In the fast-evolving world of NFTs, where digital art meets decentralized finance, even platforms designed to enhance liquidity can become targets. Recently, Flooring Protocol, a platform aiming to revolutionize NFT liquidity, reportedly experienced a cyberattack on December 16th. Let’s dive into what happened, how it unfolded, and what it means for the NFT space.

What Exactly Happened to Flooring Protocol?

Reports began circulating on X (formerly Twitter) detailing a cyberattack on Flooring Protocol. It appears the exploit targeted the platform’s peripheral or multicall smart contract. Think of it like a side door being left slightly ajar, rather than a breach in the main vault. Unfortunately, this ‘side door’ was enough for the attacker to gain access and reportedly steal NFTs.

According to on-chain data and social media accounts, the attacker didn’t just steal the NFTs; they immediately began ‘dumping’ them on the market. This rapid sale of stolen assets is a common tactic in crypto exploits, aiming to cash out quickly before countermeasures can be put in place.

We are aware of the exploit on our peripheral contract. Main contract & vaults are safe. We have deployed a fix. Working on next steps now.

— Flooring Protocol 🌊 (@FLC_FlooringLab) December 17, 2023

Swift Response and Damage Control

In a reassuring turn, the Flooring Protocol team acted swiftly. Just hours after the attack was detected, they announced the deployment of a fix. They believe this patch has effectively closed the vulnerability, preventing further exploitation through the same entry point.

Crucially, Flooring Protocol reassured users that their main smart contract remained secure. They emphasized that digital assets held within vaults and safeboxes were unaffected by this particular exploit. This is a critical point, as it suggests the core infrastructure of the platform was not compromised, limiting the scope of the damage.

The Cost of the Exploit: Millions in NFTs

While the quick fix is positive news, the exploit did have financial consequences. Reports indicate the hacker successfully sold the stolen NFTs on Blur, a popular NFT marketplace. The estimated profit from this illicit sale ranges between $1.5 million and $1.6 million, a significant sum highlighting the lucrative nature of NFT exploits.

Flooring Protocol peripheral contract exploited.

– hacker stole nfts and dumped on blur

– made ~850 ETH (~1.5M – 1.6M depending on eth price)

– main contract and vaults are safe

– fix deployedrough day for nfts @NFTTrader @FLC_FlooringLab pic.twitter.com/8o9FepFp73

— tombi.eth (@realtombibiyan) December 16, 2023

Will Users Recover Their NFTs? Don’t Get Your Hopes Up

Boring Security, a security protocol funded by ApeCoin DAO, offered a sobering perspective. They suggested that users who lost NFTs in the attack are unlikely to recover them. Since the hacker has already sold the assets on the open market, tracing and reversing these transactions becomes incredibly complex, if not impossible.

A Double Whammy for NFT Platforms: NFT Trader Also Hit

Adding to the woes of the NFT space, the Flooring Protocol attack occurred shortly after another significant exploit. NFT Trader, a peer-to-peer NFT platform, was also breached. This incident saw the theft of several high-value ‘blue-chip’ NFTs, further shaking confidence in NFT platform security.

NFT Trader Hack: Demands, Givebacks, and a ‘Female Scavenger’

The NFT Trader exploit took a slightly different, almost theatrical, turn. The hacker used on-chain messages to make demands, requesting a bounty of 10% of the stolen NFTs’ market value from the owners. It’s an unusual tactic, adding a layer of bizarre negotiation to the typical exploit scenario.

However, the NFT Trader saga became even more unpredictable. Hours into the incident, the hacker seemingly had a change of heart. They voluntarily returned some of the stolen NFTs, including a valuable World of Women NFT and several Mutant Ape Yacht Club NFTs. This unexpected act of ‘goodwill’ is rare in the world of crypto exploits.

Adding another layer of intrigue, a second party, identifying herself as a “female scavenger,” publicly revealed the NFT Trader hacker’s address. The motivations behind this reveal remain unclear, adding a mystery element to the NFT Trader incident.

