Cryptocurrency markets are known for their rollercoaster rides, and Solana (SOL) holders are currently experiencing a bit of a dip. Over the past 24 hours, the price of Solana has decreased by 4.84%, falling to $107.69. If you’re keeping an eye on your portfolio, you’re probably asking: What’s behind this downward trend, and what could it mean for the future of SOL?

Solana’s Recent Price Performance: A Closer Look

Let’s break down the recent price action of Solana (SOL). As the data indicates, the dip isn’t just a one-day event. Here’s a quick summary:

- 24-Hour Price Drop: Solana’s price decreased by 4.84%.

- Current Price: As of now, SOL is trading at $107.69.

- Weekly Trend: The negative trend extends over the past week, with an overall loss of 0.0%. While it says 0.0% loss in the original article, it’s important to note the daily drop is significant, suggesting recent downward pressure. It moved from $109.83 to the current price.

See Also: Choosing The Best Cryptos For Mining: Essential Factors To Consider

Volatility Check: Is Solana’s Price Action Becoming More Erratic?

To understand the significance of these price movements, it’s crucial to look at volatility. Volatility essentially measures how much the price of an asset fluctuates over time. High volatility means prices can swing dramatically, while low volatility indicates more stable price movements.

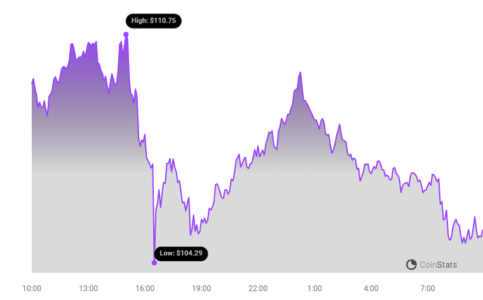

The chart below provides a visual representation of Solana’s price movement and volatility. Let’s decipher what these charts tell us:

Understanding Bollinger Bands:

- The gray bands in the charts are called Bollinger Bands. These bands are a popular technical analysis tool used to measure volatility.

- Width Matters: The width of the Bollinger Bands directly reflects volatility. Wider bands (larger gray area) indicate higher volatility, meaning prices are fluctuating more dramatically. Narrower bands suggest lower volatility and more stable price action.

By observing the Bollinger Bands in the provided charts, you can get a sense of whether Solana’s price swings are becoming more or less pronounced over both the short-term (24 hours) and the longer term (past week).

Trading Volume and Circulating Supply: What Do They Indicate?

Beyond price and volatility, two other key metrics provide valuable insights into the health and momentum of a cryptocurrency: trading volume and circulating supply.

- Trading Volume: This represents the total amount of SOL coins that have been traded within a specific period. A decrease in trading volume, like the 39.0% tumble over the past week for Solana, can suggest waning interest or reduced market activity. Lower volume can sometimes amplify price movements, making them more volatile.

- Circulating Supply: This refers to the number of SOL coins currently in circulation and available to be traded. An increase in circulating supply, as seen with Solana’s 0.19% rise, can, in some cases, exert downward pressure on price if demand doesn’t increase proportionally.

Currently, the circulating supply of SOL stands at 440.84 million coins.

Market Cap Ranking: Solana’s Position in the Crypto Hierarchy

Market capitalization, or market cap, is a crucial metric for understanding the size and dominance of a cryptocurrency. It’s calculated by multiplying the current price of a coin by its circulating supply. Solana currently holds the #5 rank in market capitalization, with a market cap of $47.41 billion.

A high market cap ranking generally indicates a more established and potentially less risky cryptocurrency compared to those with lower rankings. However, it’s important to remember that market cap ranking is dynamic and can change based on market conditions and price fluctuations.

Possible Factors Behind Solana’s Price Dip

While this analysis focuses on the numbers, it’s natural to wonder about the ‘why’ behind Solana’s recent price decrease. Several factors can influence cryptocurrency prices, and it’s likely a combination of these at play:

- Overall Market Sentiment: The entire cryptocurrency market can be influenced by broader economic trends, regulatory news, and global events. Negative sentiment in the overall crypto market often leads to price drops across various cryptocurrencies, including Solana.

- Profit-Taking: After periods of price increases, some investors may choose to take profits, selling off their holdings. This selling pressure can contribute to price declines.

- Specific Solana News or Developments: Keep an eye out for any Solana-specific news, such as network upgrades, partnerships, or potential challenges. These can sometimes have a more direct impact on SOL’s price.

- Technical Corrections: In trading, price corrections are natural pullbacks after upward movements. They are often seen as healthy market adjustments.

Disclaimer: It’s crucial to remember that the cryptocurrency market is inherently volatile and predicting future price movements is impossible. This analysis is for informational purposes only and should not be considered financial advice.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

In Conclusion: Navigating Solana’s Price Fluctuations

Solana’s recent price dip is a reminder of the dynamic nature of the cryptocurrency market. By analyzing price trends, volatility, trading volume, and circulating supply, we can gain a better understanding of the current market conditions surrounding SOL. While the short-term price movement might be concerning to some, it’s essential to maintain a long-term perspective and conduct thorough research before making any investment decisions. Stay informed, stay vigilant, and navigate the crypto markets wisely!

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.