Ever felt like the crypto regulatory landscape is a bit of a maze? You’re not alone. Recent statements from the U.S. Securities and Exchange Commission (SEC) have left many scratching their heads, particularly when it comes to classifying crypto tokens as securities. In what’s being described as an inconsistent stance, the SEC seems to be arguing that a crypto token can be both a security and not a security at the same time. Confused? Let’s dive into what’s happening.

SEC’s Crypto Stance: A Contradiction in Terms?

According to recent court hearings involving crypto giants Binance and Coinbase, the SEC’s legal team has presented arguments that suggest crypto tokens can exist in a sort of regulatory limbo. Here’s the crux of the issue:

- During hearings related to Binance and Coinbase, SEC lawyers argued that crypto tokens might be classified as both securities and non-securities.

- Adding to the puzzle, the SEC legal team sees no inherent contradiction in these seemingly opposing positions.

This apparent double-speak has raised eyebrows across the crypto community and beyond. Renowned pro-crypto attorney James Murphy, widely known as MetaLawMan on Twitter, has weighed in on this inconsistency, highlighting the SEC’s seemingly flexible – or perhaps confused – approach to crypto asset classification.

In Coinbase & Binance cases, SEC lawyers argued that tokens could be securities AND non-securities at the same time.

SEC lawyers see no contradiction in their positions. pic.twitter.com/o10jJt8t0y

— MetaLawMan (@MetaLawMan) February 8, 2024

Murphy specifically pointed to recent court hearings where SEC legal counsels appeared to present conflicting arguments, leaving many to wonder about the regulator’s actual stance.

Coinbase Case: Are Tokens Securities at Issuance?

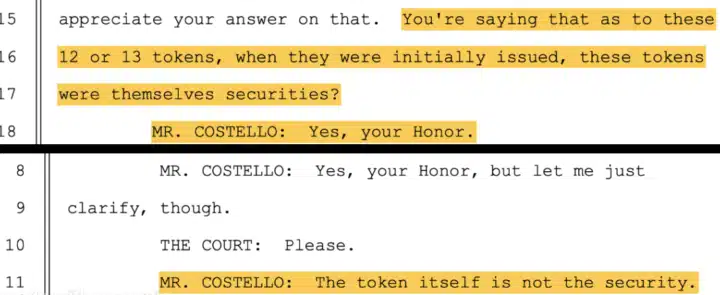

The first instance highlighted by attorney Murphy occurred during a January 17 hearing in the SEC’s lawsuit against Coinbase, a major US-based cryptocurrency exchange.

During these proceedings, the court sought clarity from the SEC regarding whether 13 specific tokens under scrutiny were considered securities right from their initial issuance. The SEC’s response?

See Also: US Treasury Secretary, Janet Yellen, Calls For Crypto Legislation On ‘Non-Security’ Tokens

“Yes, your Honor,” SEC lawyers affirmed, indicating that these tokens were indeed securities. However, in a twist that has raised eyebrows, the same SEC lawyer then added, “The token itself is not the security.”

So, if the token isn’t the security, what is? This statement immediately creates confusion. If the tokens were deemed securities at issuance, how can the token itself *not* be the security?

Binance Hearing: Tokens vs. Investment Contracts?

Adding another layer to this complex narrative, attorney Murphy pointed to a second instance in a hearing related to the lawsuit against Binance, the world’s largest cryptocurrency exchange.

In this case, the court questioned the SEC counsel on whether they agreed that there’s a distinction between the actual crypto coins (tokens) and the investment contracts associated with them. The SEC lawyers responded positively, even acknowledging that crypto assets are essentially just lines of code.

However, the plot thickened when they stated, “The token itself represents the investment contract.” This statement seems to contradict their earlier acknowledgment of the token as just code, suggesting instead that the token embodies the very investment contract that could classify it as a security.

The court itself expressed uncertainty, noting that it hadn’t previously heard the SEC assert that tokens represent investment contracts. In defense, the SEC lawyer maintained that the asset *does* embody the investment contract and dismissed any notion of contradiction within their statements.

See Also: Former Zipmex Thailand CEO Akalarp Yimwilai Charged with Fraud by Thai SEC

The Bottom Line: Is Crypto in a Regulatory Gray Area?

In essence, as attorney Murphy highlighted, the SEC appears to be arguing that a crypto token can be both a security and not a security simultaneously, and astonishingly, they don’t perceive these statements as conflicting. This stance has led MetaLawMan to remark, “The SEC seems to have a hard time keeping its story straight on crypto.”

This situation underscores the ongoing uncertainty surrounding crypto regulation in the US. The SEC’s seemingly contradictory arguments raise significant questions:

- Clarity Needed: Does the SEC truly understand the nuances of crypto assets and their underlying technology?

- Regulatory Overreach?: Is the SEC attempting to broadly classify all crypto tokens as securities to expand its regulatory purview?

- Impact on Innovation: Will this regulatory ambiguity stifle innovation and growth within the crypto industry in the United States?

For crypto businesses and investors, this lack of clarity is far from ideal. Navigating the regulatory landscape becomes significantly more challenging when the rules themselves appear to be shifting or, worse, contradictory. The crypto industry is eagerly awaiting clearer, more consistent guidance from regulators like the SEC to foster innovation while ensuring investor protection.

The ongoing legal battles and these apparent inconsistencies highlight the urgent need for a more defined and coherent regulatory framework for cryptocurrencies in the US. Until then, the crypto world remains in a state of regulatory limbo, grappling with interpretations that seem to bend the rules of logic itself.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.