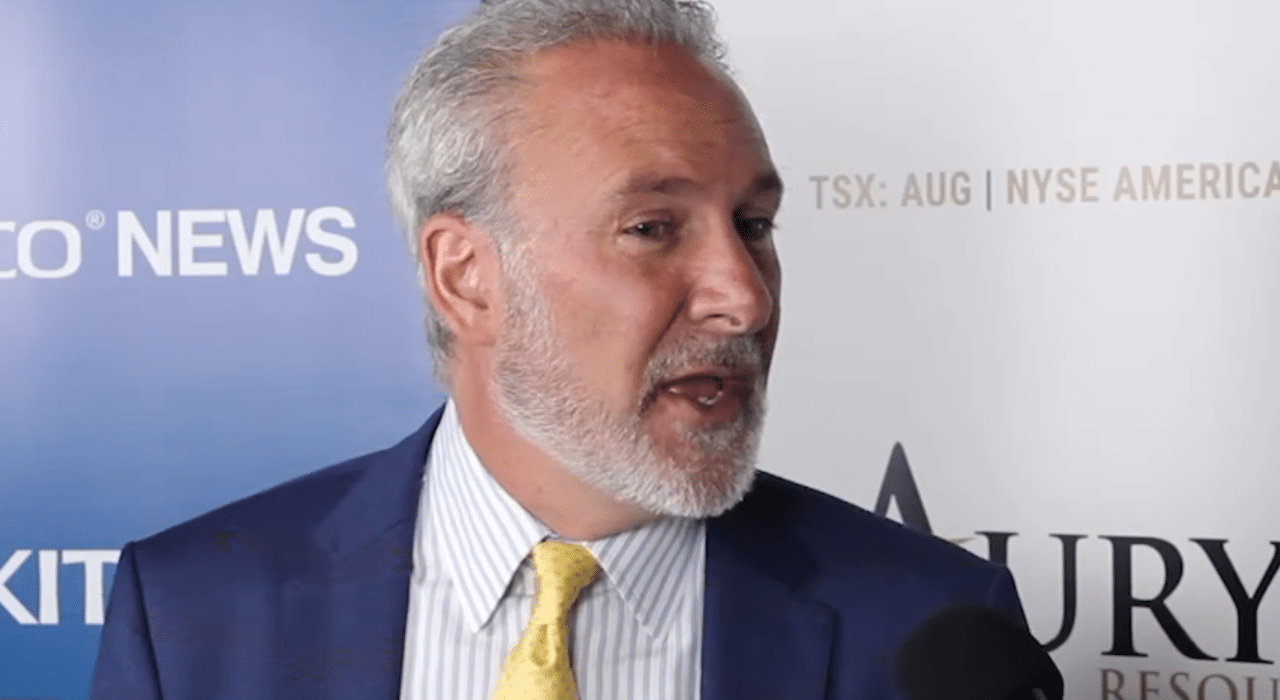

Peter Schiff, a prominent gold advocate and vocal Bitcoin critic, has once again voiced his bearish stance on Bitcoin. Known for his skepticism and infamous for allegedly losing access to his Bitcoin wallet, Schiff recently declared Bitcoin as “the biggest bubble he has ever seen.” Drawing parallels with past financial calamities, such as the dot-com bubble and the 2006 real estate crisis, Schiff warned investors of an impending collapse.

In this article, we dive into Schiff’s claims, the ongoing debate about Bitcoin’s legitimacy, and how the cryptocurrency market has responded to his critiques.

Peter Schiff: Bitcoin Skepticism at its Peak

Schiff has a long history of predicting Bitcoin’s demise, labeling it as a speculative bubble with no intrinsic value. On October 20, 2020, shortly before a significant market correction, Schiff tweeted his thoughts about Bitcoin’s conviction-driven rally:

“The level of conviction buyers have in their trade exceeds that of any bubble I’ve ever seen, including the dot-com bubble or the 2006 real estate crisis.”

This is not the first time Schiff has compared Bitcoin to past economic bubbles, but his assertion that it outstrips these historical crises in fervor adds a dramatic twist to his criticism.

Why Does Peter Schiff Think Bitcoin is a Bubble?

