After an exhilarating climb to new heights, even the most robust climbers need to pause and catch their breath. That’s precisely what Solana (SOL) is doing right now in the crypto market. Following a phenomenal year, marked by a staggering 956% rally, Solana is currently experiencing a price correction. But is this a cause for alarm, or simply a natural breather before another leap forward? Let’s dive into the details.

Solana’s Price Adjustment: What’s Happening?

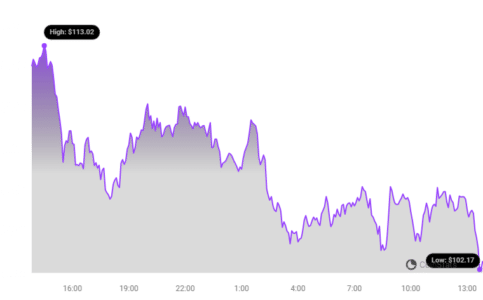

Solana, the blockchain sensation known for its speed and scalability, has seen its price adjust after a remarkable December surge. Currently, Solana is trading around $102.59. This reflects a 5.53% dip in the last 24 hours. While a price drop might initially raise eyebrows, especially in the volatile crypto world, it’s crucial to view this in context.

The trading volume for Solana has also seen a decrease, falling by over 22% to $4.36 billion. This reduction in trading activity often accompanies price corrections as the market recalibrates and investors assess their positions.

A Year of Unprecedented Growth: Putting the Correction in Perspective

To truly understand the current correction, we need to look at the bigger picture. Solana began the year at a modest $8.14. From this starting point, it embarked on an incredible journey, soaring by 956% throughout the year. To put this into perspective, even Bitcoin, the king of cryptocurrencies, experienced a commendable but comparatively smaller growth of 159% during the same period.

This meteoric rise of Solana was fueled by several factors, including:

- Technological Advancements: Solana’s blockchain boasts incredibly fast transaction speeds and lower fees compared to some of its competitors, making it attractive for developers and users alike.

- Growing Ecosystem: The Solana ecosystem has witnessed explosive growth in decentralized applications (dApps), particularly in the realms of NFTs and Decentralized Exchanges (DEXs).

- Increased Adoption: More and more projects and communities are choosing to build on Solana, further solidifying its position in the crypto space.

Is This Correction a Cause for Concern or a Healthy Market Adjustment?

For many seasoned investors, the current price correction is viewed as a natural and even healthy part of the market cycle. After such a significant and rapid ascent, a pullback is often expected and can be beneficial for the long-term sustainability of the asset. Think of it like this: trees don’t grow to the sky in a straight line; they have branches and bends, and these variations make them stronger.

Several factors suggest this correction is more of a healthy adjustment:

- Profit Taking: With the year-end approaching, it’s common for traders to take profits, especially after substantial gains. This selling pressure can naturally lead to a price decrease.

- Market Consolidation: Corrections allow the market to consolidate and digest previous gains. This period of consolidation can set the stage for future growth as it removes some of the froth and speculation.

- Normal Market Fluctuations: Cryptocurrency markets are inherently volatile. Price corrections are a regular occurrence and are part of the ebb and flow of the market.

See Also: New Solana Memecoin, Silly Dragon (SILLY), Reaches 300% Weekly Rise

What About the Solana Ecosystem?

The broader Solana ecosystem, which has been a significant driver of its growth, is also experiencing a period of slowdown. While Solana has been lauded for outperforming Ethereum in areas like NFT sales and DEX trading volume in certain periods, even this vibrant ecosystem is seeing a cooling-off phase.

Meme coins built on Solana, which experienced explosive growth and hype recently, are also seeing their prices moderate. This is again, often a natural cycle in the crypto market, where periods of intense speculation are followed by a settling down.

Will Solana Bounce Back?

Despite the current correction, there’s a prevailing sentiment of optimism regarding Solana’s future. The crypto community has witnessed Solana’s resilience in the past, with the blockchain demonstrating a capacity to recover from price dips and continue its growth trajectory.

Key factors supporting this positive outlook include:

- Strong Fundamentals: Solana’s underlying technology and its advantages in speed and scalability remain strong.

- Active Development: The Solana developer community is vibrant and continuously working on improving and expanding the ecosystem.

- Growing Adoption: Long-term adoption trends for Solana are still positive, with increasing interest from various sectors.

Final Thoughts

Solana’s current price correction appears to be a healthy and expected adjustment after a year of extraordinary growth. While price dips can be unsettling, especially in the fast-paced world of crypto, it’s crucial to maintain perspective and consider the long-term potential. The market is cyclical, and corrections are often necessary steps on the path to sustained growth. For Solana, with its strong fundamentals and thriving ecosystem, this correction might just be the pause before its next surge.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.