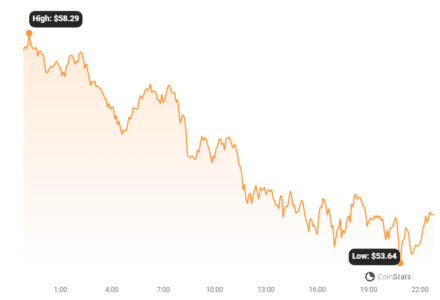

Hold onto your hats, crypto enthusiasts! The market is never a dull place, and Solana (SOL) is currently experiencing a bit of a rollercoaster ride. Over the past 24 hours, the price of Solana has taken a downturn, dropping by 4.89% to land at $53.64. If you’ve been keeping a close eye on your portfolio, you’ll notice this isn’t just a one-day blip – it’s part of a broader trend. Let’s dive deeper into what’s happening with Solana’s price and what these movements might indicate for the near future.

Solana’s Price Performance: A Closer Look

To truly understand the current situation, we need to zoom out a bit. Over the last week, Solana has seen a consistent negative trend, with a 9.0% decrease in value. It started the week at $58.29 and has gradually descended to its current price point. This consistent downward pressure raises a few key questions:

- What’s driving this price decrease? Is it market-wide sentiment, Solana-specific news, or a combination of factors?

- Is this a temporary dip or a more significant correction? Understanding the nature of this price movement is crucial for investors.

- What does this mean for the future of Solana? Is this a buying opportunity or a sign of further decline?

Looking at the charts can give us some visual clues. The image above from Coinstats provides a snapshot of Solana’s recent price action. Let’s break down what we can infer from this and other available data.

Decoding Solana’s Price Movements and Volatility

Volatility is the name of the game in the crypto world, and Solana is no stranger to price swings. To better visualize this, let’s examine the provided charts that compare Solana’s price movement and volatility over the past 24 hours versus the last week.

The chart on the left illustrates the daily price movement, while the one on the right shows the weekly trend. Notice those gray bands? Those are Bollinger Bands, a popular technical analysis tool used to measure volatility. Essentially, Bollinger Bands help us see how much the price of an asset is fluctuating around its average.

What do Bollinger Bands tell us?

- Wider Bands = Higher Volatility: When the gray bands widen, it indicates increased price volatility. This means the price is swinging more dramatically in both directions.

- Narrower Bands = Lower Volatility: Conversely, when the bands are narrow, it suggests lower volatility and more stable price movement.

By observing the Bollinger Bands in the charts, we can get a sense of how volatile Solana’s price has been recently, both on a daily and weekly basis. Is the volatility spiking, or is it relatively stable despite the price decline?

Read Also: Solana Rallies, Soared Above $54: What Is Next For SOL?

Supply, Demand, and Market Sentiment: Key Factors at Play

Price movements in cryptocurrencies, like any asset, are driven by the fundamental forces of supply and demand. Let’s look at some key metrics for Solana that can shed light on the current price action:

Trading Volume: The data reveals that Solana’s trading volume has decreased by a significant 33.0% over the past week. A decrease in trading volume can sometimes accompany a price decline, as it may suggest less buying interest or overall market activity for SOL.

Circulating Supply: Interestingly, the circulating supply of Solana has slightly increased by 0.73% in the past week, now standing at over 423.43 million SOL. While a small increase in supply might exert some downward pressure on price, a 0.73% increase alone is unlikely to be the primary driver of a 9% price drop. However, it’s a factor to consider in the broader context.

Market Cap and Ranking: Despite the recent price dip, Solana remains a significant player in the crypto market, holding the #7 market cap ranking at $23.04 billion. This indicates that even with the downturn, Solana still commands substantial investor interest and capital within the cryptocurrency ecosystem.

Potential Reasons Behind Solana’s Price Decline

Pinpointing the exact cause of a price drop in the volatile crypto market is rarely straightforward. However, we can consider some potential contributing factors:

- Broader Market Correction: The entire cryptocurrency market can be influenced by macroeconomic factors, regulatory news, and overall investor sentiment. Bitcoin’s price movements often have a ripple effect on altcoins like Solana. If Bitcoin is experiencing a downturn, it’s common for other cryptocurrencies to follow suit.

- Profit-Taking: After periods of price increases, some investors may choose to take profits, leading to selling pressure and price corrections. If Solana had recently experienced a rally, this could be a natural pullback.

- Specific Solana News or Developments: Are there any recent news events or developments specific to the Solana network that could be impacting investor sentiment? This could include network outages, updates, or competitor activity. It’s crucial to stay informed about Solana-specific news.

- General Crypto Market Sentiment: Overall sentiment towards cryptocurrencies can fluctuate. Factors like inflation concerns, interest rate hikes, or geopolitical events can impact investor risk appetite and lead to market-wide corrections.

Navigating Solana’s Price Volatility: Insights for Investors

So, what does this all mean for you as an investor or someone interested in Solana? Here are some key takeaways and actionable insights:

- Stay Informed: Keep abreast of the latest news and developments in the cryptocurrency market, particularly those related to Solana and the broader ecosystem. Reliable crypto news sources and Solana’s official channels are good places to start.

- Consider the Long-Term View: Cryptocurrency investments are inherently volatile. Short-term price fluctuations are common. Consider your long-term investment goals and whether you believe in Solana’s fundamental value and long-term potential.

- Manage Risk: Never invest more than you can afford to lose. Diversification across different cryptocurrencies and asset classes can help mitigate risk.

- Utilize Technical Analysis (Optional): Tools like Bollinger Bands and other technical indicators can help you understand price movements and volatility, but they are not foolproof predictors of future price action.

- Look for Buying Opportunities (Potentially): Price dips can sometimes present buying opportunities for long-term investors who believe in the asset’s potential. However, conduct thorough research and assess your own risk tolerance before making any investment decisions.

In Conclusion: Solana’s Price Dip – A Moment for Observation and Informed Decisions

Solana’s recent price decline is a reminder of the dynamic and often unpredictable nature of the cryptocurrency market. While the 9% drop over the past week and the 4.89% dip in the last 24 hours might be concerning, it’s essential to analyze the situation within a broader context. Factors like market volatility, trading volume, circulating supply, and overall market sentiment all play a role.

For investors, this period presents an opportunity to observe, learn, and make informed decisions. By staying informed, understanding market dynamics, and considering both short-term fluctuations and long-term potential, you can navigate the exciting world of crypto investments with greater confidence. Remember, in the crypto space, volatility is part of the journey, and informed decisions are your best compass.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.