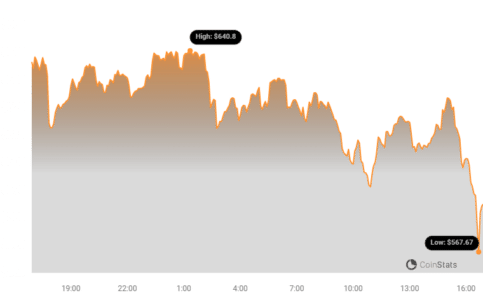

Is the recent dip in Bittensor (TAO) price a fleeting downturn or a signal of a larger shift? After a week of impressive gains, TAO has experienced a price correction in the last 24 hours. Let’s dive into the numbers and charts to understand what’s influencing Bittensor’s price movements and what it could mean for investors.

What’s Happening with TAO Price?

Currently, Bittensor (TAO) is trading at $600.73. In the past 24 hours, the price has decreased by 6.32%. This comes after a positive week where TAO saw a significant 12.0% increase, climbing from $538.34 to its current level. This recent downward movement presents an interesting point for traders and investors to consider.

See Also: Price Analysis: Cryptocurrency NEAR Protocol Price Down More Than 3% Within 24 Hours

Decoding the Charts: Price Movement and Volatility

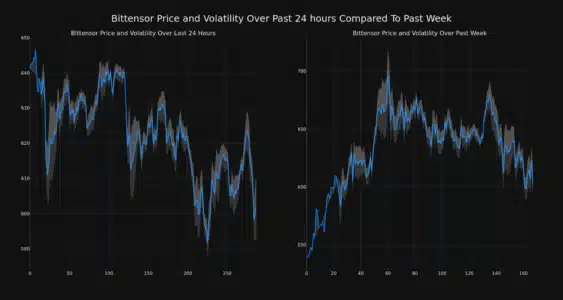

To get a clearer picture, let’s examine the price and volatility charts. The following charts compare TAO’s price movement and volatility over the last 24 hours (left) versus the past week (right). Volatility is a key factor in cryptocurrency markets, indicating the degree of price fluctuations.

Notice the gray bands on the charts. These are Bollinger Bands, a popular technical analysis tool used to measure volatility. Essentially, Bollinger Bands show the range within which the price of an asset typically trades.

Key points about Bollinger Bands and Volatility:

- Wider Bands = Higher Volatility: When the gray bands widen, it signifies increased price volatility. A larger gray area indicates greater price swings during that period.

- Narrower Bands = Lower Volatility: Conversely, narrower bands suggest lower volatility, meaning the price is relatively stable.

By observing the Bollinger Bands, we can visually assess and compare the volatility of TAO over different timeframes.

Trading Volume and Circulating Supply: What Do They Tell Us?

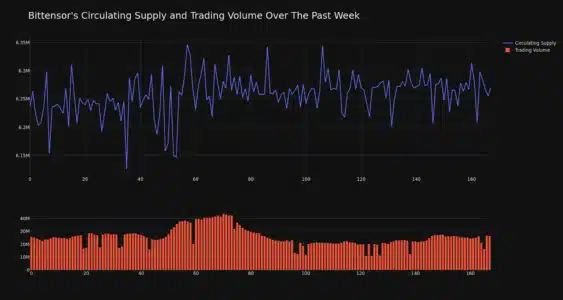

Beyond price and volatility, trading volume and circulating supply are important indicators of a cryptocurrency’s market health. Let’s take a look at Bittensor’s performance in these areas:

- Trading Volume Increase: Over the past week, Bittensor’s trading volume has increased by 3.0%. This suggests growing interest and activity around TAO.

- Circulating Supply Growth: The circulating supply of TAO has also seen a slight increase of 0.56% in the last week.

Currently, the circulating supply of TAO is 6.28 million coins. This represents approximately 29.91% of its maximum supply of 21.00 million TAO. Understanding the circulating supply helps gauge the potential scarcity and inflationary pressures of a cryptocurrency.

Market Cap and Ranking

According to the latest data, Bittensor’s current market capitalization ranks at #32 in the cryptocurrency market, with a market cap of $3.77 billion. Market cap is a crucial metric reflecting the total value of a cryptocurrency and its relative size within the market.

In Summary: Navigating TAO’s Price Fluctuations

Bittensor (TAO) is currently experiencing a price correction after a week of positive momentum. While the 24-hour price decrease of 6.32% might raise eyebrows, it’s essential to consider the context of the preceding 12% weekly gain. Increased trading volume and a slight rise in circulating supply indicate ongoing market activity and interest in TAO.

Analyzing the price charts, volatility, and key metrics like circulating supply and market cap provides valuable insights for understanding TAO’s market dynamics. As with any cryptocurrency investment, it’s crucial to conduct thorough research and consider your own risk tolerance before making any decisions.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.