The launch of spot Bitcoin ETFs has sent shockwaves through the crypto market! While Grayscale’s GBTC saw significant outflows, nine new ETFs are aggressively accumulating Bitcoin. The numbers are staggering, and the implications for Bitcoin’s price are huge. Let’s dive into the details.

Spot Bitcoin ETFs: A Buying Frenzy

Just seven days after launch, nine spot Bitcoin ETFs have collectively acquired over 100,000 BTC! To put that in perspective, it took MicroStrategy, a major Bitcoin advocate, roughly 300 days to reach the same milestone.

- Nine ETFs Dominate: BlackRock’s IBIT, Fidelity’s FBTC, and others are leading the charge.

- $4.1 Billion Inflow: The total value of BTC purchased by these ETFs in the first week is approximately $4.1 billion.

- MicroStrategy Comparison: The amount equals 53% of MicroStrategy’s total Bitcoin holdings amassed over three years.

Who are the Biggest Bitcoin ETF Buyers?

Here’s a breakdown of the top spot Bitcoin ETF accumulators:

- BlackRock’s IBIT: 37,304 BTC

- Fidelity’s FBTC: 29,232 BTC

- Bitwise Bitcoin ETF (BITB): 16,451 BTC

- ARK 21Shares Bitcoin ETF (ARKB): 10,630 BTC

The Grayscale Effect: Why is GBTC Selling Off?

While other ETFs are buying, Grayscale’s GBTC has been actively selling, offloading over 82,526 BTC since launch. This has had a noticeable impact on Bitcoin’s price.

- Massive Outflows: GBTC’s sales are worth around $3 billion.

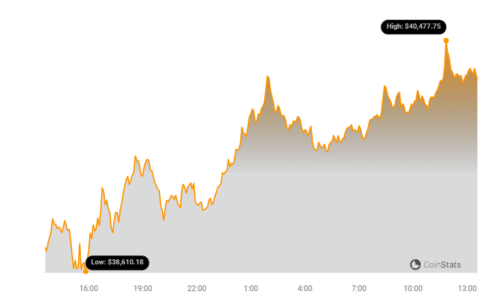

- Price Impact: Bitcoin plummeted nearly 20% following the ETF launch, partially attributed to GBTC selling pressure.

- Current Price: As of now, Bitcoin is trading around $40,243.17, showing some recovery.

Why is GBTC Selling So Much Bitcoin?

Several factors are contributing to the GBTC outflows:

- FTX Estate: Some believe the collapsed FTX exchange is dumping GBTC shares.

- High Fees: GBTC charges significantly higher trading fees (1.5%) compared to other ETFs (0.2% – 0.4%).

What Does This Mean for Bitcoin?

The spot Bitcoin ETF launch is a game-changer. The massive inflows from new ETFs demonstrate strong institutional demand. However, the GBTC situation highlights the importance of competitive fees and the potential for market volatility.

Key Takeaways:

- Spot Bitcoin ETFs are rapidly accumulating BTC.

- GBTC outflows are creating selling pressure.

- The long-term impact on Bitcoin’s price remains to be seen.

The launch of spot Bitcoin ETFs marks a pivotal moment for Bitcoin, bridging the gap between traditional finance and the crypto world. While short-term volatility is expected, the increased accessibility and institutional interest suggest a promising future for Bitcoin.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.