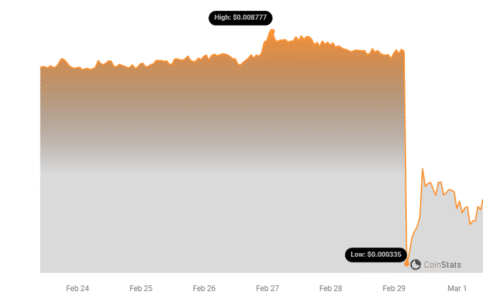

Hold onto your hats, crypto enthusiasts! The Shido Token (SHIDO) just experienced a rollercoaster ride of the worst kind. In a breathtakingly swift downturn, the token’s value plummeted by a staggering 90% in just 30 minutes. What triggered this dramatic dive? A security breach, plain and simple, shaking investor confidence and sending shockwaves through the crypto community.

The Anatomy of the Shido Security Breach: How Did It Happen?

The alarm bells first rang on February 29th when PeckShield, a renowned blockchain security firm, flagged an anomaly. Their eagle-eyed monitoring detected suspicious activity on the Shido layer-1 blockchain, and they quickly took to X (formerly Twitter) to sound the alarm:

#PeckShieldAlert #Shido $SHIDO On Feb-29-2024 07:53:54 AM +UTC, the $SHIDO contract owner 0x86b…a94d changed the staking contract owner to 0xf8e…6333

And then the new staking contract owner 0xf8e…6333 updated the staking contract with a hidden function, and then drained 4.3B $SHIDO pic.twitter.com/Ue46PjhImL

— PeckShieldAlert (@PeckShieldAlert) February 29, 2024

Further digging by PeckShield revealed a sophisticated exploit. Here’s a breakdown of how the hackers pulled off this heist:

- Contract Ownership Takeover: The attacker managed to seize control of Shido’s Ethereum staking contract. This is like getting the keys to the kingdom!

- Hidden Function Injection: Once in control, the new owner stealthily modified the contract, adding a concealed function. Think of it as a secret backdoor, unknown to the legitimate users.

- Token Drain: This hidden function was the weapon of choice. It allowed the attacker to withdraw a massive amount of staked tokens, emptying the coffers.

See Also: Crypto Exchange Four Dragons Reportedly Suffers $100m Hack In Security Breach

The Loot: How Much Was Stolen in the Shido Exploit?

The numbers are staggering. According to PeckShield’s analysis, the attacker made off with a colossal 4.3 billion Shido tokens. To put that into perspective, this represents nearly half of the token’s entire circulating supply, which CoinMarketCap reports to be around 9 billion. Imagine stealing half the gold in Fort Knox!

Before the exploit, these stolen tokens were valued at approximately $35 million. This gives you a sense of the scale of the financial damage inflicted by this security breach.

Looks like @Shido_Global got exploited and lost almost half of the supply

Attacker: https://t.co/mAdWtW1buD

Staking contract: https://t.co/q5yL7n4tzG pic.twitter.com/j5zLrH7mZq— Kinnif (@0xkinnif) February 29, 2024

Unmasking the Hacker: Who is Behind the Shido Exploit?

The crypto community doesn’t rest when a breach occurs. On-chain sleuth ZachXBT, known for his investigative prowess, jumped into action. In a post on X, ZachXBT revealed that he had identified the exploiter’s wallet address. The trail revealed some interesting details:

- Layerswap Funding: The exploiter’s address initially received funds via Layerswap, a cross-chain protocol. This suggests an attempt to obscure the origin of funds.

- Arbitrum Connection: Further funds flowed in from the Arbitrum blockchain, adding another layer to the funding puzzle.

Intriguingly, ZachXBT’s investigation didn’t stop there. He hinted at potentially uncovering the real identity behind the wallet that initially funded the exploiter. However, in a twist, it appears that even that funding wallet may have been compromised! An unexpected asset transfer from the funding wallet *before* it funded the exploiter raises serious questions and suggests a potentially wider web of compromised accounts.

Shido’s Response and the Road Ahead: What’s Next?

Shido, built on a proof-of-stake system, was on the cusp of a major milestone: the launch of its mainnet, announced just days before on February 24th, with hints of a launch the following week. This security breach couldn’t have come at a worse time.

The SHIDO token, an ERC-20 token on Ethereum, offered staking on its decentralized exchange (DEX) with a tempting 8% annual yield. This exploit throws a wrench into those plans and raises serious concerns about the platform’s security protocols.

Crypto Security Under Scrutiny: Is Your Investment Safe?

The Shido breach is unfortunately part of a larger, concerning trend in the crypto space. Security incidents are becoming almost commonplace. Let’s look at the bigger picture:

- 2023: A Year of Hacks: Over 600 hacks plagued the crypto sector in the previous year, resulting in losses exceeding a staggering $2.1 billion. While this was a 30% decrease from 2022, the numbers are still alarming.

- 2024: No Sign of Slowing Down: January 2024 alone witnessed 30 attacks, with losses hitting $182.5 million. This indicates that the threat landscape remains highly active.

- February’s Crypto Crime Spree: February is shaping up to be a particularly brutal month for crypto security. The $290 million theft from PlayDapp, along with numerous wallet breaches and phishing scams costing millions, paints a grim picture.

See Also: SEC Reveals Terraform Labs’ “Suspicious” $166m Payment To Lawyers Before Bankruptcy

Key Takeaways and Lessons Learned

The Shido Token security breach serves as a stark reminder of the ever-present risks in the cryptocurrency world. Here are some key takeaways:

- Layer-1 Security is Paramount: Even layer-1 blockchains, the foundations of the crypto ecosystem, are vulnerable. Robust security measures are non-negotiable.

- Smart Contract Audits are Essential: Thorough and continuous audits of smart contracts are crucial to identify and patch vulnerabilities before they are exploited.

- Decentralization Doesn’t Equal Security: While decentralization offers many benefits, it doesn’t automatically guarantee security. Vigilance and proactive security practices are still necessary.

- DYOR (Do Your Own Research) More Than Ever: Investors need to be extra cautious and conduct thorough research before investing in any crypto project, especially newer ones. Security audits and team transparency are key factors to consider.

The Shido Token crash is a painful lesson for the crypto community. It underscores the need for constant vigilance, improved security practices, and a healthy dose of skepticism in this rapidly evolving and often turbulent landscape.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.