Buckle up, crypto enthusiasts! Tuesday was a wild ride in the crypto market, and not the fun kind. Imagine watching Bitcoin soar, hitting a near 2-year high, only to come crashing down faster than a meme stock after a hype cycle. All thanks to a single, incredibly misleading tweet from the official Securities and Exchange Commission (SEC) account. Yes, you read that right – the SEC itself inadvertently (or not?) caused a whopping $210 million crypto meltdown. Let’s dive into this saga of fake news, market manipulation, and the ever-present uncertainty around Bitcoin ETFs.

The Tweet That Shook the Crypto World: A Pleasant Announcement Gone Wrong?

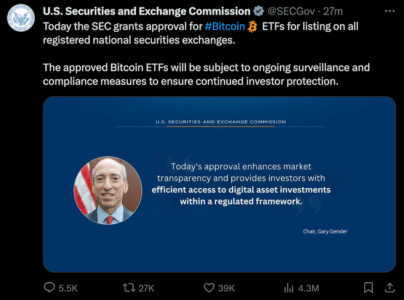

It all started with a seemingly innocuous tweet from the SEC’s official X (formerly Twitter) account. The tweet declared the approval of spot Bitcoin exchange-traded funds (ETFs). For those in the know, this is HUGE news. A spot Bitcoin ETF is the holy grail for many crypto investors, promising to open the floodgates for institutional investment and mainstream adoption.

The market reacted instantly and euphorically. Bitcoin price jumped nearly 3%, surging towards a $47,900 peak – a level not seen in 20 months. Investors rejoiced, believing this was the moment they’d been waiting for. Finally, mainstream Bitcoin ETFs were here!

From Euphoria to Earth-Shattering Disappointment: What Went Wrong?

But as they say, if something seems too good to be true, it probably is. The celebration was tragically premature. The joyous news turned out to be completely “fabricated.” As quickly as the market surged, the truth emerged: the SEC’s Twitter account had been compromised. The ETF approval tweet was fake. The rug pull was swift and brutal.

The market’s optimism evaporated. Bitcoin, which had been riding high on the wave of false hope, plummeted back down to reality. The dream of instant ETF approval dissolved, leaving behind a bitter taste of disappointment and a cloud of uncertainty hanging over the crypto market.

See Also: SEC Chair Gary Gensler’s False Tweet Immortalized On Bitcoin Ordinal Forever

Social Media, Misinformation, and Market Mayhem: A Dangerous Cocktail?

This incident throws a harsh light on the powerful, and sometimes dangerous, intersection of social media and financial markets. In the blink of an eye, a single misleading tweet can trigger massive market volatility. It underscores the absolute necessity for:

- Rigorous Fact-Checking: Investors must double, triple-check information, especially in the fast-paced crypto world. Don’t take every tweet at face value, even from official-looking accounts.

- Cautious Interpretation: Avoid knee-jerk reactions to news, especially on social media. Wait for official confirmations from multiple reliable sources before making investment decisions.

- Source Verification: Always verify the source of information. Is it truly the official SEC account? Are there other reputable news outlets confirming the story?

The $210 Million Fallout: Who Paid the Price?

The fake tweet wasn’t just a blip on the radar; it had real financial consequences. The crypto meltdown resulted in a staggering $210 million in liquidations. Let’s break down where the losses hit:

- Long Positions: A whopping $135 million was wiped out from long positions – bets that the price would go up. These investors were caught off guard, hoping to ride the ETF approval wave.

- Short Positions: Surprisingly, even those betting against Bitcoin (short positions) weren’t spared. $67 million in short positions were also liquidated, likely due to the initial price surge before the fake news was debunked.

This widespread liquidation across both long and short positions highlights the sheer turbulence caused by the misinformation. It wasn’t just one side of the market that suffered; the fake tweet created chaos for almost everyone involved.

We can confirm that the account @SECGov was compromised. We have removed the account and are investigating how this happened. https://t.co/NYeHTYaziH

— Safety (@Safety) January 9, 2024

SEC Under Fire: Breach, Blame, and Calls for Investigation

Security Lapses at the SEC?

Security experts are now questioning how an agency as critical as the SEC could have its official social media account breached. The incident raises serious concerns about the SEC’s cybersecurity protocols and the vulnerability of official government communications.

Legal Eagles Circling: Market Manipulation Charges?

Meanwhile, legal experts are not holding back. Many are pointing fingers directly at the SEC for the market pandemonium that ensued. A group of securities lawyers boldly stated, “The SEC will have to investigate itself for market manipulation,” reflecting widespread disbelief and a demand for accountability.

Political Pressure Mounts

Adding to the pressure, Senator Bill Hagerty has publicly demanded answers from the SEC, echoing the industry-wide call for a thorough investigation. Even Ripple CEO Brad Garlinghouse, a prominent voice in the crypto space, has joined the chorus, emphasizing the urgent need for the SEC to investigate itself.

And now the SEC twitter account was hacked and tweeted (falsely) that spot ETFs were approved.

When will the adults be back in charge?? https://t.co/WhC55HiTVj

— Brad Garlinghouse (@bgarlinghouse) January 9, 2024

Bitcoin ETF Approval: Still a Question Mark?

Amidst all the chaos and finger-pointing, the fundamental question remains: will the SEC finally approve a Bitcoin ETF? After years of anticipation and regulatory hurdles, the agency’s track record has been, to put it mildly, inconsistent. This incident only adds another layer of complexity to the ETF approval saga.

See Also: SEC Chair Gary Gensler Reveals SEC Account Hacked, No Approval For Spot BTC ETFs Yet

Financial commentator Charles Gasparino perhaps summed it up best: “For the SEC not to approve tomorrow would be unprecedented.” The pressure is on. Will the SEC move forward with ETF approvals despite this embarrassing episode, or will this further delay the process?

Total crypto market cap at $1.668 trillion on the daily chart: TradingView.com

What’s Next? Regulatory Reform and Market Vigilance

This is not the end of the story; it’s likely just the beginning of a new chapter. We can anticipate:

- Regulatory Reforms: Expect increased scrutiny of the SEC’s social media security and communication protocols. This incident may trigger a broader review of how regulatory bodies interact with the crypto market and disseminate information.

- Legal Battles: The calls for investigation and potential market manipulation charges could lead to legal challenges and further complicate the SEC’s relationship with the crypto industry.

- Market Rethink: This event serves as a critical wake-up call for crypto investors and the market as a whole. It reinforces the need for heightened vigilance, critical thinking, and a healthy dose of skepticism in the face of breaking news, especially on social media.

The Watchdog Under Watch: Final Thoughts

The $210 million crypto meltdown caused by a fake tweet is a stark reminder of the crypto market’s inherent volatility and susceptibility to misinformation. Accusations of manipulation are flying, and regulatory scrutiny is intensifying. The SEC, the very body tasked with overseeing these markets, now finds itself under the microscope.

One thing is clear: the SEC has some serious explaining to do and some internal tightening up to address. The crypto world, and indeed the wider financial world, is watching closely to see how the watchdog handles having its own leash pulled. The future of crypto regulation and the fate of Bitcoin ETFs may well hinge on the lessons learned from this chaotic Tuesday.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.