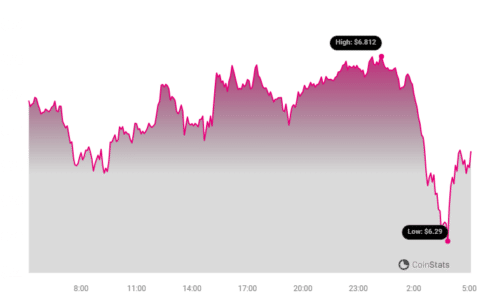

Polkadot (DOT) has been walking a tightrope, precariously balancing just above the crucial $6.3 support level. But is this hold sustainable? Or are we on the verge of seeing DOT tumble to levels not seen in months? Recent market indicators suggest the latter might be more likely, painting a potentially challenging picture for Polkadot in the near future.

Why is Polkadot Struggling to Gain Momentum?

Several factors are contributing to the current bearish sentiment around Polkadot. Let’s break down the key indicators that are raising concerns:

- Critical Support Under Pressure: DOT’s price is currently hovering around $6.5, clinging to the $6.3 support. A break below this level could trigger a significant downward move, potentially leading to multi-month lows.

- Investor Apathy Evident in Sharpe Ratio: The Sharpe Ratio, a crucial metric for assessing risk-adjusted returns, for DOT is flashing red. Currently negative and at its lowest point in seven months, at -5.17, it signals that DOT is not offering attractive risk-adjusted returns. This makes it difficult to entice new investors and retain existing ones. In simpler terms, investors are not seeing DOT as a worthwhile investment compared to the risk involved.

- Open Interest Plummets: Further fueling the bearish outlook is the significant decrease in Open Interest in DOT futures. A staggering $154 million has been pulled out of the futures market in just six days. This substantial outflow indicates that traders are losing confidence and closing their positions, reinforcing the bearish momentum.

While DOT has shown some resilience recently, preventing immediate sharp declines, the underlying bearish pressure seems to be building. The question isn’t if the price will move lower, but rather when and by how much.

Investor Confidence: A Missing Piece of the Puzzle

For any cryptocurrency, including Polkadot, a healthy recovery and sustained growth depend heavily on investor confidence and participation. Ideally, a growing ecosystem attracts new investors, and increased trading activity propels prices upwards. However, DOT is currently facing headwinds in this crucial area.

A positive Sharpe Ratio is generally seen as a green light for investors. It suggests that an asset offers good returns relative to the risk taken. Conversely, a negative Sharpe Ratio, like the current one for DOT, acts as a deterrent. It signals that the investment might not be adequately compensating investors for the risk, leading them to seek opportunities elsewhere.

The consistently low and now negative Sharpe Ratio for DOT raises concerns about its immediate attractiveness to both new and existing investors. Without a turnaround in this metric, attracting the necessary capital for a significant price recovery will be an uphill battle.

See Also: Bitcoin Price Prediction As BTC Bounces From $60,000 Level – More Selling Incoming?

Traders Exit the Futures Market

Beyond the Sharpe Ratio, another worrying signal comes from the derivatives market. The declining Open Interest in DOT futures contracts reveals that even traders who were previously betting on DOT’s future price are now pulling back. This reduction in open positions suggests a broader lack of conviction in DOT’s short-term price prospects.

This exodus from the futures market amplifies the potential for further price drops. Less participation in futures trading can lead to increased price volatility and downward pressure, especially if the spot market also experiences selling pressure.

What’s Next for DOT Price? Key Levels to Watch

As of writing, Polkadot’s price is around $6.54. After failing to maintain the falling wedge pattern, DOT is now in a vulnerable position. The market indicators are not currently in DOT’s favor, suggesting that further declines are possible.

The immediate level to watch is the $6.3 support. If DOT breaks decisively below this point, the next likely stop is around $5.7. A drop to $5.7 would mark a four-month low for DOT, potentially establishing a new bottom for 2024, at least in the short term.

Key Price Levels to Watch:

| Level | Significance |

|---|---|

| $6.3 | Critical Support – Breach could trigger further decline |

| $5.7 | Potential next support level, 4-month low |

| $5.0 | Psychological support level, potential target in extended bearish scenario |

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

In Conclusion: Navigating the Bearish Waters for DOT

Polkadot (DOT) is currently facing a confluence of bearish signals. From a concerning Sharpe Ratio to dwindling Open Interest and pressure on key support levels, the path ahead appears challenging. While the cryptocurrency market is known for its volatility and sudden shifts, the current indicators suggest caution for DOT holders and potential investors. Keeping a close eye on the $6.3 support level and overall market sentiment will be crucial in understanding DOT’s next move. Will DOT defy the odds, or are we heading towards a test of the $5 level? Only time will tell, but for now, the charts are painting a cautious picture.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.