The crypto world is buzzing! Following the monumental approval of spot Bitcoin ETFs, the spotlight has swiftly shifted to Ethereum. Could a spot Ethereum ETF be the next big catalyst to propel the crypto market even higher? Optimism is surging, and Ethereum (ETH) is reflecting this bullish sentiment, leaping to levels not witnessed since May 2022, crossing the $2600 mark. Let’s dive into what’s fueling this excitement and what the future might hold for a spot Ethereum ETF.

Why is ETH Surging After Spot Bitcoin ETF Approval?

The answer is quite straightforward: anticipation! The SEC’s green light for spot Bitcoin ETFs on Wednesday, after years of waiting, has ignited hopes that a similar product for Ethereum could be just around the corner. This landmark decision has been interpreted by many as a sign that the regulatory landscape is softening towards crypto, paving the way for broader institutional adoption. Ethereum, being the second-largest cryptocurrency and a cornerstone of the decentralized web, is naturally the next in line for ETF consideration.

- Bitcoin ETF Approval Sets Precedent: The SEC’s approval of spot Bitcoin ETFs breaks a significant barrier, suggesting they may be more open to similar crypto investment vehicles.

- Market Optimism and FOMO: The successful launch of Bitcoin ETFs has created a wave of optimism across the crypto market. Investors are now anticipating similar accessibility for Ethereum, driving up demand and price.

- Institutional Interest in ETH: Just like Bitcoin, institutional investors are keen to gain exposure to Ethereum. A spot ETF would provide a regulated and accessible route for them to invest in ETH.

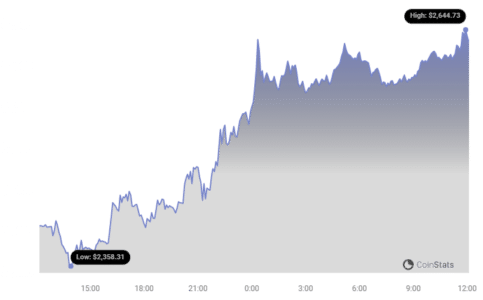

Currently, Ethereum is trading at approximately $2,620, marking an impressive 8.7% increase in the last 24 hours, according to Coinstats data. While Bitcoin is also experiencing positive movement, it’s trading relatively flat compared to ETH, up by about 2% over the same period. This clearly indicates that the ETF narrative is currently benefiting Ethereum more significantly.

Who is in the Race for a Spot Ethereum ETF?

Following the Bitcoin ETF breakthrough, several major players in the financial world are vying to launch a spot Ethereum ETF. These firms have already submitted applications to the SEC, hoping to capitalize on the growing momentum. Key applicants include:

- Ark 21Shares

- BlackRock

- Fidelity

- Grayscale

These are some of the biggest names in asset management, indicating the seriousness and scale of institutional interest in bringing a spot Ethereum ETF to market.

What are the Experts Saying About Ethereum ETF Approval Chances?

The burning question now is: how likely is a spot Ethereum ETF approval, and when could it happen? Bloomberg Intelligence ETF analyst Eric Balchunas is notably optimistic. He has reportedly stated a 70% probability of an Ethereum ETF getting the nod by May. May is significant because it’s the SEC’s final deadline for decisions on several spot Ethereum ETF applications.

Balchunas further mentioned hearing positive signals “on the back channels,” suggesting that the sentiment around spot Ethereum ETFs is favorable within regulatory circles. This kind of expert insight adds considerable weight to the growing anticipation.

Will the SEC Consider Ethereum a Security? The Million-Dollar Question

One of the persistent uncertainties surrounding Ethereum ETF approval revolves around the SEC’s classification of ETH. SEC Chair Gary Gensler has consistently avoided explicitly stating whether the regulator views Ethereum as a security or a commodity. This ambiguity has been a source of concern for the crypto industry.

However, it’s worth noting that prior to his SEC appointment, Gensler himself had publicly stated that Ethereum was considered “sufficiently decentralized” and thus, did not qualify as a security. His past remarks referenced the views of former SEC Director of Corporate Finance William Hinman, who, in a widely cited 2018 speech, expressed a similar opinion. This historical context offers a glimmer of hope that the SEC might lean towards classifying ETH as a commodity, which would significantly ease the path for ETF approval.

Looking Ahead: The Potential Impact of a Spot Ethereum ETF

The approval of a spot Ethereum ETF could have profound implications for the crypto market:

- Increased Institutional Investment: An ETF would open the floodgates for institutional capital to flow into ETH, potentially driving up prices and market capitalization.

- Enhanced Market Legitimacy: Approval by the SEC would further legitimize Ethereum and the broader crypto space in the eyes of traditional investors and the public.

- Greater Accessibility for Retail Investors: Like Bitcoin ETFs, an Ethereum ETF would make it easier for everyday investors to gain exposure to ETH through traditional brokerage accounts.

- Positive Price Action: Historically, the anticipation and launch of crypto ETFs have been associated with significant price appreciation of the underlying assets.

Conclusion: Riding the Wave of ETF Optimism

The crypto market is currently riding a wave of ETF optimism, with Ethereum at the forefront. The successful launch of spot Bitcoin ETFs has undeniably boosted the prospects of a spot Ethereum ETF. While regulatory uncertainties and SEC classifications remain factors to watch, expert opinions and historical context suggest a positive outlook. As we move closer to the potential May deadline for SEC decisions, the anticipation surrounding a spot Ethereum ETF is likely to intensify, potentially leading to further price movements for ETH. Keep a close eye on developments in this space – it promises to be an exciting journey!

See Also: Spot Bitcoin ETF Is Already Approved, Is Spot Ether ETF The Next?

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.