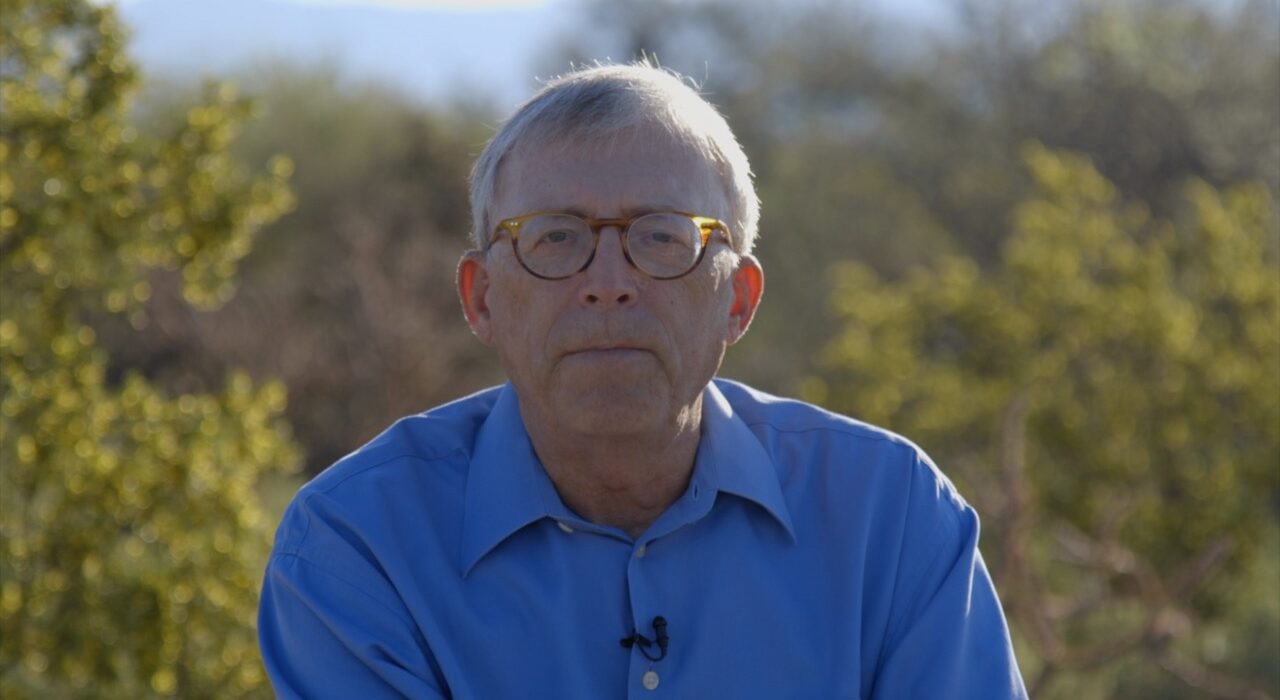

Peter Brandt Says Bitcoin Can Be a Store of Value Like Gold

Peter Brandt, a renowned trading legend with decades of market experience, recently shared his views on Bitcoin (BTC), stating that he views it as a store of value similar to gold or silver. However, Brandt also expressed skepticism about Bitcoin’s ability to serve as a reserve currency, noting that this role remains unproven.

Brandt’s comments sparked a significant discussion within the cryptocurrency community on Twitter, highlighting both support and criticism of Bitcoin’s volatility and its potential as a long-term store of value.

Peter Brandt’s Views on Bitcoin

Peter Brandt has been a vocal figure in the cryptocurrency space for some time, sharing insights on Bitcoin’s price action, market trends, and its evolving role in the financial system. In a recent tweet, Brandt compared Bitcoin to traditional stores of value like gold and silver:

“I look at Bitcoin as a store of value, like gold or silver. The ability for Bitcoin to serve as a reserve currency remains to be seen.”

Brandt’s comments emphasize Bitcoin’s growing recognition as a digital alternative to precious metals, which have long been viewed as safe-haven assets during times of economic uncertainty.

While gold and silver have maintained their status as reliable stores of value for centuries, Bitcoin’s journey toward this position is still in its early stages.

Community Reactions to Peter Brandt’s Statement

Brandt’s tweet ignited a lively debate on Twitter, with Bitcoin supporters and skeptics offering differing perspectives.

Supporters: Bitcoin as Digital Gold

Many users agreed with Brandt’s view that Bitcoin can act as a store of value, citing its limited supply and decentralized nature as key attributes:

- “If you hold gold and silver as a store of value, it wouldn’t make any sense not to hold Bitcoin, and the other way around.”

