Cryptocurrency markets are known for their rollercoaster rides, and recent data reveals another dip for those watching Lido DAO (LDO). Over the last day, LDO’s price has experienced a notable downturn. Let’s break down what’s happening with LDO, examining the price fluctuations, volatility, and what these shifts might indicate for investors.

Lido DAO (LDO) Price in Freefall? A Closer Look at the Numbers

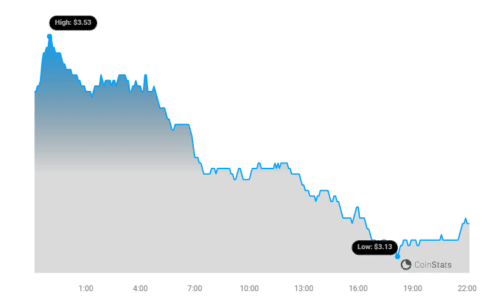

In the past 24 hours, the price of Lido DAO (LDO) has decreased by 6.33%, settling at $3.16. This isn’t an isolated event; it’s part of a larger negative trend. Looking back over the last week, LDO has seen a significant 19.0% loss, dropping from $3.89 to its current value. This consistent downward pressure raises questions about the factors influencing LDO’s market performance.

Volatility Check: Is the LDO Market Stormy?

To understand the intensity of these price movements, let’s consider volatility. Volatility measures how much the price of an asset fluctuates over time. High volatility means prices can swing dramatically, while low volatility suggests more stable price action. The chart below uses Bollinger Bands – those gray areas you see – to visualize LDO’s volatility over both a 24-hour period and the past week.

Decoding Bollinger Bands:

- Wider Bands = Higher Volatility: The wider the gray bands, the greater the price swings and uncertainty in the market. Conversely, narrower bands indicate lower volatility and more stable prices.

- Daily vs. Weekly Volatility: By comparing the Bollinger Bands on the left (24 hours) and right (weekly), we can see how volatility differs across these timeframes. This helps traders and investors gauge short-term versus medium-term market turbulence.

See Also: Price Analysis: Arbitrum (ARB) Decreases More Than 3% Within 24 Hours

Trading Volume and Circulating Supply: What Do They Tell Us?

Beyond price and volatility, trading volume and circulating supply are crucial indicators of a cryptocurrency’s market health. Let’s examine LDO’s figures:

- Trading Volume Decline: A significant 72.0% decrease in trading volume over the past week suggests reduced market activity and potentially less investor interest in LDO at the moment. Lower volume can sometimes exacerbate price drops as fewer buy orders are available to cushion selling pressure.

- Circulating Supply Slight Decrease: The circulating supply of LDO has slightly decreased by 0.61% over the past week, now standing at over 890.19 million coins. While a small decrease, changes in circulating supply can sometimes influence price, although in this case, the price decrease is likely driven by other market factors.

Currently, the circulating supply represents an estimated 89.02% of LDO’s total max supply of 1.00 billion coins. This high percentage of circulating supply means that a large majority of LDO tokens are already available in the market.

LDO’s Market Standing: Where Does it Rank?

Despite the recent price drop, Lido DAO still holds a respectable position in the cryptocurrency market. Its current market cap ranking is #36, with a market capitalization of $2.81 billion. This ranking reflects the overall value of all circulating LDO tokens and provides context within the broader crypto landscape.

Key Takeaways and Considerations for LDO Investors

To summarize the current situation with Lido DAO (LDO):

- Price Downtrend: LDO has experienced a notable price decrease over the past 24 hours and the last week.

- Volatility Present: The market exhibits volatility, as indicated by Bollinger Bands, suggesting price fluctuations are ongoing.

- Reduced Trading Activity: Trading volume has significantly decreased, pointing to potentially lower investor engagement.

- Solid Market Cap Ranking: Despite the downturn, LDO remains a top 40 cryptocurrency by market capitalization.

What does this mean for investors? Price drops are a common occurrence in the crypto market. It’s crucial to conduct thorough research and consider your own risk tolerance before making any investment decisions. Factors that could be influencing LDO’s price could include broader market sentiment, developments within the Lido DAO ecosystem, or general trends in the DeFi space. Keep a close eye on market news and conduct your own due diligence.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.