Buckle up, crypto enthusiasts! While Bitcoin has been taking a breather, Solana (SOL) has decided to steal the spotlight. Over the past day, SOL has exploded with a rally exceeding 14%, injecting a fresh dose of excitement into the altcoin market. But before you jump on the bandwagon, there’s a twist in the tale – large whale transactions are hinting at a possible change in tide. Could these big players be preparing to cash out, potentially putting a damper on Solana’s impressive climb?

Solana’s Stellar Surge: What’s Fueling the Rally?

In a market often dictated by Bitcoin’s moves, Solana has broken free, showcasing impressive bullish momentum. While the king of crypto has been consolidating, SOL has been busy carving its own path upwards. This surge is significant, placing Solana among the top-performing cryptocurrencies in the top 30 by market capitalization.

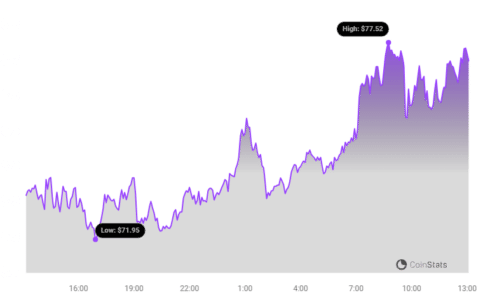

Let’s take a closer look at the numbers:

- Double-Digit Gains: Solana has rallied over 14% in the last 24 hours.

- Reaching New Heights: This rally has propelled SOL to levels around $77.52, a price point not seen since early May.

- Outperforming the Giants: SOL’s performance surpasses many of its peers, standing as the second strongest performer in the top 30 crypto list, only trailing behind Cardano (ADA).

- Closing in on XRP: Solana is rapidly narrowing the gap with XRP in market capitalization rankings. Continued momentum could even see SOL overtake XRP to claim the coveted fifth spot among the largest cryptocurrencies.

This robust rally naturally leads to the question: Is this sustainable, or is there a potential speed bump ahead?

See Also: Sales Of Solana Saga Smartphone Fell Short Of Expectations

Whale Watch: Are Big Players Signaling a Potential Pullback?

Rallies often tempt investors to take profits, and it appears some large holders, commonly known as whales, might be doing just that. Blockchain data reveals significant movements of SOL tokens to cryptocurrency exchanges, hinting at potential selling pressure.

Key Whale Activity Highlights:

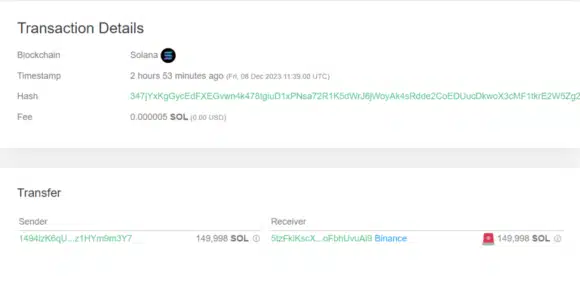

- Large Inflows: Over 300,000 SOL have been deposited into exchanges within the last 24 hours, according to Whale Alert data.

- Two Major Transactions: This inflow is attributed to two substantial transactions, each involving 150,000 SOL.

- Multi-Million Dollar Moves: Each transaction of 150,000 SOL is valued at approximately $10.2 million (at the time of transaction), indicating high-value transfers by significant holders.

- Binance Destination: At least one of these massive transfers was directed to wallets associated with the leading cryptocurrency exchange, Binance.

Why do these whale movements matter? Depositing crypto to exchanges is often a precursor to selling. Given the timing of these large SOL deposits coinciding with the price rally, profit-taking seems like a plausible motive.

See Also: Robinhood Launches A Commission-free Crypto Trading App

Interestingly, both whale transactions originated from and went to the same set of addresses, suggesting a single whale entity orchestrated these moves. If this major holder intends to sell a significant portion of their SOL holdings, it could introduce considerable selling pressure, potentially curbing the ongoing rally or even triggering a price correction.

What Does This Mean for Solana’s Price Trajectory?

Solana’s recent price surge is undoubtedly a positive sign, reflecting growing interest and potentially strong fundamentals. However, the concurrent whale activity presents a cautionary note. Here’s a balanced perspective:

Potential Bullish Factors:

- Altcoin Season: Solana’s rally could be part of a broader altcoin season, where investors diversify from Bitcoin into other cryptocurrencies.

- Network Growth: Positive developments within the Solana ecosystem, such as increased adoption, new projects, or technological upgrades, could be driving demand.

- Market Sentiment: Overall positive sentiment in the crypto market can lift all boats, including Solana.

Potential Bearish Factors:

- Whale Sell-off: Large-scale selling by whales can create significant downward pressure on price.

- Profit-Taking: As SOL reaches higher prices, more investors may be tempted to secure profits, increasing selling pressure.

- Market Correction: The crypto market is known for volatility. A broader market correction could impact Solana, regardless of its individual momentum.

The Takeaway: Ride the Wave, But Watch the Horizon

Solana’s impressive rally is certainly something to celebrate for SOL holders. The cryptocurrency is demonstrating strength and outperforming many of its competitors. However, the significant whale deposits onto exchanges cannot be ignored. These movements suggest a potential for increased selling pressure, which could temper the current bullish momentum.

As an investor or enthusiast, it’s crucial to stay informed and monitor both the positive price action and the potential headwinds indicated by whale activity. Keep an eye on on-chain data, market sentiment, and overall crypto trends to make informed decisions. The Solana story is still unfolding, and while the rally is exciting, navigating the crypto waters requires vigilance and a balanced perspective.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.