Remember the DeFi summer of 2020 and the explosive growth that followed? Decentralized Finance (DeFi) promised a revolution, offering exciting new ways to earn passive income and engage with crypto. But fast forward to 2022, and the landscape looks a bit different. Data reveals a significant contraction in the DeFi market, leaving many wondering: what’s going on and what does the future hold?

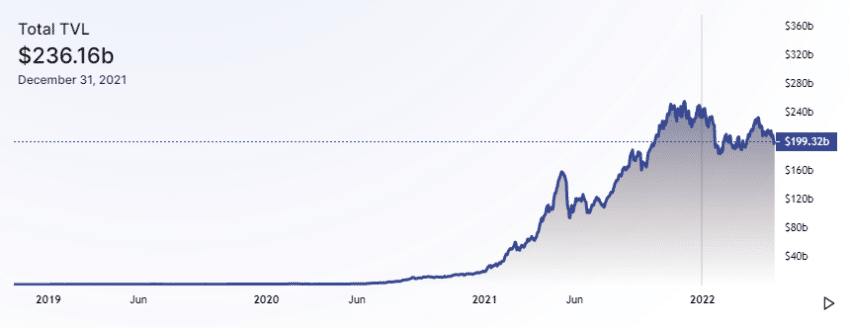

According to leading data platforms, the total value locked (TVL) in DeFi protocols has shrunk considerably. We’re talking about an almost 18% decrease since the start of the year, dropping from a whopping $236 billion at the end of 2021 to around $199 billion by early May. That’s a substantial shift!

Why the DeFi Downturn? Decoding the Decline

It’s not just one platform feeling the pinch; this isn’t an isolated incident. Instead, a broad range of major DeFi protocols and platforms are experiencing notable TVL reductions, often in double digits. Think of industry giants like Curve, Lido, MakerDAO, Aave, Compound, and PancakeSwap – all have seen significant decreases. Let’s take a look at the overall picture:

So, what’s driving this market-wide contraction? Several factors are likely at play:

-

Broader Crypto Market Correction: The entire cryptocurrency market has faced headwinds recently. Bitcoin and Ethereum, the flagships of crypto, have experienced price drops. This general market downturn naturally impacts DeFi, as many DeFi protocols are built upon these cryptocurrencies. When the overall crypto market dips, investors often reduce their exposure across the board, including in DeFi.

-

Reduced DEX Trading Volumes: Decentralized Exchanges (DEXs) are a vital part of the DeFi ecosystem. Lower trading volumes on DEXs in April, down to $92.1 billion from $117 billion in March, indicate reduced activity and potentially less capital flowing through DeFi protocols. This decreased activity can contribute to lower TVL.

-

Regulatory Scrutiny Intensifies: Regulators worldwide are increasingly focusing on the DeFi space. While regulation isn’t necessarily a bad thing in the long run (it can bring stability and maturity), the current uncertainty around future regulations can make investors cautious. The possibility of stricter rules might be prompting some to pull back funds from DeFi platforms.

-

Cybersecurity Concerns and Hacks: Unfortunately, the DeFi space has been plagued by significant hacks and exploits. As highlighted in the tags, DeFi attacks and wallet hacks are real and costly. These security breaches erode trust in the sector and can lead to substantial fund withdrawals as users become wary of the risks. We’ve seen billions lost to DeFi hacks, and this undoubtedly contributes to the negative sentiment and TVL decline.

DeFi’s Resilience: A Silver Lining?

Despite the challenges, it’s important to note that DeFi has shown a degree of resilience compared to the broader crypto market. Many investors utilize DeFi for generating passive income through liquidity pools and other yield-farming mechanisms. This inherent utility can provide a buffer against complete fund exodus. People are still finding value in DeFi’s core offerings.

What’s the DeFi Forecast for the Rest of 2022?

DeFi is undeniably a fundamental pillar of the cryptocurrency ecosystem. Its movements have ripple effects across the entire crypto market. It remains one of the most dynamic and active sectors within crypto, both in terms of user engagement and ongoing development.

However, 2022 has presented significant hurdles for DeFi. Let’s recap some key challenges:

-

Mounting Losses from Cyberattacks: The sheer scale of losses from DeFi hacks in 2022 is alarming, exceeding $1.2 billion already. This ongoing threat is a major concern that needs to be addressed for DeFi to regain and sustain growth.

-

Regulatory Pressure on the Rise: International bodies like the IMF are expressing concerns about the financial risks posed by unhosted wallets and DeFi in general. The push for regulation is gaining momentum, and how these regulations will be implemented and their impact on the decentralized nature of DeFi remains to be seen. Navigating this regulatory landscape will be crucial for the future of DeFi.

Despite these challenges, the underlying principles of DeFi – transparency, accessibility, and financial innovation – remain compelling. The industry is actively working on solutions to improve security, scalability, and user experience. The future trajectory of DeFi will likely depend on its ability to overcome these hurdles, build stronger security frameworks, and constructively engage with regulators.

Related Read: AMC Theatres Explores Accepting Dogecoin, CEO Sees Awing DOGE Poll Results

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.