Is Bitcoin mining bad for the environment? It’s a question that’s been echoing through the crypto space for years. Now, payments giant PayPal is stepping up with an innovative solution that could turn the tide towards greener Bitcoin mining. They’re proposing a ‘Cryptoeconomic’ system designed to reward miners who embrace sustainable energy sources. Let’s dive into how this could reshape the future of Bitcoin and make it more eco-friendly.

What is PayPal’s ‘Cryptoeconomic’ Incentive for Bitcoin Mining?

PayPal’s Blockchain Research Group, in collaboration with Energy Web and DMG Blockchain Solutions, is tackling the environmental concerns surrounding Bitcoin head-on. Their proposal, outlined in an April 22 blog post, centers around using ‘cryptoeconomic incentives’ to encourage Bitcoin miners to switch to low-carbon energy sources. Essentially, they want to make it more profitable to be a ‘green’ Bitcoin miner.

PayPal isn’t just throwing ideas around; they’re actively seeking feedback from the industry to refine this experimental incentive. They believe this could spark crucial discussions and further innovation in the Bitcoin ecosystem.

How Does the ‘Cryptoeconomic’ Incentive System Work?

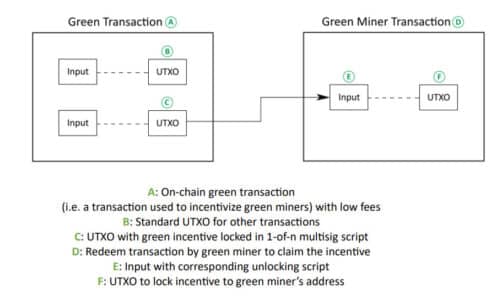

The core of PayPal’s proposal revolves around a system of accreditation and rewards for ‘green miners‘ – those who utilize sustainable energy sources. Here’s a breakdown of the key components:

- Green Miner Accreditation: Miners using sustainable energy sources would be certified and given special ‘green keys’ linked to their public keys. Think of it as a badge of honor for eco-conscious miners.

- Preferential Transaction Routing: Bitcoin transactions would be strategically directed towards these green miners. This is achieved by attaching lower fees to these transactions, making them attractive for miners to pick up.

- Locked BTC Rewards: Here’s the kicker – along with the transaction fee, an additional locked BTC reward would be included in a multisig payout address. Only accredited green miners holding the corresponding ‘green keys’ can claim this extra reward.

In simpler terms: Green miners get first dibs on transactions with bonus BTC rewards, making sustainable mining more financially appealing. As PayPal explained, “Green miners will be incentivized to mine these transactions since they will be the only ones eligible for the additional ‘locked’ BTC reward.”

See Also: ZachXBT Exposed 12 Abandoned Solana Presale Meme Coin Projects

Leveraging Energy Web’s ‘Green Proofs for Bitcoin’

To make this system robust and verifiable, PayPal’s proposal taps into Energy Web’s ‘Green Proofs for Bitcoin’ platform. This platform provides a crucial layer of certification. Miners can get accredited based on:

- Clean Energy Usage: Verifying the extent to which miners are using renewable energy sources.

- Grid Impact Scores: Assessing the positive or negative impact of their energy consumption on the electrical grid.

Once certified, green miners can register on the platform and share their ‘green keys,’ becoming active participants in the incentive program.

Real-World Testing and Results

This isn’t just a theoretical concept. PayPal BRG put their proposal to the test with Bitcoin miner DMG Blockchain Solutions Inc. They simulated real-world conditions by broadcasting low-fee transactions under varying network traffic levels.

What did they find?

As expected, under high transaction volume, low-fee transactions can get delayed or even dropped from the network. However, this is precisely where the incentive mechanism shines. These conditions increase the likelihood of green miners picking up these transactions because of the added BTC reward, even with the lower initial fee. This makes it economically viable for them to prioritize these ‘green’ transactions.

Are There Alternative Solutions?

PayPal acknowledges that other approaches exist, such as utilizing private channels like the Lightning Network or smart contracts. However, these alternatives come with their own set of trade-offs, often involving:

- Increased Complexity: Implementing solutions on layers like the Lightning Network or through smart contracts can be more technically challenging.

- Potential Centralization: Some alternative solutions might inadvertently introduce more centralized elements, which could go against the decentralized ethos of Bitcoin.

PayPal believes their proposed solution strikes a good balance. As they concluded, “The solution outlined here aims to achieve a good degree of decentralization, ease of implementation and trust independence while distributing incentives.”

The Path to a Greener Bitcoin Network?

PayPal’s ‘Cryptoeconomic’ proposal is a significant step towards addressing the environmental concerns surrounding Bitcoin mining. By strategically layering incentives on top of the existing Bitcoin network, they’re aiming to nudge miners towards sustainable practices without fundamentally altering Bitcoin’s core structure.

Will this be the ultimate solution? Only time will tell. However, it’s a promising approach that leverages economic principles to drive positive change. By making green mining more profitable, PayPal’s initiative could pave the way for a more sustainable and environmentally responsible Bitcoin ecosystem. The industry’s feedback and further innovation will be crucial in shaping the future of this exciting proposal.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.