The cryptocurrency market is a whirlwind of constant motion, and even established players like Uniswap (UNI) experience their share of ups and downs. In the last 24 hours, the popular decentralized exchange’s native token, UNI, has shown a positive uptick, injecting a dose of optimism into the market. Let’s delve into the recent price action of Uniswap and analyze what these movements could signify for traders and holders alike.

Uniswap (UNI) Sees a 4.49% Price Increase: A Sign of Recovery?

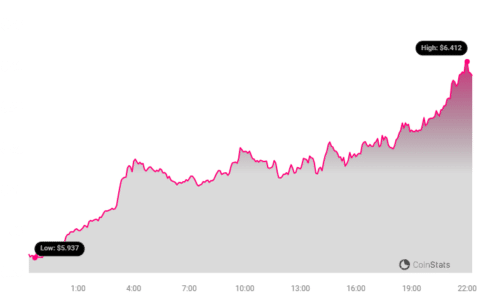

As of today, Uniswap’s (UNI) price stands at $6.28, marking a 4.49% increase over the past 24 hours. This positive movement is a welcome change, especially considering the slightly stagnant performance over the preceding week. Take a look at the price chart below to visualize this recent surge:

While a 24-hour jump is encouraging, it’s crucial to contextualize it within a broader timeframe. Over the past week, UNI experienced essentially no net change, hovering around the $6.26 mark before this recent rise. This flat weekly performance underscores the volatility inherent in the crypto market. It’s also important to remember that UNI is still trading significantly below its all-time high of $44.92. The journey back to those peaks is a marathon, not a sprint.

See Also: Price Analysis: TRON (TRX) Price Up More Than 3% In 24 Hours

Decoding Volatility: What Do Bollinger Bands Tell Us About UNI?

To understand the dynamics behind UNI’s price movements, examining volatility is key. Volatility essentially measures how much the price of an asset fluctuates over a given period. One helpful tool for visualizing volatility is Bollinger Bands. These bands, represented by the gray areas in the charts below, widen during periods of high volatility and narrow when prices are relatively stable.

Let’s compare UNI’s price movement and volatility over the last 24 hours versus the past week:

As you can see, wider Bollinger Bands indicate greater price swings. By observing the width of these bands, we can gauge the level of uncertainty and potential risk associated with trading UNI at different timeframes.

Trading Volume and Circulating Supply: Key Indicators to Watch

Price action isn’t the only metric to consider. Trading volume and circulating supply provide crucial insights into the overall health and market sentiment surrounding a cryptocurrency. Let’s break down what these indicators reveal for Uniswap:

- Trading Volume: Interestingly, while the price has increased in the last 24 hours, UNI’s trading volume has actually decreased by 19.0% over the past week. A decrease in trading volume alongside a price increase can sometimes be interpreted as a less robust rally, potentially driven by lower participation. It’s worth monitoring if volume picks up to sustain this upward momentum.

- Circulating Supply: On the other hand, the circulating supply of UNI has slightly increased by 0.31% in the past week, reaching over 753.77 million coins.

Here’s a visual representation of Uniswap’s circulating supply and trading volume trends:

Currently, the circulating supply represents an estimated 75.38% of UNI’s maximum supply of 1 billion tokens. This means that a significant portion of the total UNI supply is already in circulation, which can influence its price dynamics.

Market Cap and Ranking: Where Does UNI Stand?

Market capitalization, or market cap, is a crucial metric that reflects the total value of a cryptocurrency. It’s calculated by multiplying the circulating supply by the current price. Uniswap currently holds the #22 rank in the cryptocurrency market cap rankings, with a market cap of $4.72 billion.

This ranking highlights Uniswap’s position as a significant player in the crypto space. While price fluctuations are common, a strong market cap generally indicates a degree of stability and investor confidence in the long term.

What’s Next for Uniswap?

The recent 4.49% price increase for UNI is a positive signal, but it’s essential to remain vigilant and consider the broader market context. Here are some key takeaways and points to consider:

- Monitor Trading Volume: Keep an eye on whether trading volume increases to support the recent price gains. Higher volume would suggest stronger conviction behind the upward movement.

- Broader Market Sentiment: Uniswap, like most cryptocurrencies, is influenced by overall market sentiment. Factors like Bitcoin’s price action and macroeconomic events can impact UNI’s price.

- DeFi Developments: As a leading decentralized exchange, Uniswap’s performance is tied to the growth and adoption of the DeFi (Decentralized Finance) sector. Positive developments in DeFi could positively impact UNI.

- Long-Term Potential: Despite short-term fluctuations, Uniswap remains a fundamental piece of the crypto ecosystem. Its role in decentralized trading positions it for potential long-term growth.

Disclaimer: The information provided is not trading nor financial advice. Bitcoinworld.co.in holds no liability for any trading or investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any trading or investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.