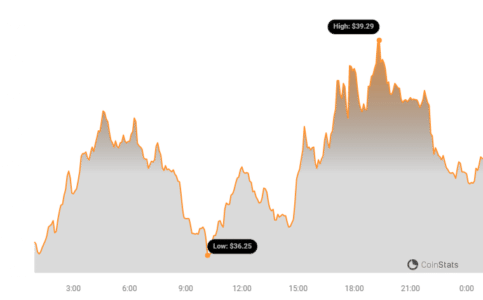

The cryptocurrency market is known for its volatility, but amidst the fluctuations, some assets are showing remarkable upward momentum. Injective (INJ) is one such cryptocurrency that has caught the attention of investors and traders alike. Over the last 24 hours, the price of Injective (INJ) has impressively climbed by 5.85%, reaching a price point of $38.61. But this isn’t just a one-day wonder; INJ has been on a roll, showcasing a robust positive trend over the past week.

Injective’s Impressive Weekly Growth: A Closer Look

Looking at the bigger picture, Injective (INJ) has demonstrated significant growth over the past week. The data reveals a substantial 13.0% gain, with the price ascending from $34.07 to its current value. This consistent upward trajectory signals strong market interest and positive sentiment surrounding Injective. Is this momentum sustainable? Let’s delve deeper into the factors influencing INJ’s price.

See Also: Price Analysis: The Price Of Dogecoin (DOGE) Rose More Than 4% In 24 Hours

Currently, Injective is trading not far from its all-time high of $45.01. This proximity to its peak value suggests that INJ could be gearing up for another potential breakout if the bullish trend continues.

Decoding INJ’s Price Movement and Volatility

To understand the dynamics of INJ’s price action, analyzing its volatility is crucial. Volatility reflects the degree of price fluctuations over a period. The chart below provides a visual comparison of Injective’s price movement and volatility over the last 24 hours (left) and the past week (right).

The gray bands you see in the charts are Bollinger Bands. These are a technical analysis tool used to measure volatility. Essentially, they indicate the range within which a cryptocurrency’s price typically fluctuates.

Here’s a simple breakdown of what Bollinger Bands tell us about volatility:

- Wider Bands = Higher Volatility: When the Bollinger Bands widen, it signifies increased price fluctuations. The larger the gray area, the more volatile the price movement is.

- Narrower Bands = Lower Volatility: Conversely, when the bands are narrow, it indicates a period of relative price stability.

By observing the Bollinger Bands, traders can gauge the risk and potential trading opportunities associated with Injective at different timeframes.

Trading Volume and Circulating Supply: Fueling the Price Surge?

Price movements are often accompanied by changes in trading volume and circulating supply. Injective is no exception. Over the past week, Injective’s trading volume has surged by an impressive 50.0%. This significant increase in trading activity suggests heightened interest and participation in the INJ market.

Alongside the trading volume, the circulating supply of INJ has also seen a slight increase of 0.96%.

Currently, the circulating supply of INJ stands at 88.39 million coins. According to the latest data, Injective holds a market cap ranking of #27, with a market capitalization of $3.41 billion. This ranking reflects Injective’s significant position within the broader cryptocurrency ecosystem.

What Could Be Driving Injective’s Growth?

While this article focuses on the data-driven price analysis, it’s natural to wonder what factors might be contributing to Injective’s recent positive performance. Here are a few potential drivers (purely speculative and for informational context):

- Increased Adoption of Injective Protocol: Injective is a layer-1 blockchain built for finance. Increased usage and adoption of its decentralized exchange (DEX) and other DeFi applications could be driving demand for INJ.

- Positive Market Sentiment: Broader positive sentiment in the cryptocurrency market can lift many boats, including INJ. Bitcoin’s performance often influences altcoins like Injective.

- Project Developments and News: Any significant partnerships, upgrades, or positive news surrounding the Injective ecosystem could boost investor confidence and drive price appreciation.

- Whale Activity: Large investors (whales) accumulating INJ can create buying pressure and contribute to price increases.

It’s important to remember that the cryptocurrency market is dynamic and influenced by numerous factors. Further research into Injective’s fundamentals, roadmap, and the broader market environment is recommended for a comprehensive understanding.

In Conclusion: INJ’s Bullish Momentum

Injective (INJ) is currently exhibiting strong bullish momentum, marked by a significant 24-hour and weekly price surge, accompanied by increased trading volume. While past performance is not indicative of future results, INJ’s current trajectory and market position are noteworthy for anyone tracking the cryptocurrency space. Keep a close eye on Injective as it continues to navigate the dynamic crypto landscape.

Disclaimer: The information provided is not trading nor financial advice. Bitcoinworld.co.in holds no liability for any trading or investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any trading or investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.