The cryptocurrency world is always buzzing with excitement, and the recent listing of Pyth Network [PYTH] on Binance, the world’s largest crypto exchange, has definitely stirred things up! Will this listing catapult PYTH to new heights, or is it just a fleeting moment in the volatile crypto market? Let’s dive into the details and analyze what this means for PYTH.

Binance Lists PYTH: A Bullish Catalyst?

Binance’s announcement to list PYTH sent ripples of anticipation through the crypto community. The promise of increased liquidity and accessibility often leads to significant price rallies for newly listed tokens. As per the official announcement, PYTH trading commenced on February 3rd at 12:00 UTC with the pairs PYTH/BTC, PYTH/USDT, PYTH/FDUSD, and PYTH/TRY.

Fellow Binancians,

Binance will list Pyth Network (#PYTH) and open trading for these spot trading pairs at 2024-02-03 12:00 (UTC): PYTH/BTC, PYTH/USDT, PYTH/FDUSD and PYTH/TRY.

More details here ➡️ https://t.co/jmFWJ2xJgV pic.twitter.com/vQ6yyzWxRd

— Binance (@binance) February 2, 2024

Social Buzz and Market Sentiment

The announcement triggered a surge in PYTH’s social metrics, indicating heightened interest and engagement within the crypto community. Data from Santiment revealed a significant spike in PYTH’s social volume on February 2nd, 2024. Furthermore, bullish sentiment surrounding the token also experienced a notable increase.

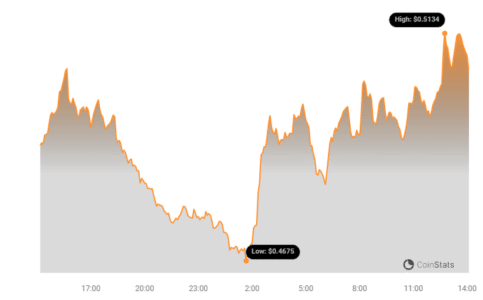

Coinstats data showed PYTH up by more than 19% in the week following the announcement. However, the initial euphoria seems to have cooled down, with PYTH experiencing a slight dip in the last 24 hours.

At the time of writing, PYTH was trading at $0.4645 with a market capitalization of over $696 million.

Analyzing PYTH’s Current State: What Does the Future Hold?

To gain a deeper understanding of PYTH’s potential for further growth, let’s analyze its current market indicators:

- Sideways Movement: Analysis of PYTH’s daily chart suggests a possibility of sideways price movement in the short term.

- Neutral Indicators: The Money Flow Index (MFI) and Relative Strength Index (RSI) indicate a neutral trend, further supporting the potential for sideways movement.

- Bearish Crossover: The Moving Average Convergence Divergence (MACD) displays a bearish crossover, which could potentially lead to a price decrease.

- Bullish CMF: The Chaikin Money Flow (CMF) shows a slight uptick above the neutral mark, indicating some buying pressure.

Derivatives Market: A Glimmer of Hope?

Interestingly, the derivatives market presents a slightly more optimistic outlook. The downtrend in open interest, coupled with a consistently green funding rate, suggests a potential trend reversal and continued interest from futures investors.

Conclusion: Navigating the PYTH Landscape

The Binance listing has undoubtedly put Pyth Network in the spotlight. While the initial price surge has subsided, the increased social engagement and potential signals from the derivatives market offer a mixed outlook. Investors should closely monitor market indicators and conduct thorough research before making any investment decisions. The cryptocurrency market is known for its volatility, and careful analysis is crucial for navigating the PYTH landscape.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading nor financial advice. Bitcoinworld.co.in holds no liability for any trading or investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any trading or investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.