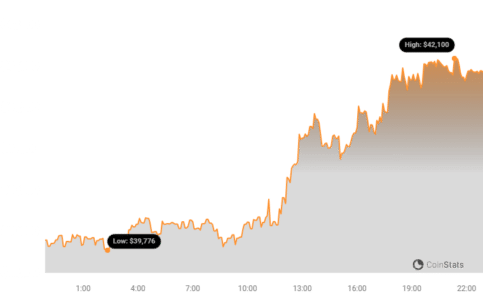

Exciting news for Wrapped Bitcoin (WBTC) holders! The price of WBTC has experienced a significant surge in the last 24 hours, jumping nearly 6%. But what’s driving this upward momentum, and is this a sign of more gains to come? Let’s dive into a detailed price analysis of Wrapped Bitcoin to understand the recent market movements and what they could mean for the future.

Wrapped Bitcoin Price Rally: What’s Fueling the Increase?

Over the past day, Wrapped Bitcoin (WBTC) has seen its price climb by an impressive 5.75%, reaching $41,969.00. This significant increase is a welcome sight for WBTC enthusiasts and the broader crypto market, especially after periods of fluctuation.

Looking at the bigger picture, this positive price action extends beyond just the last 24 hours. In fact, WBTC has maintained a positive trajectory over the past week, adding 1.0% to its value. Starting from $41,569.60, it has steadily climbed to its current price point. This consistent upward movement suggests a potential strengthening trend for Wrapped Bitcoin.

While the current price is encouraging, it’s worth noting that WBTC still has room to grow to reach its all-time high of $70,643.00. However, recent gains indicate renewed interest and positive market sentiment around this wrapped version of Bitcoin.

See Also: Price Analysis: The Price Of Chainlink (LINK) Increased More Than 3% Within 24 Hours

Decoding WBTC’s Volatility and Price Movement

To better understand the dynamics of WBTC’s price, let’s examine its volatility and price movement over different timeframes. The chart below provides a visual comparison:

The charts utilize Bollinger Bands (the gray bands) as a tool to measure volatility. Here’s a simple breakdown of what Bollinger Bands tell us:

- Bollinger Bands and Volatility: The width of the Bollinger Bands directly reflects the level of volatility. Wider bands indicate higher price fluctuations and greater uncertainty, while narrower bands suggest lower volatility and more stable price movement.

- Daily vs. Weekly Volatility: By comparing the Bollinger Bands on the left (24-hour) and right (weekly) charts, we can see how volatility differs across these periods. This helps traders and investors understand short-term versus medium-term price fluctuations.

Trading Volume and Circulating Supply: Key Market Indicators

Beyond price and volatility, trading volume and circulating supply are crucial indicators for assessing the health and momentum of a cryptocurrency. Let’s look at these metrics for WBTC:

- Decreased Trading Volume: Interestingly, the trading volume for WBTC has decreased by 20.0% over the past week. A decrease in trading volume can sometimes indicate reduced market participation or a period of consolidation. However, it’s important to consider this in conjunction with price movement.

- Slight Decrease in Circulating Supply: The circulating supply of WBTC has also slightly decreased by 0.36% in the last week, settling at over 157 thousand coins. This minor reduction might be due to WBTC being burned or moved into cold storage.

- High Circulating Supply Percentage: Currently, the circulating supply is estimated to be 100.0% of the maximum supply, which is also 157 thousand. This essentially means that almost all WBTC that can exist is already in circulation.

WBTC Market Cap and Ranking

As of now, Wrapped Bitcoin holds the #17 rank in market capitalization, with a market cap of $6.63 billion. This ranking reflects its significant position within the cryptocurrency ecosystem and highlights its importance as a bridge between Bitcoin and the decentralized finance (DeFi) space.

What is Wrapped Bitcoin (WBTC) and Why Does It Matter?

For those new to WBTC, let’s quickly clarify what it is and why it’s relevant:

- Bitcoin on the Ethereum Network: Wrapped Bitcoin (WBTC) is essentially Bitcoin brought to the Ethereum blockchain. It’s an ERC-20 token backed 1:1 by Bitcoin.

- Unlocking Bitcoin’s Potential in DeFi: WBTC allows Bitcoin holders to participate in the vast and growing world of Decentralized Finance (DeFi) applications on Ethereum. Bitcoin, in its native form, cannot be directly used on the Ethereum network. WBTC solves this by providing a wrapped version that is compatible with Ethereum’s smart contracts and DeFi protocols.

- Benefits of WBTC:

- Earn Yield on Bitcoin: WBTC holders can lend, borrow, and earn yield on their Bitcoin through DeFi platforms.

- Increased Liquidity: WBTC increases the liquidity of Bitcoin by making it accessible to the Ethereum ecosystem.

- Faster Transactions: Transactions on Ethereum can be faster and sometimes cheaper than on the Bitcoin network.

Is WBTC a Good Investment?

The recent price increase and the ongoing development in the DeFi space make WBTC an interesting asset to watch. However, like all cryptocurrencies, investing in WBTC carries risks. Here are a few points to consider:

- Market Volatility: The cryptocurrency market is inherently volatile. Price swings can be significant and rapid.

- DeFi Risks: Participating in DeFi protocols also carries risks such as smart contract vulnerabilities and impermanent loss.

- Regulatory Landscape: The regulatory environment for cryptocurrencies is still evolving and can impact the market.

Actionable Insights:

- Stay Informed: Keep track of WBTC price movements, trading volume, and developments in the DeFi space.

- Risk Management: If considering investing in WBTC or using it in DeFi, understand the risks involved and practice proper risk management.

- Do Your Own Research (DYOR): Always conduct thorough research before making any investment decisions in the crypto market.

Conclusion: WBTC Showing Positive Signs, But Market Vigilance is Key

Wrapped Bitcoin’s recent price surge and overall positive weekly performance are encouraging signs. The decreased circulating supply and high percentage of max supply utilized could also indicate scarcity and potential future value appreciation. However, the decrease in trading volume warrants attention, and investors should remain vigilant about overall market conditions and potential volatility.

As WBTC continues to bridge the gap between Bitcoin and the DeFi ecosystem, its role in the crypto market is likely to remain significant. Staying informed and understanding the dynamics of WBTC, along with the broader crypto market, is crucial for making informed decisions.

Disclaimer: The information provided is not trading nor financial advice. Bitcoinworld.co.in holds no liability for any trading or investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any trading or investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.