See Also: NFT Trader Hacked, Hacker Stole NFTs Worth Millions Of Dollars

Flooring Protocol: A Rising Star in NFT Liquidity

Launched just two months prior, on October 15th, Flooring Protocol quickly gained traction. Its innovative approach to NFT liquidity, breaking down NFTs into ERC-20 tokens, resonated with holders of popular collections like Azuki Elementals, Pudgy Penguins, and y00ts.

This novel mechanism positioned Flooring Protocol as a central hub for these specific NFT communities, significantly boosting their trading volume within the broader NFT marketplace. It essentially became a major ‘holder’ of these coveted collections.

The numbers speak for themselves. By October 16th, Flooring Protocol had amassed impressive holdings: 914 Azuki Elementals, 191 Pudgy Penguins, and 365 y00ts. This translated to a Total Value Locked (TVL) exceeding 1,800 ETH, demonstrating the platform’s rapid growth and user adoption.

The platform’s native token, FLC, also saw a surge in interest upon launch. It briefly achieved a fully diluted valuation exceeding a staggering $4 billion, highlighting the initial hype and potential perceived in Flooring Protocol’s approach.

FLC Token: Community Focus and Market Reaction

The FLC token has a total supply of 25 billion. A significant portion, 40%, is dedicated to community support, emphasizing a decentralized and user-centric approach. A quarter of the total supply is held as a reserve, potentially for future development or stability measures.

Within the community allocation, half of the 40% is specifically earmarked for liquidity incentives through staking. This mechanism aims to reward users for contributing to the platform’s liquidity, fostering a healthy and active ecosystem.

FLC Price Jumps Despite the Exploit: A Market Anomaly?

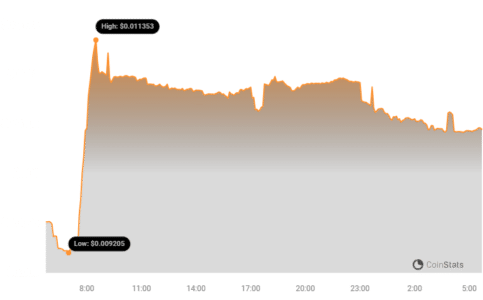

In a surprising twist, despite the security breach, the price of FLC actually increased. Data from Coinstats indicates a 12% jump in FLC prices in the 24 hours following the attack. This counterintuitive market reaction could be attributed to various factors, including dip-buying sentiment, belief in the team’s swift response, or broader market trends.

The token’s recent performance has been mixed. While experiencing strong gains over the last 30 days (52%) and 14 days (8.3%), FLC has faced a downturn in the immediate week prior to the exploit, losing 22.2% of its value. This volatility is characteristic of the crypto market, and particularly pronounced in newer tokens associated with emerging platforms.

Key Takeaways and the Road Ahead

The Flooring Protocol exploit, alongside the NFT Trader incident, serves as a stark reminder of the ongoing security challenges within the NFT and DeFi spaces. While Flooring Protocol’s rapid response in patching the vulnerability is commendable, the incident highlights the critical need for:

- Robust Security Audits: Platforms must prioritize comprehensive and continuous security audits, particularly for smart contracts, to identify and mitigate potential vulnerabilities proactively.

- Proactive Monitoring and Incident Response: Swift detection and response are crucial in minimizing the damage from exploits. Flooring Protocol’s quick action is a positive example.

- User Education and Risk Awareness: Users need to be aware of the inherent risks in interacting with DeFi and NFT platforms, understanding that exploits, while becoming less frequent, are still a reality.

Despite this setback, Flooring Protocol’s innovative approach to NFT liquidity still holds promise. The platform’s quick recovery and the market’s seemingly positive reaction to the FLC token suggest underlying confidence in its long-term potential. However, the incident underscores that in the rapidly evolving world of crypto, security must remain paramount for sustained growth and user trust.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.