The cryptocurrency market can be a wild ride, and recently, investors holding ORDI tokens experienced a significant dip. Inspired by Casey Rodarmor’s Ordinals Protocol, the ORDI token has seen a sharp decline, mirroring Bitcoin’s own struggles. Let’s dive into what’s causing this downturn and what it means for the future.

ORDI Plummets Amidst Bitcoin’s Struggles: What’s Happening?

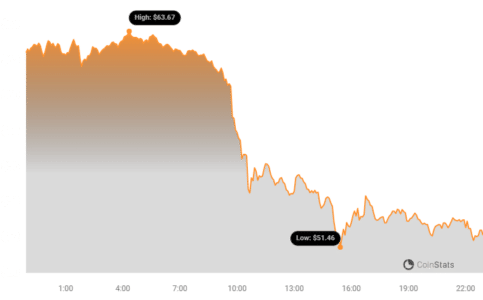

ORDI, a Bitcoin-centric cryptocurrency, experienced a notable drop, falling below $52.33 for the first time since December of last year. This dip is largely attributed to a broader market downturn, seemingly triggered by outflows from spot Bitcoin ETFs. But let’s break down the key factors at play:

- Bitcoin’s Price Movement: ORDI’s price is closely correlated with Bitcoin’s performance. As Bitcoin’s price dips, ORDI tends to follow suit.

- Spot BTC ETF Outflows: The Grayscale spot Bitcoin ETF, a major player in the market, has seen significant outflows. This puts downward pressure on Bitcoin’s price as Grayscale liquidates BTC to cover redemptions.

- Market Sentiment: Overall market sentiment plays a crucial role. Fear and uncertainty can lead to sell-offs, further exacerbating price declines.

Grayscale’s ETF Outflows: A Major Contributor

Speculations point to Grayscale’s ETF outflows as a primary driver behind ORDI’s recent woes. As the largest and most liquid BTC-focused fund approved for trading, Grayscale’s actions have a significant impact on the market. The recent approval of spot BTC ETFs by the SEC has led to some interesting dynamics.

Outflows from Grayscale’s ETF put sell pressure on Bitcoin. Here’s why:

- Redemptions: When investors redeem their shares in the ETF, Grayscale must liquidate actual BTC to fulfill those redemptions.

- Profit-Taking: Traders who profited from the initial ETF hype may be taking profits, leading to further sell pressure.

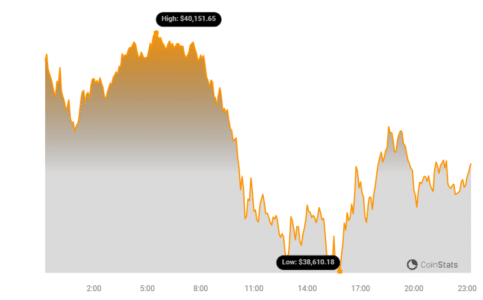

This decline happened shortly after Bitcoin dropped below $40,000, less than two weeks after the SEC approved spot BTC ETFs.

See Also: LUNC Price Drops As Crypto.com Announced Plan To Delist LUNC

Reports indicate that Grayscale has offloaded over $2.1 billion worth of BTC since the SEC’s approval, with $2 billion exiting its funds. A significant portion of this was attributed to bankrupt crypto exchange FTX, which recently dropped a lawsuit against Grayscale and its parent company, Digital Currency Group.

Bitcoin’s Plunge: A Ripple Effect

During the same period, Bitcoin experienced a significant drop, falling over 20% and down 10% for the month. At the time of writing, Bitcoin was trading at $39,218.17.

ETF Landscape: A Shifting Balance

While Grayscale’s ETF remains the largest with a market cap exceeding $20 billion and a BTC portfolio of 558,280 Bitcoins, other players are emerging. Issuers like BlackRock and Franklin Templeton have been steadily increasing their BTC holdings since the ETFs officially launched on January 11th.

According to Arkham Intelligence, BlackRock, Bitwise, Fidelity, and Franklin Templeton collectively hold over 80,000 BTC, valued at nearly $5 billion. This suggests a growing interest in Bitcoin ETFs from institutional investors.

What Does This Mean for ORDI and Bitcoin?

The recent market volatility highlights the interconnectedness of the cryptocurrency ecosystem. Outflows from a major Bitcoin ETF can trigger a chain reaction, impacting altcoins like ORDI. While short-term price fluctuations are common, the long-term outlook for Bitcoin and the broader crypto market remains positive, driven by increasing institutional adoption and technological advancements.

Key Takeaways:

- ORDI’s price is closely tied to Bitcoin’s performance.

- ETF outflows, particularly from Grayscale, are contributing to the current downturn.

- The ETF landscape is evolving, with new players increasing their BTC holdings.

- Market volatility is inherent in the cryptocurrency market.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

LATEST: The Great GBTC Gouge hit record -$640m on Monday, the Nine did their best to offset but fell short w/ a $553m haul. ROLLING NET FLOWS still healthy at +$1b but ongoing battle. The Nine now have a 20% share vs GBTC. Volume also remains very high for new launches in 2nd wk pic.twitter.com/ng0BU8mi6L

— Eric Balchunas (@EricBalchunas) January 23, 2024

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.