The crypto world is buzzing! Just when everyone thought the story of OPNX and its co-founder Su Zhu had faded into the background, a single tweet ignited a massive price surge for the platform’s native token, OX. What’s behind this sudden resurgence, and what does it mean for the future of OPNX?

Su Zhu’s Tweet Sparks OX Token Surge: A Timeline

- September 2023: Su Zhu, co-founder of OPNX, is arrested in Singapore.

- December 1, 2023: Su Zhu posts “gm” (good morning) on X (Twitter) for the first time since his arrest.

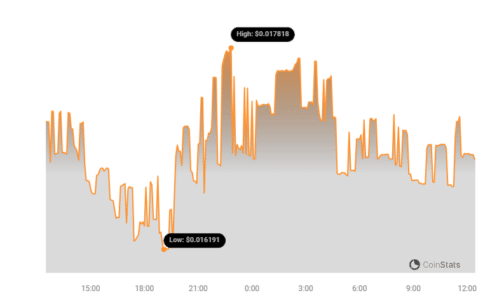

- 20 Minutes Later: The OX token price jumps nearly 50%, hitting a 63-day high.

This unexpected surge raises several questions:

Why Did the OX Token Price Explode?

The immediate catalyst appears to be Su Zhu’s tweet. Here’s why:

- Speculation and Hope: Zhu’s return to social media fueled speculation about his release and potential involvement in OPNX’s future.

- Community Sentiment: The tweet may have reignited interest and positive sentiment within the OPNX community.

- Trading Bots and Algorithms: Automated trading systems likely detected the social media activity and triggered buy orders.

OPNX: From Bankrupt Exchange to Potential Comeback?

OPNX, or Open Exchange, was founded by Su Zhu and Kyle Davies after the collapse of their crypto hedge fund, Three Arrows Capital (3AC). The platform aimed to allow trading of creditor claims from bankrupt crypto companies. However, OPNX itself faced challenges and ultimately entered bankruptcy proceedings.

The 3AC Connection: A Quick Recap

Three Arrows Capital (3AC) was a prominent crypto hedge fund that imploded in June 2022, triggering a wave of bankruptcies and market turmoil. The fund’s collapse was attributed to:

- Excessive Leverage: 3AC took on significant debt to amplify its investments.

- Poor Risk Management: The fund failed to adequately manage its exposure to volatile crypto assets.

- Contagion Effect: 3AC’s downfall triggered a domino effect, impacting other crypto companies.

What’s Next for Su Zhu and OPNX?

Su Zhu’s legal situation remains unclear, though some speculate that he may have been released from prison. Kyle Davies, the other co-founder, is believed to be residing in Bali. The future of OPNX is also uncertain, but the recent OX token surge suggests that there’s still interest in the platform.

Key Takeaways

- Social media activity can have a significant impact on crypto asset prices.

- The OPNX story highlights the risks and challenges associated with the crypto industry.

- The future of OPNX and its founders remains uncertain.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.