- “Bitcoin’s scarcity and digital nature make it the perfect alternative to gold in the digital age.”

Supporters often refer to Bitcoin as “digital gold” because of its capped supply of 21 million BTC, which mirrors the scarcity that makes precious metals valuable.

Critics: Volatility Remains a Concern

On the other hand, some users criticized Bitcoin’s price volatility, arguing that its wild swings make it unsuitable as a store of value:

- “Bitcoin is a terrible store of value considering it has 10% swings intraday and suffers periodic 80-90% corrections.”

- “If someone sells as little as $2M of BTC over a weekend, it would cause an immediate price crash.”

This group highlighted Bitcoin’s speculative nature and its tendency to behave as a risk asset correlated with the broader stock market, rather than a hedge against economic turmoil.

One comment stood out:

“Bitcoin behaves as a risk asset and is correlated the most with the stock market. It doesn’t react to geopolitical risk at all. It might become ‘digital gold’ at some point, but right now, it’s just a speculation tool.”

These views underscore the challenges Bitcoin faces in achieving the same level of stability as gold and silver, which have relatively steady price movements compared to cryptocurrencies.

Bitcoin’s Store of Value Narrative: A Closer Look

The debate around Bitcoin’s status as a store of value is not new. Since its inception in 2009, Bitcoin has been touted as a revolutionary asset that could challenge traditional financial systems. However, questions remain about its reliability as a safe haven.

1. Limited Supply and Scarcity

Bitcoin’s scarcity is one of its most appealing features. Unlike fiat currencies, which can be printed endlessly by central banks, Bitcoin has a fixed supply of 21 million coins. This digital scarcity makes it an attractive hedge against inflation.

Gold and silver have historically served as stores of value for the same reason: their finite supply prevents dilution. Bitcoin’s supporters argue that its deflationary nature mirrors these precious metals.

2. Volatility Challenges

Despite its scarcity, Bitcoin’s extreme price volatility raises concerns about its suitability as a store of value. For example:

- Bitcoin often experiences intraday price swings of 5-10%, which is unusual for traditional safe-haven assets like gold.

- It has undergone multiple price corrections, with some drops exceeding 80-90% during bear markets.

While gold and silver prices can fluctuate, they typically do so within a much narrower range, making them more predictable for investors seeking stability.

3. Correlation with Risk Assets

Historically, Bitcoin has shown strong correlations with riskier assets like stocks, particularly during periods of global economic uncertainty. In March 2020, for instance, Bitcoin and equities experienced simultaneous crashes, raising doubts about Bitcoin’s role as a safe haven.

However, in recent years, Bitcoin’s narrative has begun to shift. Institutional investors, such as MicroStrategy and Tesla, have adopted Bitcoin as a hedge against inflation, viewing it as a long-term store of value rather than a short-term speculative asset.

Bitcoin vs. Gold: Key Differences

While both Bitcoin and gold share attributes like scarcity and decentralization, there are fundamental differences between the two:

| Attribute | Bitcoin | Gold |

|---|---|---|

| Supply | Fixed at 21 million BTC | Finite but difficult to measure |

| Portability | Highly portable (digital) | Physical, less portable |

| Divisibility | Easily divisible into satoshis | Requires smelting/processing |

| Volatility | Highly volatile | Relatively stable |

| Storage | Requires digital wallets | Requires physical storage |

| Track Record | 14 years | Thousands of years |

Despite Bitcoin’s advantages in portability and divisibility, its shorter track record and volatility remain challenges. Gold, on the other hand, has stood the test of time as a stable store of value.

The Path Forward: Will Bitcoin Become Digital Gold?

While Bitcoin is still maturing, there is growing evidence that it is evolving into a digital gold for the 21st century. Institutional adoption, increasing trust among investors, and its finite supply have strengthened Bitcoin’s reputation as a store of value.

However, achieving mainstream recognition as a safe-haven asset will require:

- Reduced Volatility: Greater stability in Bitcoin’s price movements.

- Regulatory Clarity: Clearer regulations to attract institutional investors.

- Wider Adoption: Broader use of Bitcoin as a hedge against economic uncertainty.

Final Thoughts

Peter Brandt’s perspective on Bitcoin as a potential store of value has reignited the debate between Bitcoin enthusiasts and critics. While Bitcoin’s volatility remains a concern, its scarcity, decentralization, and growing institutional interest position it as a strong contender to gold’s dominance.

The journey to becoming “digital gold” may not be complete, but Bitcoin continues to solidify its role in the modern financial landscape. As the cryptocurrency matures and stabilizes, it could eventually prove to be the ultimate store of value in an increasingly digital world.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.