institutional players that Bitcoin is not just a fad, but a legitimate asset class with staying power. As institutional money continues to flow into Bitcoin, and as its reputation as “digital gold” solidifies, we’re likely witnessing a fundamental shift in how traditional finance views and interacts with cryptocurrency.

Want to stay ahead of the curve in the crypto world? Dive into our latest news to explore the groundbreaking startups and innovations shaping the future of crypto and disrupting traditional industries. The revolution is underway!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.