Hold onto your hats, crypto enthusiasts! If you thought Solana (SOL) was going to stay in sideways trading territory for the rest of 2023, think again. Bucking all expectations, Solana has unleashed a powerful rally, surging to levels we haven’t seen in over a year. Yes, you read that right – Solana is trading above the crucial $40 mark, and it’s showing no signs of slowing down. Let’s dive into what’s fueling this impressive surge and what it means for the future of SOL.

Solana Price Breaks $42: What’s Igniting This Bullish Fire?

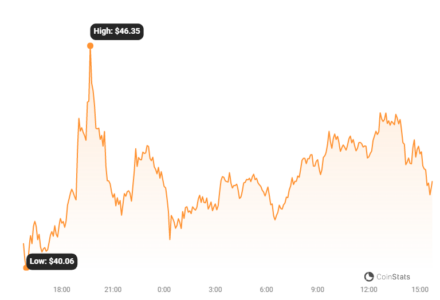

As of now, SOL is trading at a robust $42.52. That’s not just a number; it’s the highest peak Solana has reached since August 17, 2022. Take a look at this chart to visualize the momentum:

This price surge isn’t just a blip. Solana has decisively broken through significant resistance levels and is confidently trading above key Exponential Moving Averages (EMAs) for four consecutive days of bullish closes. The market is taking notice, and the trading volume speaks volumes. On Wednesday alone, SOL’s trading volume exploded by a staggering 155%, hitting a massive $3.8 billion according to CoinMarketCap. This puts Solana in the big leagues, now ranking fifth globally in cryptocurrency trading activity, even surpassing established giants like XRP (XRP) and Chainlink (LINK). So, what’s the secret sauce behind this impressive performance?

Key Catalysts Fueling Solana’s Ascent

Several factors are converging to create this perfect storm for Solana. Let’s break down the key drivers:

- Institutional Investment is Flowing In: Last week saw a substantial $24 million net inflow into investment funds specifically focused on Solana. This influx of institutional capital signals strong confidence in Solana’s potential and is a major bullish indicator.

- Portfolio Diversification: Smart investors are always looking for the next big opportunity. As portfolios diversify across the crypto landscape, Solana is emerging as a top contender for new capital allocation. Its strong technology and growing ecosystem are attracting attention beyond just the usual suspects.

- Strategic Partnerships are Elevating Solana’s Standing: Solana’s recent alliance with the Dubai Multi Commodities Centre is a game-changer. This partnership not only boosts Solana’s credibility but also opens doors to new opportunities and integrations within a significant global hub.

- Year-to-Date Performance is Undeniable: Let’s face it, numbers don’t lie. SOL holders are sitting on impressive gains, with the token up a whopping 332% year-to-date. This kind of performance attracts further investment and reinforces the bullish narrative.

Read Also: Bitcoin Surges 25% in 2 Weeks- Is This the Beginning of Bull Run?

Firedancer Testnet Launch: A New Era for Solana?

But perhaps the most significant catalyst of all is the launch of Solana’s highly anticipated scaling solution, Firedancer, on the testnet this week. What exactly is Firedancer, and why is it such a big deal?

Firedancer: Unleashing Solana’s True Potential

Firedancer is designed to address one of Solana’s key challenges: network congestion and occasional outages. It promises to be a permanent solution by:

- Boosting Speed: Firedancer aims to dramatically increase Solana’s transaction processing speed, making it even faster and more efficient.

- Enhancing Dependability: By improving network architecture, Firedancer is set to make Solana more reliable and less prone to disruptions.

- Increasing Validator Diversity: Firedancer seeks to strengthen the network by promoting a more diverse and robust validator ecosystem.

The successful launch of the Firedancer testnet has injected a fresh wave of optimism into the Solana community. Investors are now seeing Solana as a truly scalable, reliable, and secure platform, solidifying its position as a leading contender in the blockchain space.

Could Solana Overtake Ethereum?

The renewed confidence in Solana’s technology has led some to believe that it could become an even stronger rival to Ethereum. Could Solana actually challenge, or even surpass, Ethereum’s market share in the coming months? While it’s a bold prediction, the momentum is certainly building. Firedancer could be the key to unlocking Solana’s full potential and attracting even more developers and users to its ecosystem.

Navigating Potential Headwinds: The FTX Factor

However, it’s not all smooth sailing. Despite the bullish momentum, there’s a potential headwind to be aware of. Recently, over $56 million worth of SOL tokens linked to FTX wallets were unstaked and moved to major exchanges like Coinbase and Binance. This has introduced a degree of caution into the market.

Will FTX-Linked SOL Trigger Selling Pressure?

The concern is that if these FTX-related tokens are liquidated, it could create significant selling pressure on SOL, potentially dampening the current rally. Traders are understandably watching this situation closely. While the underlying bullish sentiment remains strong, this FTX factor is a reminder that the crypto market can be volatile, and vigilance is always key.

Final Thoughts: Is Solana Poised for Continued Growth?

Despite the potential FTX-related selling pressure, the overall outlook for Solana remains overwhelmingly positive. Investor optimism is soaring, driven by strong fundamentals, strategic partnerships, and the game-changing Firedancer upgrade. Solana is undoubtedly one of the top performing cryptocurrencies this week, and many believe this is just the beginning of a sustained bull run. Keep a close eye on Solana – it’s a project with serious momentum and the potential to reshape the future of blockchain technology.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.