1. Lack of Intrinsic Value

Schiff has consistently argued that Bitcoin lacks intrinsic value compared to assets like gold. He believes that gold’s tangible properties make it a reliable store of value, while Bitcoin’s value is based solely on speculation and demand.

2. Trader Conviction and Market Psychology

The intensity of belief among Bitcoin supporters is another factor that Schiff deems problematic. He sees the strong conviction as a sign of irrational exuberance, reminiscent of the fervor before the dot-com and housing market collapses.

3. Comparisons to Historical Bubbles

Schiff’s assertion aligns Bitcoin with infamous bubbles like:

- Dot-com bubble (1995–2000): Where companies with little revenue were overvalued based on speculative optimism.

- 2006 Real Estate Crisis: Marked by over-leveraged investments in housing markets that eventually collapsed.

4. Volatility and Speculation

Schiff also cites Bitcoin’s extreme price volatility and reliance on speculative trading as evidence of its unsustainable nature. For Schiff, the market’s rapid corrections only reinforce his perspective that Bitcoin is more akin to a casino than a legitimate financial asset.

Community Reactions to Schiff’s Criticism

Bitcoin Proponents Fight Back

The cryptocurrency community often ridicules Schiff’s bearish predictions, pointing out that Bitcoin has repeatedly defied his dire forecasts. Many argue that Schiff’s fixation on gold blinds him to the transformative potential of blockchain technology and decentralized finance.

The “Forgotten Password” Incident

Adding fuel to the fire, Schiff’s critics frequently reference his public admission of losing access to his Bitcoin wallet due to forgetting the password. For many Bitcoin advocates, this incident symbolizes his disconnect from the technology.

Market Resilience

Despite Schiff’s ongoing criticism, Bitcoin has displayed remarkable resilience, breaking past $100,000 in 2024 and garnering institutional interest. This success challenges Schiff’s claims of it being a speculative bubble.

Is Bitcoin Truly Comparable to Past Bubbles?

Similarities

- Speculation: Like the dot-com bubble, Bitcoin has seen speculative investment that inflates its price.

- Volatility: Both Bitcoin and historical bubbles exhibit significant price swings.

- Hype: Media coverage and public excitement mirror that of past speculative markets.

Differences

- Utility: Unlike previous bubbles, Bitcoin has practical use cases in cross-border payments, store of value, and decentralized finance.

- Adoption: Increasing institutional adoption from companies like Tesla and PayPal lends credibility to Bitcoin.

- Decentralization: Bitcoin operates on a decentralized network, contrasting with the centralized entities involved in past crises.

The Broader Debate: Bitcoin vs. Gold

The ongoing rivalry between Bitcoin and gold as a store of value is central to Schiff’s critique. Let’s compare the two assets:

| Feature | Bitcoin | Gold |

|---|---|---|

| Scarcity | 21 million supply cap | Limited but expandable |

| Portability | Highly portable (digital) | Bulky and physical |

| Divisibility | Divisible up to 8 decimals | Limited divisibility |

| Volatility | High | Low |

| Adoption | Growing (digital finance) | Established (physical assets) |

Bitcoin proponents argue that its digital nature and fixed supply make it a better hedge against inflation compared to gold. Critics like Schiff counter that gold’s millennia-long history as a store of value makes it the superior asset.

Bitcoin’s Future: Speculation or Reality?

Institutional Adoption

Institutions like BlackRock, MicroStrategy, and Grayscale have heavily invested in Bitcoin, viewing it as “digital gold.” This increasing adoption challenges Schiff’s bubble narrative.

Regulatory Developments

As governments worldwide explore central bank digital currencies (CBDCs) and crypto regulations, Bitcoin’s position in the global financial system becomes more entrenched.

Technological Innovations

Advancements like Lightning Network and Layer 2 solutions continue to enhance Bitcoin’s scalability and usability, adding value beyond speculation.

Final Thoughts

Peter Schiff’s declaration of Bitcoin as “the biggest bubble ever” reflects his unwavering skepticism, but it also underscores the polarizing nature of cryptocurrencies. While Bitcoin shares some characteristics with past bubbles, its utility, adoption, and decentralized infrastructure set it apart from speculative manias like the dot-com era.

The debate between Bitcoin and traditional assets like gold will continue as the crypto market evolves. Whether Schiff’s predictions come true or Bitcoin proves to be the defining asset of the 21st century, only time will tell.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.