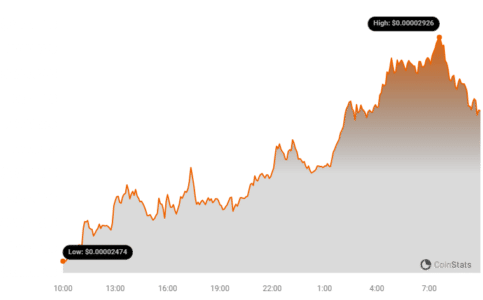

Shiba Inu (SHIB) just performed one of the strongest moves on the market with a price comeback above $0.000028, which was believed to be a strong psychological threshold for the asset.

However, SHIB is currently not facing any kind of technical resistance and should be safe at least before hitting the psychological resistance of $0.00003.

This recent surge is a blessing for SHIB holders and traders considering the performance token has been showing in the last few days.

As for any price action so far, it would appear that it is mostly just a result of increasing buys. This is a positive cue as seen by the SHIB breakout after the consolidation.

The moving averages also provide us with some insights. SHIB has managed to move above the 50-day moving average, suggesting some intensity to the upside price.

The next major one to watch will be the 200-day moving average, in orange, well below the price and, at this point, an addition to bullish sentiment.

The other thing to notice is the volume, of course: it surges in accordance with the price, showing a descending tendency.

Volume is a very critical factor because it acts as validation for the strength of the price’s move. Looking further ahead, the next obstacle is at $0.00003. The level is important as, aside from being psychological, it is the roundest.

If SHIB can hold at that level that follows the hurdle, it could mean the path to even larger gains in the future.

RSI is approaching the “overbought” threshold, meaning that prices will soon receive short-term selling pressure.

In the long run, however, if SHIB manages to stay in this trend with very strong buying volumes, there is a really good chance of further upside action.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.