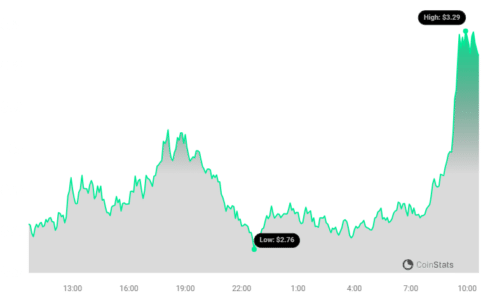

Buckle up, crypto enthusiasts! The NEAR Protocol (NEAR) is making waves in the market, and if you blinked, you might have missed a significant jump. Over the last 24 hours, NEAR has experienced a breathtaking 17.72% surge, propelling its price to $3.34. This isn’t just a minor blip; it’s a full-blown rocket launch in the crypto world! Let’s dive into what’s powering this impressive rally and what it could mean for the future of NEAR.

What’s Behind the NEAR Protocol Price Explosion?

This price surge isn’t happening in a vacuum. Several key indicators point towards strong market activity and growing investor confidence in NEAR Protocol. Let’s break down the numbers:

- Price Jump: A significant 17.72% increase in the last 24 hours.

- Trading Volume Skyrockets: An astounding 173.49% increase in trading volume, reaching a massive $483.15 million. This indicates a frenzy of buying and selling activity around NEAR.

- Market Cap Boost: NEAR’s market capitalization has also jumped by 18.06%, now standing at a robust $2.86 billion. This reflects a substantial increase in the overall perceived value of the NEAR network.

These figures collectively paint a picture of heightened market enthusiasm. But what exactly is driving this surge?

Digging Deeper: Why is NEAR Protocol Gaining Traction?

NEAR Protocol isn’t just another cryptocurrency; it’s designed with a focus on solving some critical challenges in the blockchain space. Known for its innovative approach, NEAR prioritizes:

- Scalability: NEAR uses a technology called “Nightshade sharding” to process transactions in parallel, making it significantly faster and more scalable than many older blockchains. This is crucial for handling a growing number of users and applications.

- User-Friendliness: NEAR aims to make decentralized applications (dApps) as easy to use as web applications. This focus on user experience can attract a broader audience beyond just crypto-natives.

- Developer Accessibility: NEAR provides a developer-friendly environment, making it easier for developers to build and deploy dApps. This fosters innovation and expands the ecosystem.

This recent price surge could be a direct response to growing recognition of NEAR’s technological advantages and its potential to become a leading platform for decentralized applications. Perhaps recent announcements about partnerships, technological upgrades, or successful dApp launches within the NEAR ecosystem are fueling this positive sentiment.

See Also: KuCoin Lists Script Network Token (SCPT) On Its Trading Platform

Open Interest Soars: A Sign of Stronger Market Conviction?

Beyond price and volume, another crucial metric is Open Interest (OI). Data from Coinalyze reveals a significant 47.18% increase in NEAR’s total open interest in the last 24 hours, reaching a notable $117.8 million.

What exactly is Open Interest? In simple terms, open interest represents the total number of outstanding derivative contracts, like futures or options, that are yet to be settled. A rising OI generally indicates that new money is flowing into the market and traders are opening new positions. This can be a sign of increasing market participation and stronger conviction behind price movements.

NEAR Open Interest Breakdown:

Let’s see where the bulk of this open interest is concentrated:

- Binance: Dominates with $69.6 million in open interest.

- Bybit: Follows closely with $30.2 million.

- OKX: Holds $13 million in open interest.

- Other Platforms: Contribute to the remaining open interest.

The significant increase in open interest, especially on major exchanges like Binance and Bybit, suggests that traders are not just reacting to the price surge but are actively placing bets on NEAR’s future price movement.

Decoding Market Sentiment: Longs vs. Shorts – The Mystery Remains

While the surge in total open interest is undoubtedly bullish, the crucial piece of the puzzle that remains unclear is the ratio between long and short positions. Is this OI increase driven by traders betting on further price increases (long positions) or those anticipating a potential pullback (short positions)?

Without a clear breakdown, the market sentiment surrounding NEAR remains somewhat ambiguous. A predominantly long-biased OI would suggest strong bullish conviction, while a significant presence of short positions could indicate hedging or anticipation of a correction.

What’s Next for NEAR Protocol?

The coming days will be critical in determining the sustainability of NEAR’s recent gains. Investors and analysts will be closely watching:

- Price Action: Will NEAR maintain its upward momentum, or will we see a correction?

- Trading Volume: Will the high trading volume persist, indicating continued interest, or will it subside?

- Open Interest Trends: Will OI continue to climb, reinforcing bullish sentiment, or will it plateau or decline?

- Broader Market Context: How will NEAR perform relative to Bitcoin and the overall cryptocurrency market? General market sentiment can significantly impact altcoin movements.

NEAR Protocol’s performance in this period could offer valuable insights into broader market trends and the appetite for altcoins with strong fundamentals and innovative technologies. As the crypto landscape continues to evolve, NEAR is definitely positioning itself as a cryptocurrency to watch closely.

In Conclusion: NEAR Protocol – A Rising Star in the Crypto Galaxy?

NEAR Protocol’s impressive 17% price surge, coupled with a massive increase in trading volume and open interest, signals a significant shift in market attention towards this innovative blockchain. Whether this rally is fueled by genuine long-term conviction or short-term speculation remains to be seen. However, NEAR’s focus on scalability, user-friendliness, and developer accessibility provides a strong foundation for future growth. Keep an eye on NEAR Protocol – it might just be warming up for an even bigger leap!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.