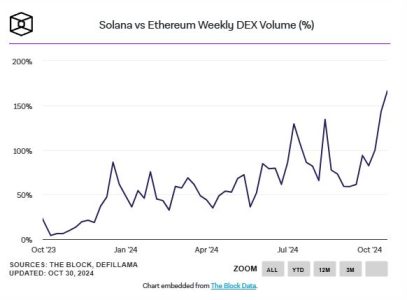

Solana DEX Weekly Volume Reaches 168% of Ethereum’s Mainnet

In a remarkable display of growth within the decentralized finance (DeFi) sector, Solana’s decentralized exchange (DEX) has achieved a weekly trading volume that is 168% of Ethereum’s mainnet volume, as reported by The Block. This substantial increase marks a significant leap from the 48.85% share observed at the beginning of the year. The surge is primarily attributed to the rapid market share expansion of Raydium (RAY), a leading automated market maker (AMM) on the Solana network.

Introduction to Solana’s DEX Performance

Overview of Solana and Its Ecosystem

Solana is renowned for its high-performance blockchain, capable of handling thousands of transactions per second with low latency and minimal fees. This scalability makes Solana an attractive platform for decentralized applications (dApps) and DeFi projects seeking efficiency and speed. The Solana ecosystem has grown rapidly, encompassing a wide range of projects, including DEXs, lending platforms, and NFT marketplaces.

Solana DEX vs. Ethereum Mainnet

While Ethereum remains the dominant platform for DeFi applications, Solana’s DEX performance showcases its potential to compete effectively in the DeFi space. Achieving 168% of Ethereum’s mainnet volume within a single week highlights Solana’s increasing adoption and the shifting dynamics of decentralized trading.

Factors Driving Solana DEX’s Significant Growth

Raydium’s Market Share Expansion

A pivotal factor behind Solana DEX’s impressive volume surge is the rapid increase in Raydium (RAY)‘s market share. In October, Raydium captured 18.4% of the DEX market, a substantial rise from 7.6% in January. This growth can be attributed to several strategic initiatives:

- Enhanced Liquidity Pools: Raydium has consistently expanded and optimized its liquidity pools, attracting more traders and liquidity providers.

- Innovative Features: Introduction of new trading pairs, yield farming opportunities, and integration with other Solana-based projects have boosted user engagement.

- User Experience Improvements: Continuous upgrades to the platform’s interface and performance have made trading more seamless and attractive to users.

Increased Adoption of Solana-Based DeFi Projects

Beyond Raydium, the broader adoption of Solana-based DeFi projects has contributed to the overall increase in DEX volume. Projects offering lending, borrowing, and yield optimization have attracted significant investment, enhancing the liquidity and trading activity on Solana’s DEXs.

Competitive Advantage of Solana’s Technology

Solana’s technological edge, characterized by its high throughput and low transaction costs, provides a competitive advantage over Ethereum, especially during periods of high network congestion and elevated gas fees on Ethereum. This advantage has made Solana an attractive alternative for traders seeking efficient and cost-effective trading solutions.

Implications for the DeFi and Cryptocurrency Markets

Shifting Market Dynamics

Solana DEX’s outperformance relative to Ethereum’s mainnet signals a potential shift in market dynamics within the DeFi ecosystem. As Solana continues to attract more users and projects, it could challenge Ethereum’s dominance, leading to a more diversified and competitive DeFi landscape.

Enhanced Liquidity and Market Stability

The increase in trading volume and liquidity on Solana DEXs contributes to greater market stability. Higher liquidity reduces price slippage and enhances the overall trading experience, making decentralized exchanges more viable for large-scale transactions.

Attraction of Institutional Investors

Solana’s robust performance and growing DeFi ecosystem may attract institutional investors looking for scalable and efficient blockchain solutions. Institutional interest can further bolster Solana’s market position and drive sustained growth in the DeFi sector.

Expert Opinions

Dr. Emily Carter, Blockchain Analyst

“The surge in Solana DEX volume, driven by Raydium’s market share expansion, underscores Solana’s potential to rival Ethereum in the DeFi space. Solana’s technological capabilities provide a strong foundation for sustained growth and innovation within decentralized exchanges.”

Mark Thompson, Financial Strategist

“Solana’s impressive performance relative to Ethereum highlights the evolving nature of the DeFi market. As more projects leverage Solana’s high-performance network, we can expect increased competition and further advancements in decentralized trading solutions.”

Sarah Lee, Cryptocurrency Researcher

“The rapid growth of Raydium and Solana’s DEX volume demonstrates the importance of scalability and user experience in driving DeFi adoption. Solana is well-positioned to capitalize on these factors, potentially reshaping the DeFi ecosystem in the coming years.”

Future Outlook

Continued Growth of Solana DEXs

With the current trajectory, Solana DEXs are poised for continued growth. Ongoing improvements in technology, strategic partnerships, and the launch of new DeFi projects will likely sustain and enhance trading volumes.

Expansion of DeFi Offerings

Solana’s DeFi ecosystem is expected to expand, with more projects introducing innovative financial products and services. This expansion will attract a broader user base, increasing demand for decentralized trading and lending platforms.

Regulatory Developments

As DeFi platforms like Solana’s DEXs grow, they may attract increased regulatory attention. Navigating these regulatory landscapes will be crucial for sustaining growth and ensuring compliance within the evolving legal frameworks governing decentralized finance.

Potential Collaboration with Ethereum

While Solana competes with Ethereum, there is also potential for collaboration and interoperability between the two ecosystems. Cross-chain solutions and partnerships could enhance the functionality and reach of both platforms, benefiting the broader cryptocurrency market.

Conclusion

The Solana DEX’s achievement of reaching 168% of Ethereum’s mainnet weekly volume is a testament to Solana’s growing influence and the effectiveness of its DeFi initiatives, particularly the rapid market share expansion of Raydium (RAY). This milestone not only highlights Solana’s competitive edge in the DeFi space but also signals a potential shift in the dynamics of decentralized trading.

As Solana continues to enhance its DeFi ecosystem through technological advancements and strategic partnerships, its DEX platforms are well-positioned to attract more users and liquidity, fostering a more robust and competitive DeFi market. The ongoing success of Solana DEXs underscores the importance of scalability, liquidity, and user experience in driving the adoption and growth of decentralized financial systems.

To stay updated on the latest developments in decentralized exchanges and blockchain innovations, explore our article on latest news, where we cover significant events and their impact on the digital asset ecosystem.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.