Are institutional investors finally warming up to crypto again? Recent data suggests a resounding YES! And guess which cryptocurrency is stealing the spotlight? It’s none other than Solana! Buckle up, because the Solana network is witnessing a surge of institutional interest like never before.

Solana’s Institutional Influx: A Record-Breaking Week

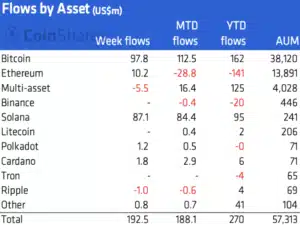

According to a recent report by CoinShares, a leading digital asset management firm, Solana-based institutional investment products experienced an unprecedented inflow of $87 million in just one week. Yes, you read that right – $87 million! This monumental figure isn’t just a flash in the pan; it signifies a significant shift in institutional sentiment towards Solana and the broader crypto market.

This massive injection of capital propels Solana to the seventh position in the cryptocurrency popularity contest among institutional investors, boasting a total of $241 million in assets under management (AUM). To put this into perspective, Solana is now rubbing shoulders with crypto giants, indicating its growing acceptance and potential in the eyes of big players.

Bitcoin Still Leads, But Solana is Gaining Ground

While Solana’s surge is remarkable, Bitcoin continues to reign supreme in the institutional investment arena. Bitcoin funds absorbed a substantial $98 million in inflows, capturing the lion’s share of investment capital. This reaffirms Bitcoin’s position as the king of crypto, trusted and favored by institutional investors seeking exposure to the digital asset class.

Here’s a quick breakdown of how other cryptocurrencies fared in terms of institutional inflows last week:

- Bitcoin: $98 million

- Solana: $87 million

- Ethereum: $10.2 million

- Cardano: $1.8 million

- Polkadot: $1.2 million

Ethereum-linked investment products secured the third spot with a respectable $10.2 million in inflows, while Cardano and Polkadot funds attracted $1.8 million and $1.2 million, respectively. These figures highlight a diversified interest in various cryptocurrencies beyond just Bitcoin, suggesting a broadening institutional appetite for the crypto space.

Crypto Market Sentiment Shift: From Outflows to Inflows

The bigger picture reveals an even more encouraging trend. Last week witnessed a total of $193 million pumped into cryptocurrency funds across the board. This is the most significant weekly inflow since mid-December, signaling a potential turning point in market sentiment.

Consider this: just the week before, crypto funds experienced outflows of $47 million. This dramatic reversal to a $193 million inflow underscores a substantial restoration of faith in the cryptocurrency market by institutional investors. After months of a downward trend and market uncertainty, this influx could be a crucial indicator of a market recovery and renewed bullish momentum.

Interestingly, amidst this wave of positive inflows, Ripple (XRP) was the only cryptocurrency to experience negative sentiment. Funds linked to XRP saw $1 million in outflows. This could be attributed to ongoing regulatory uncertainties surrounding Ripple, making institutional investors cautious about allocating capital to XRP-related products.

Geographical Breakdown: Europe Leads the Charge

Where is all this institutional money coming from? Europe is taking the lead, accounting for a whopping 76 percent of the total inflows. While the report mentions that a significant portion of the remaining funds originated from American sources, the dominance of European investment suggests a potentially more favorable regulatory environment or a stronger institutional adoption of crypto in Europe compared to other regions.

Grayscale Dominates Total Crypto AUM

Currently, the total amount of cryptocurrency under management stands at $57 billion. A significant portion of this massive figure is managed by Grayscale, the world’s largest digital asset manager. Grayscale’s dominance highlights its pivotal role in facilitating institutional access to the cryptocurrency market and its influence on overall market trends.

Blockchain Equities Ride the Wave

The positive sentiment isn’t limited to cryptocurrencies alone. Blockchain-related equities also benefited, experiencing $23 million in inflows during the same period. This indicates a broader institutional interest in the entire blockchain ecosystem, encompassing both digital assets and companies operating in the space.

Bitcoin’s Price Surge and Market Recovery

Adding fuel to the fire, Bitcoin’s price recently achieved a multi-month high of $48,000. This price surge, coupled with the substantial institutional inflows, paints a picture of a cryptocurrency sector on the mend. The increased institutional participation not only validates the long-term potential of cryptocurrencies but also injects much-needed liquidity and stability into the market.

What Does This Mean for Solana and the Crypto Market?

Solana’s remarkable institutional inflow is a testament to its growing prominence and potential. Here’s what this surge could signify:

- Increased Network Adoption: Institutional investment often translates to increased adoption and utilization of the Solana network, particularly in DeFi and other applications.

- Price Appreciation: Higher institutional demand can drive up the price of Solana (SOL), benefiting existing holders and attracting new investors.

- Market Validation: Institutional interest provides further validation for Solana as a viable and promising blockchain platform, solidifying its position in the crypto ecosystem.

- Development and Innovation: Increased capital can fuel further development and innovation within the Solana ecosystem, leading to new features, applications, and improvements.

For the broader crypto market, the resurgence of institutional inflows is a welcome sign. It suggests that:

- Market Bottom May Be In: The significant inflows could indicate that institutional investors believe the market has bottomed out and are positioning themselves for future growth.

- Renewed Bullish Momentum: Increased institutional participation can inject bullish momentum into the market, potentially leading to a sustained recovery and price appreciation across various cryptocurrencies.

- Mainstream Adoption: Growing institutional involvement is a crucial step towards mainstream adoption of cryptocurrencies as a legitimate asset class.

Conclusion: A Bright Future for Solana and Crypto?

Solana’s record-breaking $87 million institutional inflow is a watershed moment, highlighting its growing appeal and potential within the crypto landscape. Coupled with the broader market trend of positive institutional inflows and Bitcoin’s price recovery, the signs are increasingly pointing towards a revitalized cryptocurrency market. While challenges and volatility are inherent in the crypto space, the renewed faith from institutional investors offers a strong foundation for future growth and innovation. Keep a close watch on Solana and the institutional investment trends – they could be key indicators of the next chapter in the crypto revolution!

Related Posts – XRP Price Goes Up After Unexpected Reappearance On Coinbase

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.