Cryptocurrency markets are known for their volatility, but sometimes, certain tokens make headlines with impressive rallies. Chainlink (LINK), a leading decentralized oracle network, is one such cryptocurrency that has been turning heads recently. Over the past 24 hours, Chainlink (LINK) price jumped by a significant 7.08%, reaching $19.44. But that’s just the tip of the iceberg. Let’s dive deeper into what’s fueling this surge and what it means for investors.

Chainlink’s Impressive Weekly Gains: A Deeper Look

The recent 24-hour surge is part of a larger bullish trend for Chainlink. Looking back at the past week, LINK has demonstrated remarkable growth, gaining a whopping 36.0%. The price has ascended from $14.33 to its current level, indicating strong buying pressure and positive market sentiment around the oracle network.

See Also: Crypto Market Analysis For The Week

While this recent performance is exciting, it’s important to remember that Chainlink has previously reached even higher peaks. The coin’s all-time high stands at $52.70. This historical context helps to understand the potential for future growth and also the inherent volatility of the crypto market.

Volatility Check: Are Things Getting Too Hot?

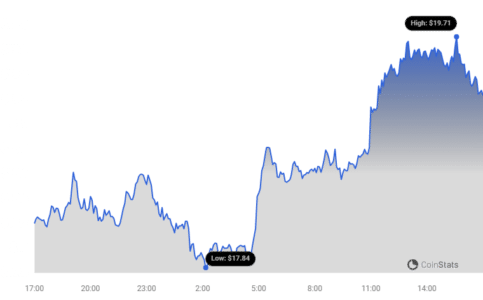

To understand the stability of this price movement, let’s examine Chainlink’s volatility. The charts below provide a visual representation of price fluctuations and volatility over the last 24 hours versus the past week.

The gray bands in these charts are Bollinger Bands, a popular technical indicator used to measure volatility. Essentially, Bollinger Bands illustrate the range within which a price typically fluctuates. Wider bands indicate higher volatility, meaning the price is experiencing larger swings.

Currently, while there’s been significant upward price movement, assessing the width of the Bollinger Bands in detail (which would require real-time chart analysis) helps determine if the volatility is unusually high or within a normal range for such a price surge. Understanding volatility is crucial for traders and investors to manage risk.

Trading Volume and Circulating Supply: Gauging Market Interest

Price movements alone don’t tell the whole story. Let’s look at trading volume and circulating supply to get a more complete picture of Chainlink’s market dynamics.

Over the past week, Chainlink’s trading volume has skyrocketed by an impressive 188.0%. This massive increase in trading activity suggests heightened interest and participation in the LINK market. Simultaneously, the circulating supply of LINK has also seen a modest increase of 3.82%.

Currently, the circulating supply stands at 587.10 million LINK. This represents a significant portion, approximately 58.71%, of Chainlink’s total maximum supply of 1.00 billion LINK tokens. The relationship between circulating supply and price can be complex, but generally, a substantial circulating supply means that a good portion of the tokens are available for trading.

Chainlink’s Market Position: A Top Contender

With a circulating supply of 587.10 million and the recent price surge, Chainlink’s market capitalization has reached a substantial $11.48 billion. This places LINK at the #11 rank in the overall cryptocurrency market cap rankings. This ranking underscores Chainlink’s position as a major player in the crypto space and a leading decentralized oracle network.

What’s Driving the Chainlink Rally? (Potential Factors)

While pinpointing the exact reasons for any cryptocurrency price surge is challenging, several factors could be contributing to Chainlink’s recent bullish momentum:

- Broader Crypto Market Recovery: The overall cryptocurrency market has shown signs of recovery recently. Bitcoin and Ethereum, often seen as market leaders, have also experienced price increases, which can lift the prices of altcoins like Chainlink.

- Increased DeFi Activity: Chainlink is a crucial infrastructure component for Decentralized Finance (DeFi) applications. Increased activity and growth in the DeFi sector often translate to higher demand and utility for Chainlink oracles.

- Project Developments and Partnerships: Positive news regarding Chainlink’s network development, new partnerships, or integrations can significantly boost investor confidence and drive up demand for LINK tokens. Keeping an eye on official Chainlink announcements is key.

- Whale Activity: Large investors, often referred to as “whales,” can significantly influence market movements. Large purchases of LINK by whales could contribute to upward price pressure.

- General Market Sentiment: Positive sentiment and increased risk appetite in the broader financial markets can also spill over into the cryptocurrency market, benefiting assets like Chainlink.

Is Chainlink (LINK) a Good Investment Now?

The recent price surge and positive market indicators surrounding Chainlink are certainly encouraging. However, it’s crucial to remember that the cryptocurrency market is inherently volatile and investments carry risk. Before making any investment decisions regarding Chainlink or any other cryptocurrency, consider the following:

- Do Your Own Research (DYOR): Thoroughly research Chainlink’s technology, use cases, team, and roadmap. Understand the risks and potential rewards.

- Risk Tolerance: Assess your own risk tolerance. Cryptocurrency investments can be highly volatile and are not suitable for all investors.

- Diversification: Never put all your eggs in one basket. Diversify your investment portfolio across different asset classes.

- Long-Term Perspective: Consider your investment horizon. Are you looking for short-term gains or long-term growth potential?

- Consult a Financial Advisor: If you are unsure, seek advice from a qualified financial professional who can provide personalized guidance based on your financial situation and investment goals.

Disclaimer: The information provided is not trading nor financial advice. Bitcoinworld.co.in holds no liability for any trading or investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any trading or investment decisions.

In Conclusion: Chainlink’s Bullish Momentum and Future Outlook

Chainlink (LINK) has demonstrated significant bullish momentum, with a 36% price increase over the past week and a substantial surge in trading volume. While the reasons behind this rally are multifaceted and require ongoing observation, the positive price action and strong market position of Chainlink are noteworthy.

As with any cryptocurrency investment, thorough research, risk management, and a clear understanding of market dynamics are essential. Keep a close eye on Chainlink’s developments, broader market trends, and always make informed decisions. The world of crypto is dynamic, and staying informed is your best tool for navigating its exciting, yet unpredictable, landscape.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.