Solana (SOL) has had a wild ride lately! After soaring to new heights in recent weeks, it seems to be coming back down to Earth. What’s causing this shift? Well, some significant movements from FTX-linked addresses might be playing a role. Let’s dive into what’s happening and what it means for Solana.

Solana’s Recent Price Dip: What’s Going On?

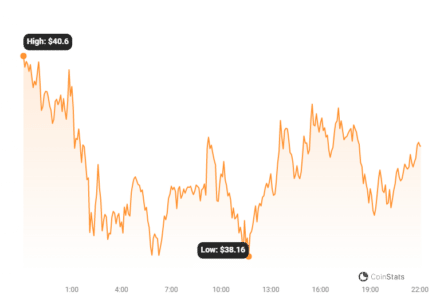

- Price Drop: SOL is down over 6% in the last 24 hours, currently trading around $39.82 (according to CoinGecko).

- FTX Factor: This dip coincides with large SOL transfers from FTX-linked addresses, as revealed by Solscan.

- Liquidation Plan: Remember the court-approved liquidation of $3.4 billion in crypto assets from the FTX estate (including $1.16 billion in SOL)? That’s still in play, with a weekly cap of $100 million, which is likely to keep downward pressure on SOL.

The FTX Estate and Solana: A Closer Look

The FTX estate’s liquidation plan, approved in September, allows them to sell off a substantial amount of crypto, including a significant chunk of SOL. This ongoing process is creating some uncertainty in the market.

Approximately $10.31 million SOL has been liquidated in the last 24 hours. More over $7 million of that total came from leveraged-long traders.

Where is the SOL Going? Binance and Kraken Involved

Data from Solscan shows that “FTX Cold Storage #2” transferred over 250,000 SOL tokens (worth around $9.8 million) to Kraken. These transactions were routed through an intermediate address.

That same intermediate address also sent over 300,000 SOL tokens to addresses linked to Binance, according to Breadcrumbs.

The identity of the owner of the intermediate address is currently unknown. Its first on-chain contact was 10 days ago, when it received almost 158,000 SOL from FTX Cold Storage #2.

Other Market Movements

- Overall Picture: Despite the recent dip, Solana is still up by a staggering 23.9% in the last week, outperforming most other top cryptocurrencies.

- FTX Activity: The FTX estate has been actively selling and staking assets, including investing $122 million in SOL and $5 million in ETH.

- Broader Market: Bitcoin and Ethereum are also down by almost 2%, while other notable losers include CoinFlux’s token and PEPE.

Read Also: Bitcoin Magazine Faces Lawsuit Threat From US Federal Reserve Over Parody Apparel

Key Takeaways and What’s Next

- FTX Influence: The FTX estate’s liquidation continues to impact Solana’s price.

- Exchange Activity: Large SOL transfers to major exchanges like Binance and Kraken are worth watching.

- Market Sentiment: While there’s a current dip, Solana has shown strong performance recently.

It’s crucial to stay informed and do your own research before making any investment decisions. Keep an eye on the FTX estate’s activities, exchange movements, and overall market trends to navigate the ever-changing crypto landscape.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.