Buckle up, crypto enthusiasts! Just when we thought the approval of spot Bitcoin ETFs would send Bitcoin to the moon, the market threw us a curveball. Bitcoin (BTC) has taken a nosedive, breaking below the $40,000 mark for the first time in over two weeks. Instead of the anticipated surge, we’re witnessing a sell-off. Let’s dive into what’s happening.

Bitcoin’s Price Plunge: A Quick Snapshot

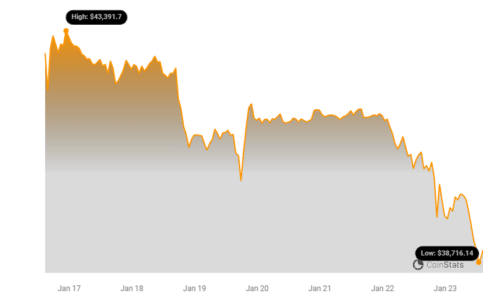

The numbers don’t lie. Bitcoin’s been on a downward slide this past week, and the drop intensified recently. According to Coinstats, Bitcoin is currently hovering around $38,967.62. That’s a significant dip, representing:

- Nearly a 7% decrease in the last 24 hours.

- An 8% loss over the past week.

Here’s a visual representation of the recent price action:

Spot Bitcoin ETFs: A Catalyst for Sell-Off?

The timing is quite ironic. This price drop comes hot on the heels of the much-celebrated approval of spot Bitcoin exchange-traded funds (ETFs) in the United States. Remember the hype? These ETFs were supposed to be game-changers, opening the floodgates for institutional and retail investment by offering a regulated and accessible way to invest in Bitcoin without directly holding the asset.

Many analysts predicted that these ETFs would ignite a massive demand surge, pushing Bitcoin prices to new heights. However, the reality has been quite the opposite. Instead of a buying frenzy, we’re seeing a considerable sell-off. But why is this happening?

Grayscale Bitcoin Trust: The Key to the Puzzle?

Market analysts point towards fund outflows from certain key players, particularly Grayscale’s Bitcoin Trust (GBTC). GBTC recently transitioned from a closed-end fund to a spot Bitcoin ETF. This conversion, while seemingly positive, unlocked a crucial change for investors.

Previously, as a closed-end fund, GBTC had limitations on share redemptions. Investors looking to exit their positions often faced difficulties or had to sell at a discount. The ETF conversion changed this landscape dramatically, providing investors with a much easier exit route.

Essentially, the conversion acted like a release valve. Investors who were potentially holding GBTC shares for a while, perhaps looking for liquidity or profit-taking opportunities after the ETF approval, now had a straightforward way to cash out. This appears to be precisely what’s happening, leading to significant Bitcoin outflows from Grayscale and contributing to the downward pressure on Bitcoin’s price.

Broader Crypto Market Feeling the Chill

Bitcoin’s price correction is also casting a shadow over the wider cryptocurrency market. Major altcoins are also experiencing declines, indicating a broader market sentiment shift.

- Ethereum (ETH): Down over 4.45% in the last 24 hours, currently trading around $2,214.

- Solana (SOL): Declined by 6.09% in the past day, with a price of approximately $80.12.

You can track the live prices of these and other cryptocurrencies on platforms like ETH Coinstats and SOL Coinstats for real-time updates.

See Also: Bitcoin Price Has Continued To Fall, Dropping Below $40,000

What’s Next for Bitcoin?

The initial reaction to spot Bitcoin ETFs has certainly been unexpected. While the sell-off may seem concerning, it’s crucial to remember that the cryptocurrency market is known for its volatility. This price correction could be a temporary market adjustment as investors re-evaluate positions after the ETF launch. The long-term impact of spot Bitcoin ETFs on the market remains to be seen.

Will this sell-off continue, or is this a buying opportunity? As always, the crypto market keeps us on our toes. Keep following Bitcoinworld.co.in for further updates and in-depth analysis as this story develops.

Disclaimer: The information provided is not trading advice. Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.