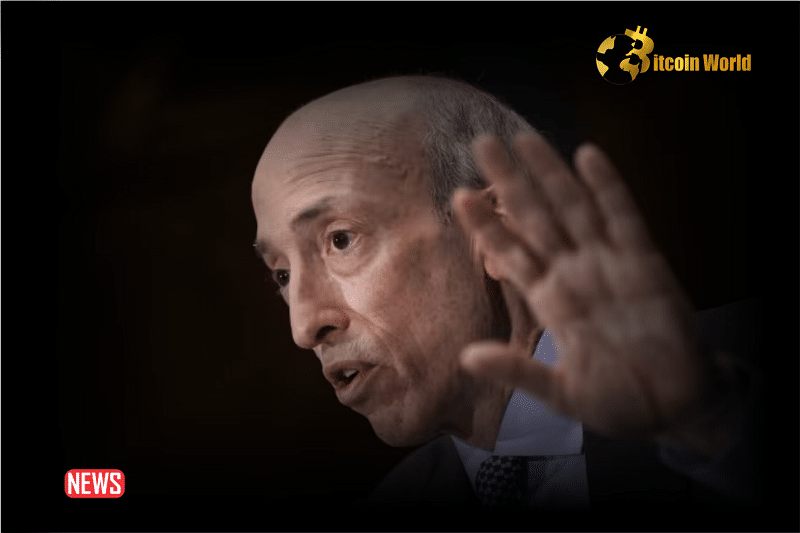

- SEC Chair and fervent crypto critic Gary Gensler has issued a second warning about the risks of cryptocurrency investments within 24 hours.

- Gensler emphasizes caution for investors, highlighting the differences between crypto and regulated securities markets.

- Celebrity endorsements of crypto assets should not be the basis for investment decisions.

- Investors are warned against high-pressure sales tactics and promises of guaranteed returns, common in investment scams.

Gary Gensler, the anti-crypto Chair of the U.S. Securities and Exchange Commission (SEC), is known for not mincing words when it comes to the risks associated with cryptocurrencies.

Gensler issued a second warning within 24 hours, emphasizing the need for caution among investors considering crypto assets.

This latest advisory follows a string of concerns raised by the agency, highlighting serious risks and the potential lack of regulatory protections in the crypto market.

See Also: US SEC Warns Against FOMO On Bitcoin Spot ETFs

The Investor’s Dilemma: To Buy or Not to Buy Crypto

The allure of cryptocurrencies has captivated a wide range of investors, from seniors in retirement communities grappling with advice from their tech-savvy children to millennials eager to jump on the bandwagon.

Despite the hype, Gensler’s message remains clear: investors should tread carefully. The crux of the issue lies in the fundamental differences between the regulated securities markets and the relatively unregulated world of cryptocurrency investments.

These differences can be stark, with crypto investors potentially facing unclear dealings and uncertain returns.

A thread ?

Some things to keep in mind if you're considering investing in crypto assets:

— Gary Gensler (@GaryGensler) January 8, 2024

The recent trend of celebrities endorsing various cryptocurrencies adds another layer of complexity.

Gensler cautions against making investment decisions based on these endorsements.

The glitter of celebrity involvement should not distract from the need for thorough, independent research.

Moreover, the SEC warns that new and trendy investments are often fertile ground for fraudsters who capitalize on the lack of historical data and the excitement surrounding the product.

One key piece of advice from the SEC is the importance of recognizing the high-pressure sales tactics and too-good-to-be-true promises often associated with investment fraud.

Investors are urged to ask pointed questions and seek clear answers before diving into the crypto pool.

See Also: Hacker Exploited SEC Chair’s Phone Number To Post Fake Spot BTC ETF Approval: X

However, Gensler points out a harsh reality: even in cases of fraud, there might be little that regulators like the SEC can do to help recover lost investments.

As for those who decide to take the plunge into digital currencies or tokens, Gensler suggests a cautious approach.

Investing only what one can afford to lose can mitigate the potential financial devastation if the investment goes south. Diversification is another strategy recommended by the SEC to spread risk.

While cryptocurrencies might shine as the latest opportunity, they come with their fair share of risks.

Gensler’s advice? Proceed with caution, do your homework, evaluate your financial goals, and don’t rely on chance when making investment decisions.

This double-down warning from Gensler comes at a critical time for the crypto industry, which is anxiously awaiting the SEC’s decision on spot bitcoin ETF applications.

The SEC’s stance is a reminder that in the rapidly evolving world of cryptocurrencies, regulatory oversight and investor education are key to navigating this complex and often treacherous market.

As always, the SEC claims it is committed to protecting investors, but ultimately, the responsibility lies with individuals to make informed and prudent decisions about their investments.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.