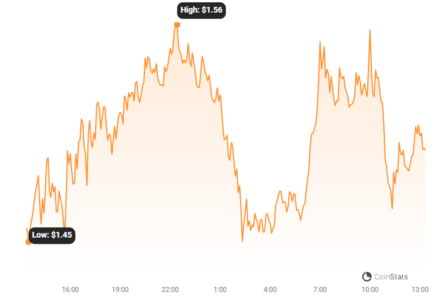

- Following the announcement of a new agreement, NEAR experienced intraday growth.

- While the coin traded at overbought levels, the bulls maintained market control.

Following the announcement of a cooperation with Nym Technologies, the native token of the layer 1 Near Protocol [NEAR] experienced an intraday price rise of 11% on November 1. On 1 November, NEAR’s price went up by almost 11% after the foundation behind the protocol announced its partnership with Nym Technologies.

The cooperation will see the incorporation of the Nym mixnet into the Near ecosystem, according to the announcement blog post. Near hopes to safeguard the privacy and security of its ecosystem’s developers, operators, and consumers through this integration.

While NEAR has since lost most of its gains, its price was still up by 9% in the last 24 hours, according to Coinstat data.

A Price Drop is on the Way

At the time of publication, NEAR Protocol was trading at $1.5, its highest price since June 3rd. The token’s value has increased by over 25% in the last week. However, readings from the altcoin’s price movement on a daily chart revealed that it was due for a price correction.

To begin, the price of the token is trading above the upper range of its Bollinger Bands indicator. When the price of an asset exceeds the upper range of this indicator, the market is deemed overbought. At these levels, price reversals and corrections are common.

At the time of publication, key momentum indicators were at overbought highs. The Money Flow Index (MFI) for NEAR was 100, and the Relative Strength Index (RSI) was 78.73. An MFI score of 100 indicates significant purchasing pressure, but an RSI value of 70 indicates strong upward momentum.

Read Also: Robert Kiyosaki Praises Bitcoin As Stocks Crash

Buyers’ weariness kicks in at these highs, as bulls struggle to launch additional price growth. Most market participants are primarily interested in profit at these levels, hence token distribution is typical.

The Bulls May not be Easily Moved

While NEAR’s major momentum revealed that the alt was overbought at the time of publication, other indications confirmed that the bulls were still in control of the spot market.

The bulls’ strength (green) at 41.35 was greater than the bears’ (red) at 4.84, according to the token’s Directional Movement Index (DMI).

In addition, the Average Directional Index (yellow) was at 41.30. An ADX value of 41.30 is considered relatively high, indicating that the market was experiencing a strong trend at the time of writing.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.