Hold onto your hats, crypto enthusiasts! Solana (SOL) is making waves again, kicking off the week with a powerful surge that has broken through key resistance levels. If you’ve been watching the market, you’ll know SOL has been on a tear, and this week is no different. Let’s dive into what’s fueling this impressive climb and what it means for Solana moving forward.

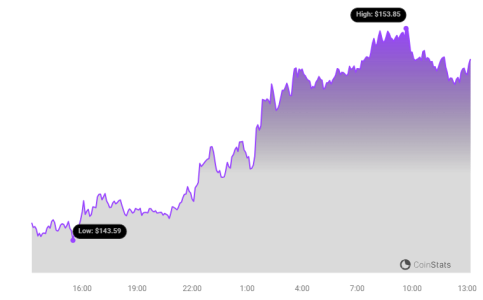

According to Coinstats, Solana’s price decisively smashed through the $145 resistance mark and didn’t stop there, blasting past the psychological $150 barrier to reach a peak of $154. Take a look at this chart to visualize the impressive move:

As of now, SOL is trading around $152, showcasing a solid 4.3% increase over the last 24 hours and a notable 9% jump over the past week. This bullish momentum has investors and analysts alike wondering – what’s next for Solana?

Where is Solana Headed Next? Key Resistance and Support Levels to Watch

For traders and investors, understanding key price levels is crucial. Currently, the immediate focus is on the next significant resistance level, which is anticipated to be around $155. Let’s break down what this means:

- Breaking $155 Resistance: If Solana can successfully close above $155, it could signal a strong continuation of the upward trend. This breakthrough could pave the way for another leg up in its price journey.

- Next Target: $165: Should SOL overcome the $155 hurdle, the next key resistance level to watch out for is near $165. A move past this point would further solidify the bullish outlook.

- Potential High: $170+: With sustained momentum, analysts suggest that Solana could potentially push even higher, targeting levels above $170. This would mark a significant milestone for SOL and reinforce its strong market position.

However, the crypto market is known for its volatility. What happens if the bullish momentum stalls?

- Holding $152 Support: The immediate support level to watch is around $152. It’s crucial for Solana to hold above this level to maintain its current gains and prevent a significant pullback.

- Downside Correction: If SOL fails to maintain above $152, we could see a downward correction.

- Next Support: $150 and $147: The next support levels to consider are at $150 and then $147. These levels could act as cushions if selling pressure increases.

To summarize these key levels, here’s a quick table:

| Scenario | Key Level | Potential Outcome |

|---|---|---|

| Bullish Breakout | $155 Resistance | Potential advance towards $165 and beyond |

| Immediate Support | $152 Support | Crucial level to hold for continued gains |

| Downside Support 1 | $150 Support | First level of defense against correction |

| Downside Support 2 | $147 Support | Stronger support level in case of deeper pullback |

What’s Fueling Solana’s Ascent? Exploring the Catalysts

So, what’s behind this impressive price action? Several factors could be at play, contributing to Solana’s recent surge:

1. FTX Bankruptcy and Potential Buying Pressure

Interestingly, the ongoing FTX bankruptcy saga might be indirectly benefiting Solana. As FTX prepares to redistribute a substantial $16 billion to its creditors, market experts are predicting a surge in buying pressure for major cryptocurrencies like Bitcoin and Solana. Why Solana specifically?

During its peak, FTX and Alameda Research were significant holders of SOL tokens. The redistribution could mean that creditors, receiving funds, might reinvest a portion back into assets they are familiar with, including SOL. This potential influx of capital could be contributing to the increased demand and price appreciation.

2. The Solana ETF Buzz: Hype or Reality?

The prospect of a Solana Exchange Traded Fund (ETF) is another factor generating excitement within the community. Following the approval of Bitcoin ETFs and the anticipation surrounding Ethereum ETFs, the crypto world is speculating about which cryptocurrency might be next in line. Solana, with its growing ecosystem and market presence, is naturally a contender.

However, it’s important to temper expectations. Gracie Chen, CEO of Bitget, offers a more cautious perspective. While acknowledging the enthusiasm, Chen believes that the U.S. Securities and Exchange Commission (SEC) might be hesitant to approve more crypto ETFs beyond Ethereum in 2024. Therefore, while a Solana ETF could be a future catalyst, it might not be an immediate driver for the current price surge.

3. Solana’s Technological Strengths: A Long-Term Appeal

Beyond short-term market dynamics, Solana’s inherent technological advantages continue to make it an attractive platform. Its core features are compelling:

- High Transaction Speed: Solana is renowned for its incredibly fast transaction processing capabilities, significantly outperforming many other blockchains.

- Low Transaction Fees: Coupled with speed, Solana offers remarkably low transaction fees, making it highly cost-effective for users and developers.

These technical strengths make Solana a preferred choice for a wide range of applications, from decentralized finance (DeFi) and non-fungible tokens (NFTs) to general-purpose transactions. This underlying utility and adoption are crucial for long-term value appreciation.

4. Robust Network Activity: Signs of a Thriving Ecosystem

On-chain metrics further reinforce Solana’s positive trajectory. The network is demonstrating strong and consistent activity:

- High Daily Transactions: Solana consistently processes over 100,000 transactions daily.

- Strong User Demand: This high transaction volume is a clear indicator of robust demand for the Solana platform and its applications.

- User Confidence: Sustained network activity reflects ongoing user confidence in Solana’s technology and its potential for future growth.

This vibrant ecosystem and user engagement provide a solid foundation for Solana’s continued expansion and potentially further price appreciation.

Conclusion: Is Solana’s Rally Sustainable?

Solana’s recent price surge above $150 is undoubtedly capturing attention and generating excitement. Fueled by a combination of potential FTX-related buying pressure, ETF speculation, and its robust technology and network activity, Solana is demonstrating significant momentum.

While the short-term price action is bullish, it’s crucial to remember the inherent volatility of the crypto market. Monitoring key resistance and support levels, as outlined earlier, will be essential for traders and investors. Whether Solana can sustain this rally and extend its gains further remains to be seen, but the underlying factors supporting its growth are undeniably strong.

As always, remember to conduct thorough research and consider your own risk tolerance before making any investment decisions in the cryptocurrency market.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.