Safello’s IPO Oversubscribed by 1,240%, Highlighting Growing Investor Interest in Crypto

The Swedish cryptocurrency brokerage Safello has captured immense investor interest, with its initial public offering (IPO) oversubscribed by a staggering 1,240%. This represents $60 million in subscriptions against an initially planned $5 million, underscoring the surging appetite for cryptocurrency-related investments.

Massive Demand for Safello’s Nasdaq Listing

Safello, headquartered in Stockholm, is preparing to list on the Nasdaq First North Growth Market on May 12. The company revealed on Wednesday that it had received nearly 502 million Swedish Krona in subscriptions for its IPO.

According to Safello CEO Frank Schuil, the overwhelming demand highlights growing confidence in the cryptocurrency market, particularly in regulated, user-friendly platforms like Safello. The company anticipates that its public listing will open new avenues for growth, enabling it to execute its strategic road map effectively.

CoinShares’ Success Sets the Stage

Safello’s planned listing follows the footsteps of CoinShares, a leading European crypto asset manager, which debuted on Nasdaq First North in March 2021. CoinShares’ successful listing was one of the key inspirations for Safello’s move to go public, as it showcased the potential for cryptocurrency companies to thrive in public markets.

A Brief History of Safello

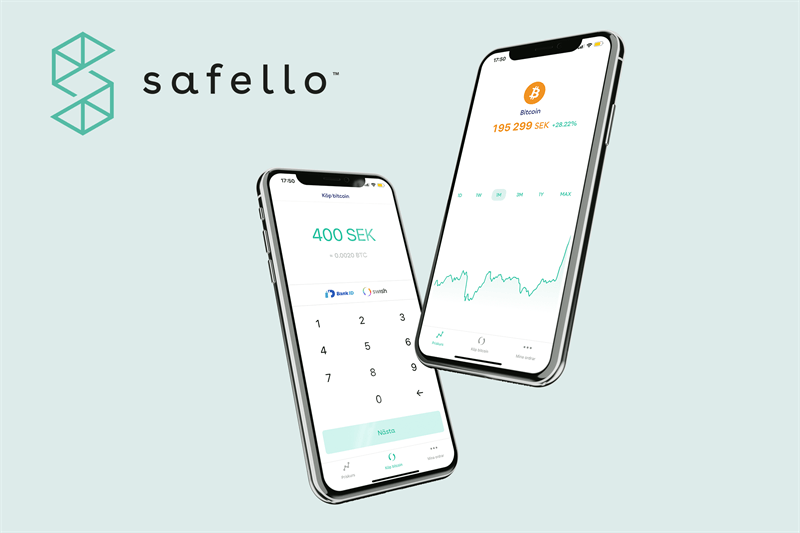

Founded in 2013 by Frank Schuil, Safello provides online cryptocurrency brokerage services, enabling users to buy and sell cryptocurrencies like Bitcoin. The company is regulated by the Swedish Financial Supervisory Authority, offering a secure and transparent platform for digital asset transactions.

Major players in the crypto industry, including Barry Silbert’s Digital Currency Group, back Safello, reinforcing its credibility. Over the years, Safello has positioned itself as a trusted name in Sweden’s growing cryptocurrency market.

2021: A Milestone Year for Crypto Companies

The overwhelming response to Safello’s IPO aligns with a broader trend of cryptocurrency companies going public in 2021. Analysts and industry leaders have described this year as a watershed moment for the crypto industry, with increasing numbers of firms opting for public listings to fuel growth and attract institutional investment.

Notably, Coinbase, the largest cryptocurrency exchange in the United States, made its historic debut on the Nasdaq Global Select Market in April 2021. The listing was a pivotal moment for the industry, raising awareness and setting benchmarks for future IPOs.

Safello’s Vision for Growth

With its Nasdaq listing on the horizon, Safello is poised to accelerate its growth strategy. The company aims to leverage the opportunities provided by the public market to expand its product offerings, enhance customer experiences, and solidify its position as a leading cryptocurrency brokerage in Europe.

CEO Frank Schuil emphasized that Safello will continue to adhere to the allocation rules set in its IPO prospectus, ensuring transparency and fairness for investors.

Conclusion

The extraordinary demand for Safello’s IPO highlights the growing mainstream acceptance of cryptocurrencies and the platforms facilitating their adoption. As the company prepares to list on Nasdaq First North, it signals a bright future not only for Safello but for the broader cryptocurrency industry.

To learn more about the innovative startups shaping the future of the crypto industry, explore our article on latest news, where we delve into the most promising ventures and their potential to disrupt traditional industries.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.