Despite some price stagnation, Polygon (MATIC) is showing impressive growth where it counts: user adoption. The number of unique addresses on the Polygon PoS chain has surged past 400 million, signaling strong network activity and potential for future gains. Let’s dive into what’s driving this growth and what it means for the future of Polygon.

Polygon’s Unique Address Milestone: What Does It Mean?

Reaching 400 million unique addresses is a significant achievement for any blockchain network. It indicates a growing user base and increasing adoption. On February 1st, Polygonscan data showed the network jumping from 399.89 million to over 400.11 million addresses, adding nearly 216,000 new addresses in a single day. This surge suggests a substantial influx of new users and capital into the Polygon ecosystem.

But why is this happening, especially when the price of MATIC hasn’t seen the same upward trajectory?

The AggLayer Effect: Interoperability Driving Growth

One key factor driving Polygon’s growth is the unveiling of the Aggregation Layer (AggLayer), version one of Polygon’s interoperability layer for CDK chains. The AggLayer aims to solve the problem of fragmented liquidity across different Layer 2 chains. By allowing users to interact with the entire ecosystem of zero-knowledge Layer 2 chains as if it were a single blockchain, Polygon is creating a more seamless and user-friendly experience.

Here’s how the AggLayer benefits the Polygon ecosystem:

- Unified Liquidity: Reduces fragmentation, making it easier for users to access and move assets across different chains.

- Improved User Experience: Simplifies interactions with multiple Layer 2 chains, creating a more cohesive experience.

- Increased Network Activity: Attracts more users and developers to the Polygon ecosystem.

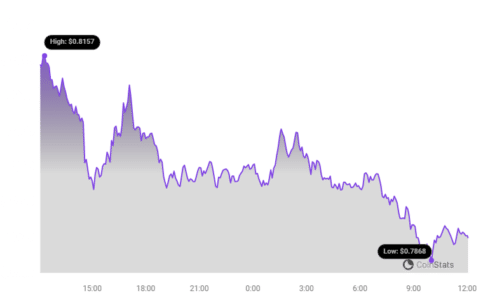

MATIC Price: Why Isn’t It Reflecting Network Growth?

Despite the positive developments in network growth and technology, the price of MATIC has remained relatively muted. It’s currently trading in a range between $0.7 and $1, a range it’s been stuck in for several months. This can be frustrating for MATIC holders who were expecting a rally in 2024, especially after a relatively quiet 2023.

So, what’s holding MATIC back?

Several factors could be contributing to this price stagnation:

- Market Sentiment: Overall market conditions and investor sentiment towards altcoins can impact MATIC’s price.

- Profit-Taking: Some investors may be taking profits after previous gains, putting downward pressure on the price.

- Alternative Investments: The rise of other promising projects may be diverting capital away from MATIC.

Looking Ahead: Will MATIC Make a Comeback?

Despite the current price challenges, there are reasons to be optimistic about MATIC’s future. The increase in unique addresses indicates growing network activity and potential capital inflows. Furthermore, Polygon Labs is focused on streamlining its operations and aligning the network behind a single narrative. The recent layoffs, while unfortunate, could be a strategic move to improve efficiency and focus on core priorities.

Here are some factors that could contribute to a MATIC rally in the future:

- Successful Implementation of AggLayer: A seamless and user-friendly interoperability layer could attract more users and developers to the Polygon ecosystem.

- Increased Adoption of Polygon CDK: The Polygon Chain Development Kit (CDK) allows developers to easily create custom Layer 2 chains, further expanding the Polygon ecosystem.

- Improved Market Sentiment: A positive shift in overall market sentiment towards altcoins could benefit MATIC.

See Also: Polygon Labs Lays Off 19% Of Staff After ‘Rapid Growth’ During Crypto’s Bull Run

The Bottom Line

Polygon’s achievement of reaching 400 million unique addresses is a testament to the network’s growing adoption and potential. While the price of MATIC hasn’t yet reflected this growth, the ongoing development of the AggLayer and the focus on streamlining operations could pave the way for a future rally. Keep an eye on Polygon as it continues to build towards its vision of a network of aggregated chains.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.