The crypto market can be a rollercoaster, and Solana (SOL) holders recently experienced a significant dip. Over the past few days, Solana’s price took a sharp turn downwards, leading to a massive shakeout in the futures market. Let’s dive into what happened with Solana’s open interest and why it matters.

What Triggered the Solana Price Drop?

Starting around April 12th, Solana (SOL) began experiencing a significant price correction. The price tumbled from approximately $172 down to $117 within just two days – a dramatic 30% decrease! This rapid price drop sent shockwaves through the market and triggered a cascade of liquidations, particularly for traders who had bet on Solana’s price going up (known as ‘long’ positions).

The Open Interest Plunge: What Does It Mean?

Open Interest (OI) is a crucial metric in the crypto futures market. Think of it as the total amount of money currently invested in outstanding futures contracts for an asset like Solana. A rising OI generally suggests increasing interest and activity in the market, while a declining OI can indicate traders are closing positions and market momentum is shifting.

In Solana’s case, the price downturn directly impacted its Open Interest. According to data from CoinGlass, Solana’s OI experienced a sharp decline, falling by roughly 21% in just 24 hours. Let’s break down the key numbers:

- Peak OI (April 12th): Before the downturn, Solana’s Open Interest was robust, indicating strong market participation.

- OI on April 14th: After the price crash, Solana’s OI stood at $1.62 billion.

- Liquidation Impact: This decline coincided with over $85 million worth of long positions being liquidated.

Essentially, as Solana’s price fell, traders who had borrowed funds to bet on price increases were forced to close their positions (liquidate) to prevent further losses. This mass liquidation further contributed to the OI decline.

Solana Open Interest: A Snapshot of the Downturn

To visualize the impact, consider this:

| Date | Solana Price (Approx.) | Open Interest (Approx.) | Key Event |

|---|---|---|---|

| April 12th | $172 | High (Specific Value Not Provided) | Price Downturn Begins |

| April 14th | $117 | $1.62 Billion | OI Down 21%, $85M+ Longs Liquidated |

| Current (Post-Downturn) | $134.648 | $2.04 Billion | Price Recovery & OI Rebound |

Source: Data from CoinGlass & Coinstats

Wider Market Trend: Is Solana Alone?

Interestingly, Solana wasn’t the only cryptocurrency experiencing these pressures. The broader crypto market witnessed a downturn, with several top cryptocurrencies showing similar declines. Let’s take a look at how some other major players fared:

- XRP: Experienced the most significant drop among the top 10, with a 12.12% decrease in 24 hours.

- Dogecoin (DOGE): Followed closely with a 10.86% decline.

- Cardano (ADA): Also saw a substantial decrease of 10.20%.

This widespread downturn suggests broader market factors at play, potentially influencing investor sentiment and trading activity across the board.

Network Congestion: Adding Fuel to the Fire?

Adding to Solana’s woes, these price fluctuations occurred amidst ongoing network congestion issues. Earlier in April, specifically around April 9th, Solana’s blockchain faced intermittent congestion. This led to:

- Transaction Delays: Users reported slower transaction processing times and increased errors.

- Project Launch Postponements: Several crypto projects planning to launch on Solana had to delay their timelines due to the network instability.

- User Concerns: Growing frustration among Solana users regarding network reliability.

Solana developers are actively working to address these technical challenges, aiming for a resolution by April 15th. Whether these network issues directly contributed to the price downturn is debatable, but they certainly didn’t help investor confidence and may have exacerbated selling pressure.

Silver Linings? Solana’s Rebound and Future Outlook

Despite the recent turbulence, there are signs of resilience. As of now, Solana’s price has shown signs of recovery, climbing back to around $134.648 – a 12% increase in the past 24 hours! Correspondingly, the Open Interest has also seen a slight rebound, reaching $2.04 billion. This suggests that some traders are seeing the dip as a buying opportunity and are re-entering the market.

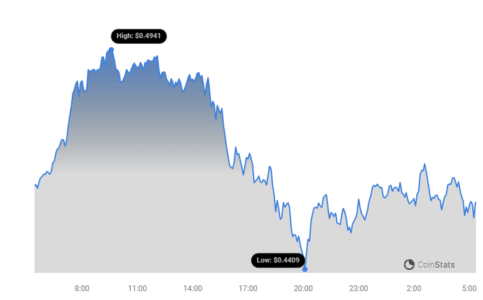

To track Solana’s price movements in real-time, you can refer to resources like Coinstats.

Key Takeaways: Navigating Crypto Volatility

- Volatility is Inherent: The crypto market is known for its volatility. Solana’s recent price swing is a stark reminder of this.

- Open Interest Matters: Monitoring Open Interest can provide insights into market sentiment and potential shifts in momentum.

- Network Health is Crucial: For blockchain platforms like Solana, network stability and performance are vital for user trust and project development.

- Market Interconnectedness: Crypto markets are often correlated. Downturns can affect multiple assets simultaneously.

While the recent Solana price drop and Open Interest decline were significant events, the subsequent price recovery and OI rebound indicate the dynamic nature of the crypto market. It remains to be seen how Solana will navigate its network challenges and market fluctuations in the long run.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

#Binance #WRITE2EARN

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.