Navigating the choppy waters of the crypto market can feel like searching for an oasis in the desert. For Cardano (ADA) holders, recent data paints a mixed picture, sparking both caution and glimmers of hope. Are you wondering about the current state of ADA profitability and what the charts are hinting at? Let’s dive deep into the latest insights and understand what’s shaping Cardano’s market landscape.

Cardano (ADA) Profitability: A Snapshot

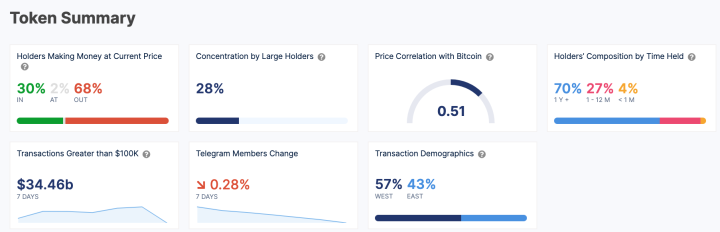

Recent reports indicate that only 30% of Cardano (ADA) holders are currently seeing profits. This stark statistic means a significant majority, a whopping 70%, are currently holding ADA at a loss. This situation underscores the volatile nature of the cryptocurrency market and the importance of staying informed. But is it all doom and gloom for ADA?

- Only 30% of Cardano (ADA) holders are currently in profit, signaling widespread unrealized losses among investors.

Signs of Strength Amidst Market Weakness?

Despite a less-than-stellar performance over the past month, Cardano isn’t entirely without its bright spots. Interestingly, on-chain data suggests that ADA is exhibiting signs of strong underlying support. This resilience could be a crucial factor as the market looks for direction. You can delve deeper into previous price analysis to see how bulls are positioning themselves for a potential rebound: Cardano (ADA) Price Analysis: Bulls Aim Steady Increase.

Adding to the positive signals, Cardano’s DeFi ecosystem is experiencing notable growth. The Total Value Locked (TVL) in Cardano-based DeFi applications has not only recovered but has surged to levels twice as high as its peak during the bullish market of 2021! This surge indicates increasing confidence and activity within the Cardano network’s decentralized finance sector.

Whale Watch: The Influence of Large Investors

Data from IntoTheBlock reveals that a substantial 28% of the total ADA supply is held by large investors, often referred to as ‘whales’. This concentration of holdings signifies a moderately high level of whale control in the ADA market. What does this mean for the average investor?

- Potential Price Stability & Manipulation Risks: Large holders can exert significant influence on price movements. Their trading activities, whether buying or selling, can amplify market trends and potentially introduce manipulation risks.

- Impact on Volatility: While large holders can sometimes provide stability by holding for the long term, their coordinated actions can also trigger periods of high volatility.

Cardano’s Large-Scale Investor Activity: What Are They Up To?

The past week has seen a massive $34.46 billion in large transactions involving ADA. This enormous volume points to significant activity from institutional or large-scale investors. These transactions could represent both inflows (buying pressure) and outflows (selling pressure), indicating high-stakes engagement with ADA. Monitoring these large transaction volumes can offer clues about the sentiment and strategies of major market players.

Price Trends and Technical Indicators: A Deeper Dive

As of the latest data, ADA’s price is showing a declining trend. This downtrend has been particularly evident since the beginning of June, characterized by consistently lower highs on the price charts. This pattern aligns with the prevailing bearish sentiment in the broader crypto market.

Decoding the Technical Signals

Let’s break down some key technical indicators to understand the current market dynamics for ADA:

- Bollinger Bands: The Bollinger Bands on the ADA chart are currently tight. This tightness typically suggests a period of low volatility. When bands are narrow, it often precedes a period of increased volatility, though it doesn’t indicate the direction of the breakout.

- Price Oscillation Around Middle Band: ADA’s price is currently oscillating closely around the middle band of the Bollinger Bands. This movement indicates a lack of strong bullish or bearish momentum, reinforcing the idea of a consolidation phase.

- Moving Average Convergence Divergence (MACD): The MACD is currently flatlining at zero. This flatline further supports the sentiment indicated by the Bollinger Bands, suggesting indecision in the market and a lack of clear momentum.

- Double-Top Formations: The chart reveals numerous double-top formations. These are typically recognized as bearish reversal indicators. Double tops suggest that an asset has attempted to break through a resistance level twice but failed, indicating potential downward pressure.

- Price Below Moving Averages: ADA’s price is currently trading below all key moving averages. This is generally considered a bearish signal. When the price is consistently below moving averages, it often indicates that the overall momentum is downward.

- Price Fluctuations and Resistance: ADA’s price has been fluctuating between higher resistance points and lower support levels. Each attempt to recover has been met with resistance, failing to establish new highs and instead forming lower peaks, further outlining the double-top patterns.

- Relative Strength Index (RSI): Interestingly, the RSI is oscillating between 50 and 60. This range indicates a neutral market with a slight lean towards bullish sentiment. While other indicators suggest bearish signals, the RSI offers a slightly less pessimistic view, suggesting potential for underlying strength.

Key Takeaways for ADA Holders

So, what does all this mean for Cardano holders?

- Market Consolidation: ADA is currently in a consolidation phase, characterized by low volatility and indecisive price action.

- Bearish Signals Dominate: Technical indicators like double-top formations and price below moving averages suggest a prevailing bearish sentiment in the short term.

- Underlying Strength: Despite bearish signals, the RSI indicates a neutral stance with a slight bullish lean, and on-chain data shows strong support and growing DeFi TVL.

- Whale Influence: Large investor activity remains significant and can influence price direction.

Looking Ahead: Is Profit on the Horizon?

The current Cardano market presents a complex picture. While a significant portion of holders are currently in unrealized losses and technical indicators lean bearish, there are underlying signs of strength and growing DeFi activity. Whether profit is on the immediate horizon remains uncertain. For ADA holders, staying informed, monitoring market movements, and understanding both technical and on-chain data will be crucial in navigating these times. Keep an eye on those key indicators, watch for shifts in whale activity, and stay tuned for further developments in the Cardano ecosystem!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.